Bitcoin Value Weekly Outlook

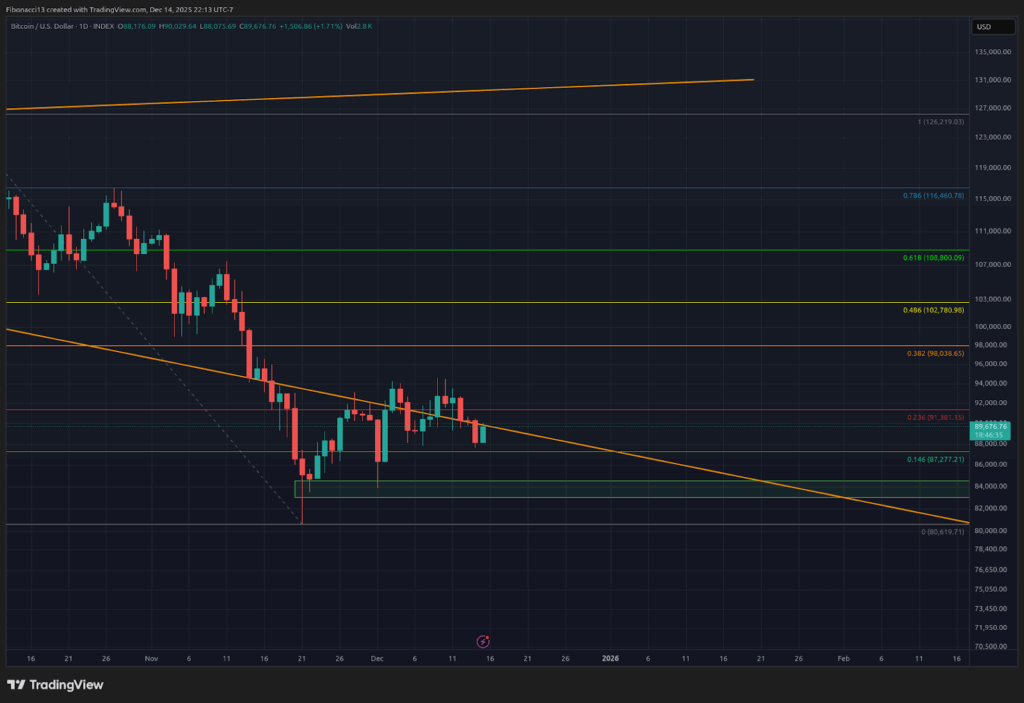

Bitcoin value is trying torpid heading into this week. Final week noticed costs reject as soon as once more from the $94,000 resistance stage. The bulls weren’t in a position to acquire any momentum in anyway as the worth bled down into Sunday to shut at $88,170. This week, the bears will look to interrupt the $84,000 help stage and take the worth into the low $70,000 vary. The bulls will desperately attempt to maintain onto this $84,000 stage as help, however it might not be capable to survive one other take a look at.

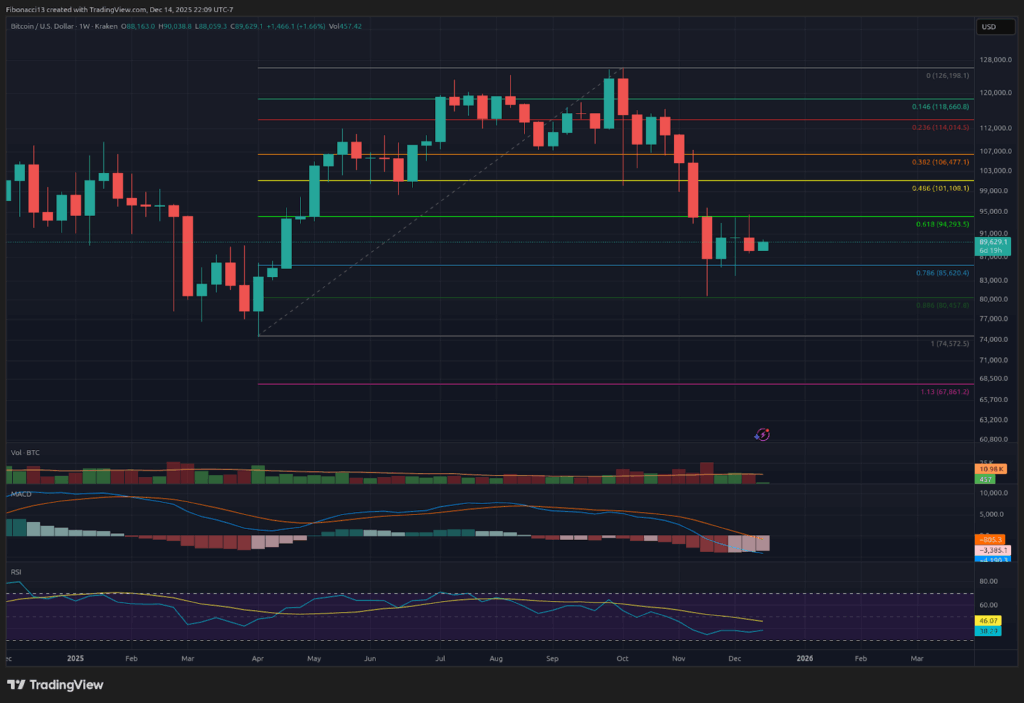

Key Help and Resistance Ranges Now

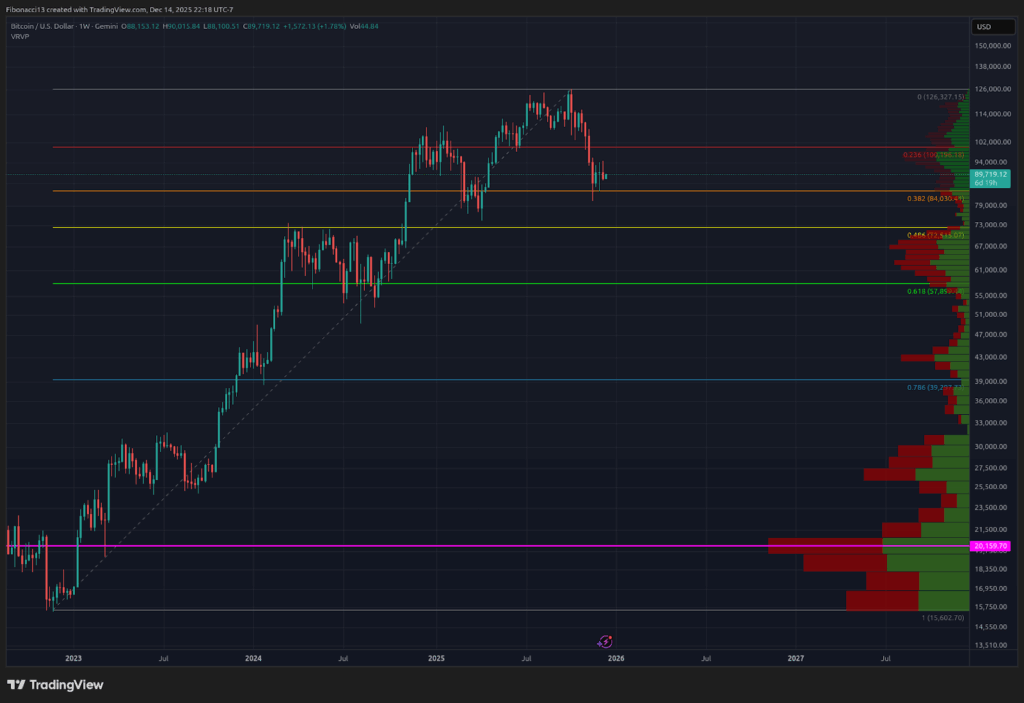

With the $84,000 help stage once more beneath strain this week, the bears will look to lastly drive the worth down under it. There’s a small probability bulls could possibly defend $85,000, however it’s unlikely to carry right here until we see huge shopping for quantity step in. The $72,000 to $68,000 help zone under ought to be a strong flooring on preliminary assessments, so it could possible take a number of weeks to interrupt down via this stage if we get there. Beneath right here, bulls will look to hold onto the 0.618 Fibonacci retracement help at $57,000.

Up larger, we now have a blanket of resistance now from $94,000 all the best way as much as $118,000. If bulls can handle to lastly conquer $94,000, they’ll look to $101,000 subsequent, though sellers ought to step in strongly above $97,000. Above $101,000, it ought to be a sluggish go all the best way to $107,000. Much more shopping for strain could be crucial above $107,000 to push via this thick zone all the best way to $118,000. None of those ranges appear attainable anytime quickly with the present value motion, nevertheless.

Outlook For This Week

Bitcoin’s weekly purple candle shut was not what the bulls needed to see final week. The bears obtained a much-needed relaxation over the previous few weeks and may see renewed energy this week. Search for the bears to try to interrupt the $84,000 help stage in some unspecified time in the future this week, with bulls doubtlessly attempting to place in a bounce to keep up larger lows across the $87,000 to $85,000 space. If value drops under $84,000 this week, I’d count on to see acceleration right down to a minimum of $75,000 and sure into the low $70,000 space.

Market temper: Extraordinarily Bearish – Bulls had a while to attempt to push the worth above short-term help over the past couple of weeks and failed to take action. The bears are in management and ought to be effectively rested for renewed promoting energy to the draw back.

The following few weeks

Sellers acquired a much-needed break over the previous few weeks, whereas patrons have been solely in a position to pause the bearish momentum. Bears ought to take benefit right here to take out the $84,000 help stage. Within the subsequent few weeks, search for the help zone within the $72,000 to $68,000 space to be hit. Nonetheless, we should always see a robust bounce from this space after an preliminary take a look at. So if this zone is touched, search for value to a minimum of re-test the $84,000 stage from down there, with potential for a good stronger bounce. This zone is a possible space for a reversal out of the bear market, but when the “4-Yr Cycle” holds true, then the worth would possible take a look at decrease later into 2026.

Terminology Information:

Bulls/Bullish: Patrons or buyers anticipating the worth to go larger.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Help or help stage: A stage at which the worth ought to maintain for the asset, a minimum of initially. The extra touches on help, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of help. The extent that’s more likely to reject the worth, a minimum of initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios primarily based on what is named the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).