- Bitcoin slipped to $86,000 as macro uncertainty weighed on threat belongings

- Analysts see orderly consolidation slightly than panic-driven promoting

- Lengthy-term capital and ETFs proceed to reshape Bitcoin’s market construction

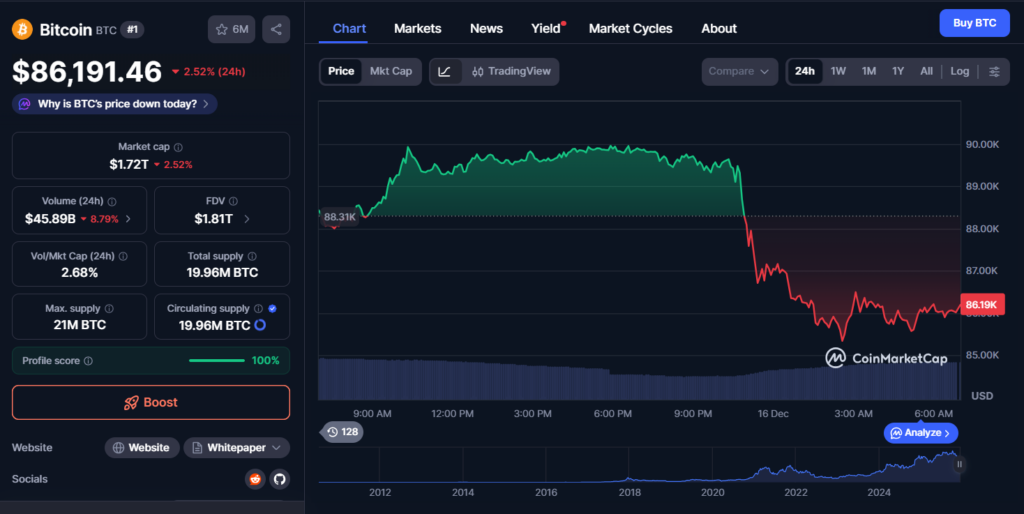

Crypto markets remained underneath strain on Monday as Bitcoin slipped to the $86,000 vary throughout U.S. afternoon buying and selling, extending losses from the weekend. The transfer got here as traders continued to digest combined macro indicators, with warning returning regardless of comparatively modest declines in conventional fairness markets. Bitcoin’s pullback pushed it beneath a variety it had held for over two weeks, elevating questions on near-term route slightly than signaling outright panic.

Main altcoins adopted Bitcoin decrease, with Ethereum, XRP, and Solana every falling greater than 5% on the day. Crypto-linked equities noticed even steeper declines, as corporations like Technique, Galaxy Digital, and Circle posted losses exceeding 8%. The promoting strain contrasted with U.S. inventory markets, the place the Nasdaq and S&P 500 completed solely barely decrease, highlighting crypto’s sensitivity to shifts in sentiment.

Macro Indicators Create Uneven Buying and selling Situations

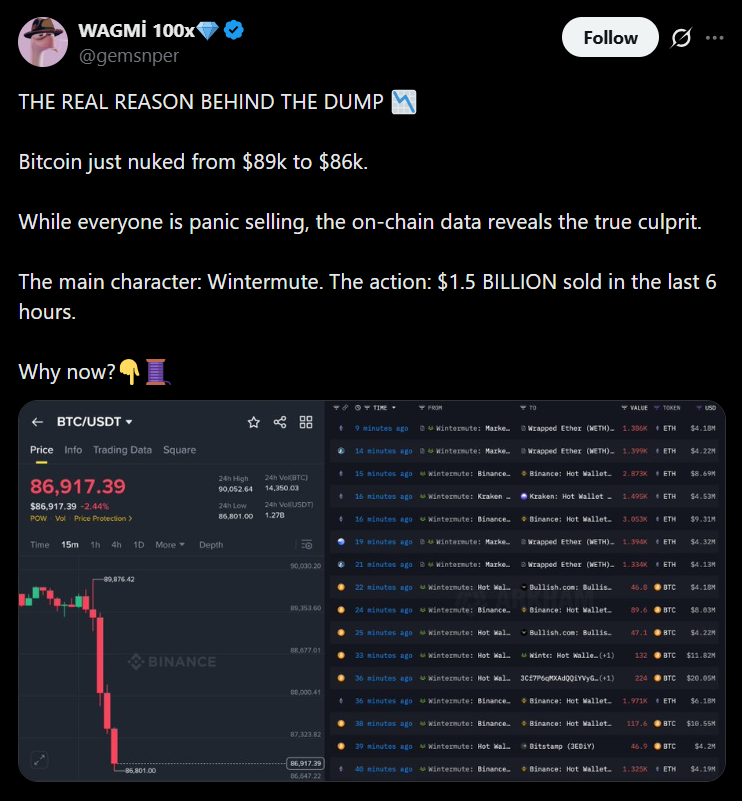

Market members pointed to lingering macro uncertainty as the first driver behind the downturn. Buying and selling agency Wintermute described the atmosphere as one in every of digestion slightly than outright risk-off habits, noting that each equities and crypto are struggling to seek out clear route. Bitcoin’s drop beneath $86,000 has sparked debate, however analysts see no indicators of pressured promoting or liquidity stress at this stage.

The Federal Reserve’s latest charge lower initially supported threat belongings, however ahead steerage stunned markets with a extra cautious tone. Projections now counsel just one extra lower in 2026, clashing with market expectations that had priced in a number of. This disconnect between coverage signaling and investor positioning has created instability, particularly as world central banks, together with the Financial institution of Japan, put together for tightening measures that might have an effect on liquidity flows.

Why Analysts See Orderly, Not Disorderly, Danger

Regardless of the sharp strikes, analysts emphasize that present circumstances stay structurally totally different from previous crypto drawdowns. Bitcoin’s market is more and more dominated by long-term holders, ETF inflows, and institutional capital, which has helped soak up provide and dampen excessive volatility. Drawdowns since 2024 have been noticeably shallower, reinforcing the concept Bitcoin is transitioning right into a extra mature asset class.

Some analysts argue that Bitcoin now behaves extra like gold than a speculative tech asset, with worth motion pushed by affected person capital slightly than leverage. Traditionally, Bitcoin has lagged gold rallies by a number of months, and with gold posting robust features this 12 months, some imagine Bitcoin could observe after a interval of consolidation. For now, nevertheless, merchants anticipate uneven ranges and selective dip-buying slightly than a clear breakout.

What Comes Subsequent for Crypto Markets

Trying forward, market members anticipate volatility to persist into early 2026 as traders await clearer indicators on development, liquidity, and coverage. Regulatory developments within the U.S. may reintroduce optimism, however macro forces stay the dominant affect. Till confidence improves, crypto is prone to commerce in vast ranges, with rallies considered as tactical alternatives slightly than the beginning of a brand new pattern.

For Bitcoin bulls, the absence of pressured promoting affords some reassurance, however endurance could also be required. The following sustained transfer will doubtless rely on how world financial coverage, liquidity circumstances, and institutional flows evolve within the months forward.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.