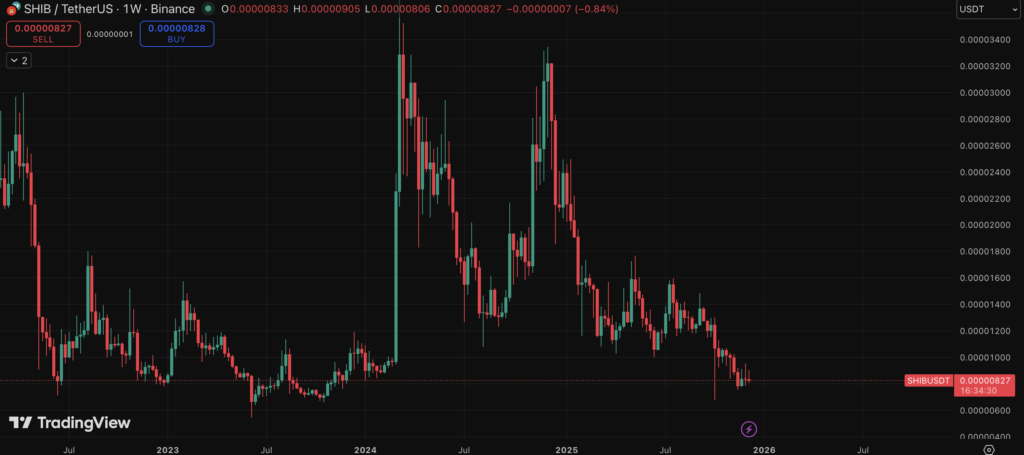

- SHIB stays down roughly 90% from its 2021 peak, with weak restoration and fading investor curiosity over time.

- Analysts level to restricted real-world utility, low developer exercise, and an outsized token provide as main structural dangers.

- Because the market matures, capital is more and more rotating towards belongings with confirmed use instances, leaving meme-driven tokens extra susceptible.

For buyers asking why to not purchase Shiba Inu, monetary analyst Neil Patel has been pretty blunt. His considerations aren’t about short-term worth swings or meme coin drama, they go deeper than that. SHIB continues to be down roughly 90% from its 2021 peak, and years later, it’s struggling to point out significant real-world worth. In accordance with Patel, this isn’t only a cooling-off section. It factors to structural weaknesses which are turning into tougher to disregard because the crypto market matures.

No clear downside being solved

One of many largest pink flags Patel highlights is utility, or the shortage of it. Not like Bitcoin, which is more and more considered as digital cash, or Ethereum, which underpins 1000’s of functions, SHIB stays largely pushed by hype. Social momentum, memes, and on-line hypothesis nonetheless do many of the heavy lifting.

Whereas the Shiba Inu ecosystem has talked up tasks like Shibarium, ShibaSwap, and even a metaverse idea, precise adoption stays skinny. On-chain exercise is restricted, and developer engagement is noticeably low in comparison with different networks. The truth is, SHIB doesn’t even rank among the many prime tasks when measured by developer participation. That’s not an ideal signal for long-term sustainability, particularly in an area the place builders often lead worth creation.

As Patel put it, it’s merely tough to argue that Shiba Inu’s blockchain solves a real-world downside proper now. And that hole issues greater than many holders need to admit.

A brutal fall from its peak

The value historical past tells its personal story. Shiba Inu peaked in October 2021 in the course of the peak of the meme coin frenzy, touching roughly $0.000088. Since then, it’s been a protracted and painful slide decrease. A drawdown of round 90% wipes out extra than simply paper earnings, it usually wipes out confidence too.

Even up to now 12 months alone, SHIB has shed a major chunk of its worth, reflecting how a lot enthusiasm has pale for the reason that increase. Patel notes that whereas speculative habits by no means really disappears from markets, the sustained downtrend suggests curiosity is shifting elsewhere. In his view, the value motion doesn’t appear to be momentary weak point. It appears to be like like a market slowly transferring on.

Provide math works in opposition to SHIB

One other main challenge comes all the way down to basic math. SHIB’s circulating provide sits round 589 trillion tokens, an nearly incomprehensible quantity. That sheer scale creates a ceiling on worth development that’s onerous to flee.

For SHIB to achieve even one cent, not a greenback, the market cap would wish to exceed the mixed worth of the world’s largest corporations. That sort of valuation isn’t simply unlikely, it’s primarily unrealistic below present market circumstances. Token burns assist on the margins, however they don’t change the underlying downside quick sufficient to materially shift the equation.

This provide dynamic makes it extraordinarily tough for SHIB to ship the sort of returns that many retail buyers nonetheless hope for.

Stronger options exist already

Patel additionally factors out that buyers aren’t quick on higher choices. Bitcoin continues to learn from shortage and rising institutional acceptance. Ethereum stays the spine of decentralized finance, NFTs, and tokenized belongings, with actual utilization throughout world markets. These networks aren’t excellent, however they’re fixing tangible issues and attracting long-term capital.

In comparison with that, Shiba Inu appears to be like extra like a speculative wager than an funding. Patel argues that buyers in search of crypto publicity don’t have to gamble on meme-driven belongings when extra established tasks supply clearer fundamentals and stronger adoption.

A warning rooted in fundamentals, not concern

The broader takeaway from Patel’s warning is that SHIB’s dangers go nicely past volatility. Its worth nonetheless hinges closely on social media sentiment, which might flip rapidly and with out warning. That makes the token unpredictable in a means that feels nearer to playing than long-term investing.

While you mix weak utility, overwhelming provide, fading hype, and rising competitors from belongings with real-world use instances, the warning begins to make sense. Shiba Inu should have its moments, hypothesis all the time finds a means, however from a fundamentals-first perspective, the considerations raised by analysts aren’t straightforward to dismiss anymore.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.