Bitcoin stays caught in a tightening vary simply above the $80K mark. Regardless of the current bounce from sub-$85K ranges, the general market tone nonetheless leans cautious. There’s been no significant breakout, and sentiment hasn’t shifted bullish but.

BTC Technical Evaluation

By Shayan

The Each day Chart

On the every day timeframe, the worth continues to be trapped contained in the broader descending channel that’s been energetic over the previous couple of months. BTC not too long ago bounced from the $81K assist zone and has since printed a sequence of upper lows. Nevertheless, every push has been capped at round $95K, proper beneath the channel’s increased boundary and the important thing bearish order block.

The asset is now buying and selling beneath each the 100-day and 200-day MAs, that are curving downward round $107K. This can be a clear signal that consumers are nonetheless preventing the macro pattern. Until a robust every day shut above $96K happens, the construction stays bearish to impartial.

The 4-Hour Chart

Zooming into the 4H chart, BTC is forming a transparent ascending triangle between $80K and $95K. This type of construction typically resolves upward, however provided that quantity and momentum assist the breakout. Proper now, the breakout makes an attempt close to $94K hold getting rejected.

There’s a tightening squeeze between the trendline assist and horizontal resistance, and the worth is nearing the apex. So a breakout or breakdown is probably going inside the subsequent few periods.

Patrons would need to see a clear breakout above $95K with quantity to focus on the $100K zone. Sellers, however, would look to a break beneath the ascending trendline, aiming for a retest of $85K and even the essential $80K space.

On-Chain Evaluation

Bitcoin Alternate Reserve

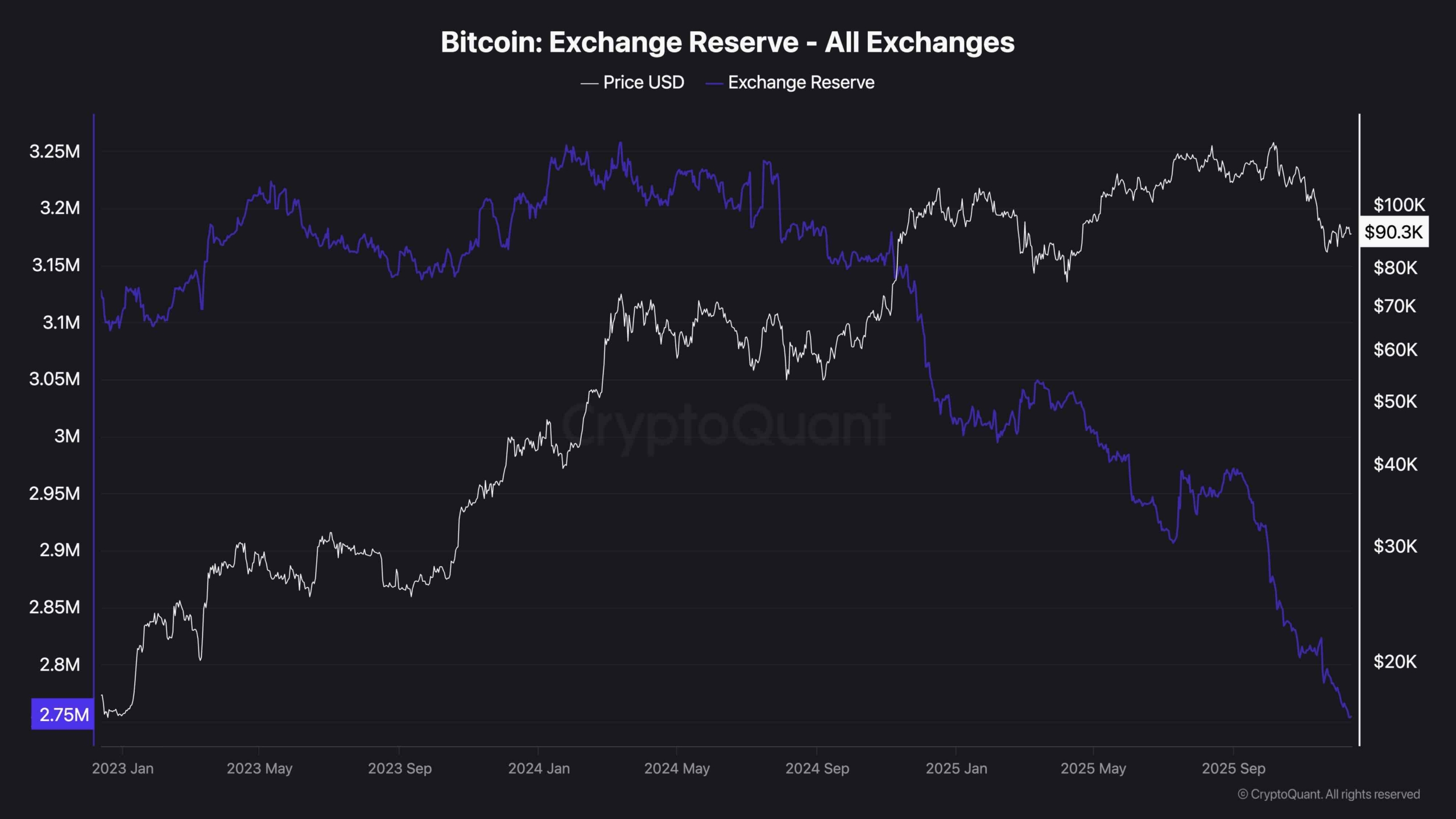

Alternate reserve information paints a extra fascinating image. BTC reserves on exchanges proceed to fall sharply, now hitting multi-year lows round 2.75M BTC. This usually suggests long-term holders aren’t all in favour of promoting, and provide is drying up.

Nevertheless, this hasn’t translated into worth energy but. The divergence between falling reserves and sideways worth motion exhibits one factor: demand continues to be not robust sufficient to push costs increased, regardless of low alternate provide.

This might be as a result of institutional flows and retail curiosity stay weak at present ranges, or as a result of capital is sitting on the sidelines ready for macro readability. Till spot demand kicks in, the falling reserves alone gained’t be sufficient to ignite a sustainable rally.

The submit Bitcoin Worth Evaluation: BTC’s Subsequent Massive Transfer Is Brewing – Breakout or Breakdown Forward? appeared first on CryptoPotato.