Based on Itaú Asset Administration, Brazil’s largest personal financial institution, buyers ought to contemplate holding 1%–3% of their portfolios in Bitcoin beginning in 2026. The advice got here in a analysis outlook launched this week and frames Bitcoin as a small, complementary holding somewhat than a fundamental wager.

Itaú Backs Small Bitcoin Positions

The financial institution’s be aware factors to Bitcoin’s low correlation with many conventional property and to foreign money dangers that hit native buyers onerous this 12 months. Itaú additionally moved to construct the infrastructure behind that view: in September 2025 it created a devoted crypto division and named former Hashdex govt João Marco Braga da Cunha to steer the group. That new unit sits alongside the financial institution’s current merchandise and is supposed to assist shoppers entry regulated crypto instruments.

Entry By means of Native Merchandise

Brazilian savers can already attain Bitcoin through merchandise tied to Itaú. The financial institution is a part of the group that launched the IT Now Bloomberg Galaxy Bitcoin ETF, identified by its ticker BITI11, which started buying and selling on November 10, 2022. The ETF provides buyers a spot-like path to Bitcoin contained in the native market, and it sits alongside unit trusts and pension merchandise that provide crypto publicity.

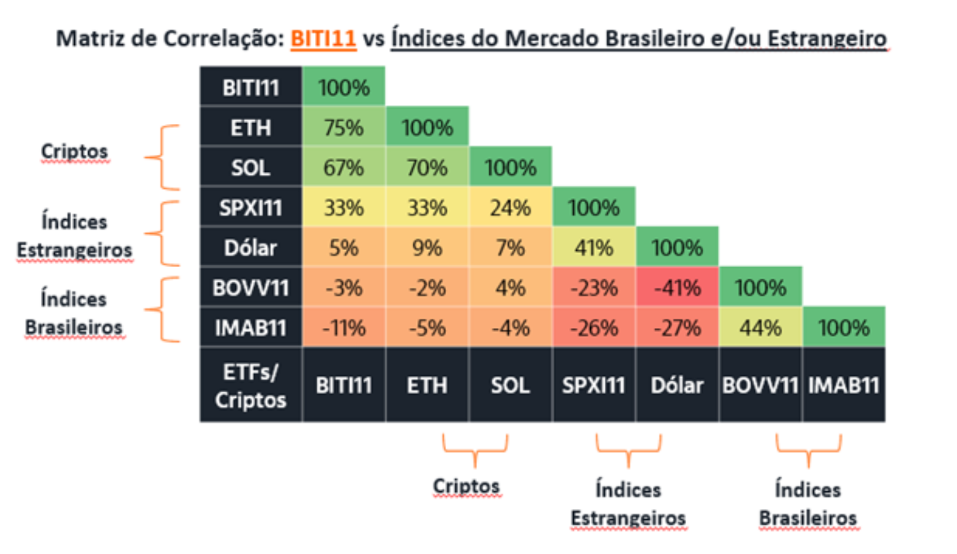

A correlation matrix displaying how BITI11, a Bitcoin ETF, strikes in relation to main Brazilian and world market indices, in line with information from Itaú.

Small However Present Crypto Footprint

Itaú says its regulated crypto suite manages roughly R$850 million throughout a number of funds and ETFs, a modest quantity in contrast with its wider enterprise however nonetheless a transparent sign of product readiness. The financial institution’s asset arm is massive: it manages greater than 1 trillion reais for shoppers, which helps clarify why its steerage on allocations attracts broad consideration.

Market Context And Timing

Itaú’s transfer arrives after a 12 months through which foreign money swings amplified losses for some Brazilian holders of overseas property. That actuality seems to be a part of the mathematics behind recommending a 1%–3% place — a small buffer for these frightened about local-currency shocks, not a wager meant to switch shares or bonds. The financial institution frames the place as a disciplined, long-term allocation, not a short-term commerce.

What This Means For Traders

For strange buyers the steerage is easy to learn: preserve publicity small and managed. A 1% place will hardly change a diversified portfolio by itself, whereas 3% remains to be inside what many establishments have referred to as a “satellite tv for pc” slot. Primarily based on studies, Itaú expects to supply extra decisions — from low-volatility wrappers to riskier methods — by the brand new unit as demand grows.

Featured picture from La Nación, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.