Bitcoin falls to a two-week low whereas MicroStrategy indicators new Bitcoin buy with “Orange Dots.”

Bitcoin fell to $87,577 on Binance late Sunday, marking a two-week low amid renewed market volatility. Some analysts blame the promoting strain on the Financial institution of Japan insurance policies on world threat urge for food. Over the previous month, Bitcoin has been buying and selling round $85k-$95k, which exhibits an outlined buying and selling vary. The current dip beneath $88,000 has examined crucial help and sentiment has been cautious.

Macro Pressures Preserve Downward Strain on Bitcoin

The current rate of interest lower by the Federal Reserve didn’t have any vital impression on rising cryptocurrency costs. Final Wednesday, the Fed lower the speed 25 foundation factors right down to a goal fee of three.5% to three.75%. Bitcoin dropped 1.08% in 24 hours, indicating continued sideways strain. Traders are nonetheless cautious about dangerous belongings, within the face of wider financial uncertainty and decrease demand indicators.

₿ack to Extra Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

Macro traits have been extra answerable for volatility than company shopping for over the previous few weeks. Financial institution of Japan interventions and issues about world economics added to downward strain. Technical analysts concentrate on $85,000-$95,000 being necessary areas for market stability. Sustained weak point beneath $88,000 may add to bearish sentiment that might result in additional promoting. Total, macroeconomic situations nonetheless have an effect on the short-term conduct of markets.

Associated Studying: Technique challenges MSCI plan to drop digital asset firms | Dwell Bitcoin Information

The Federal Reserve’s coverage strikes haven’t calmed the funding fears, regardless of decreased rates of interest. Analysts say that cryptocurrency merchants take note of long-term financial indexes and liquidity situations. Central financial institution interventions all over the world are nonetheless highly effective, imposing strain on speculative belongings. Consequently, the market gamers maintain observe of the macroeconomic knowledge and the technical help ranges to commerce successfully.

MicroStrategy’s Orange Dots Sign New Bitcoin Accumulation

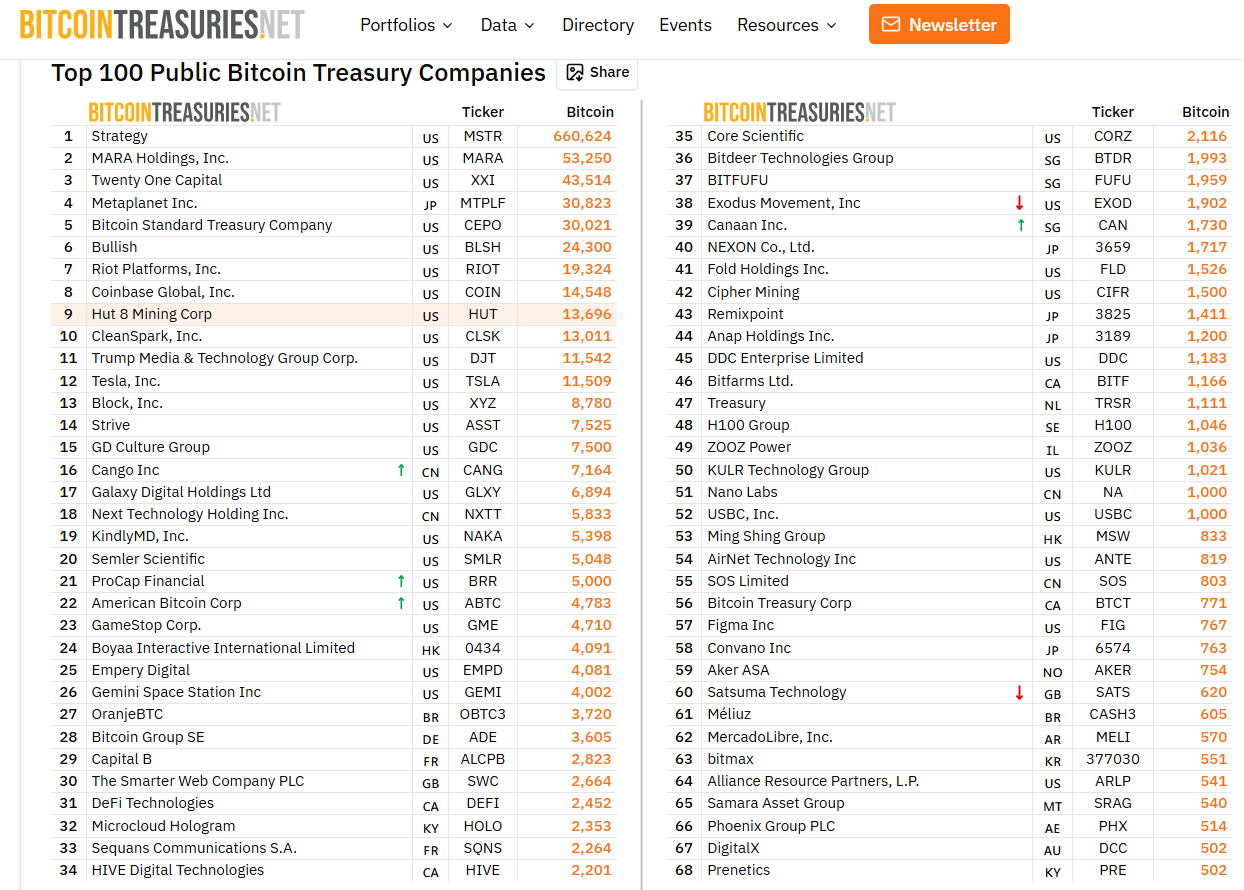

Michael Saylor, MicroStrategy founder, posted his signature “Orange Dots” chart, captioned: “₿ack to Extra Orange Dots.” That is being extensively interpreted as a sign of an imminent, large acquisition of Bitcoin. MicroStrategy presently holds round 660,624 BTC, making it the most important company Bitcoin holder worldwide. Saylor approaches worth weak point as a long-term shopping for alternative, and he continues together with his accumulation technique.

Traditionally, Orange Dot posts have preceded main acquisitions the following day, and it subsequently influenced investor expectations. Company purchases could add momentary help in periods of promoting strain that’s macro-based. Analysts underscore the truth that institutional accumulation continues to be a think about shaping market liquidity and sentiment. Traders take all these company actions into consideration in opposition to the backdrop of worldwide financial uncertainty and make buying and selling selections with a steadiness of optimism and warning.

Bitcoin’s vary sure buying and selling is each a mirrored image of the extent of technical help in addition to macro pressures. Market individuals monitor $85,000 – $95,000 very carefully as key areas of attainable stabilization. Company accumulation offsets some downward traits within the macro economic system, however volatility stays. The mixture of institutional shopping for and financial situations nonetheless characterizes short-term market sentiment.

Orange Dots could psychologically consolation merchants and point out attainable shopping for alternatives by dips. Persistent macroeconomic pressures, central banks, and geopolitical threat elements are nonetheless crucial threat elements. Traders take note of institutional cues, in addition to technical ranges, when navigating by current market situations. MicroStrategy’s continued accumulation technique provides to its long-term confidence in Bitcoin’s worth proposition.