- Chainlink trade reserves have fallen to a yearly low as accumulation continues

- LINK value stays weak regardless of ETF inflows and diminished sell-side provide

- Quick-term sentiment is bearish, however long-term accumulation alerts persist

Chainlink has quietly stayed on the radar for whales, establishments, and retail merchants, even whereas the broader market continues to pull. On-chain knowledge factors to heavy accumulation occurring within the background, but LINK’s value hasn’t adopted by way of. That disconnect is beginning to elevate eyebrows.

Regardless of persistent weak point throughout crypto, curiosity in LINK hasn’t disappeared. As a substitute, it’s shifted into quieter conduct, extra chilly storage, much less buying and selling. The query now’s whether or not that’s sufficient to counter the broader market stress urgent down on value.

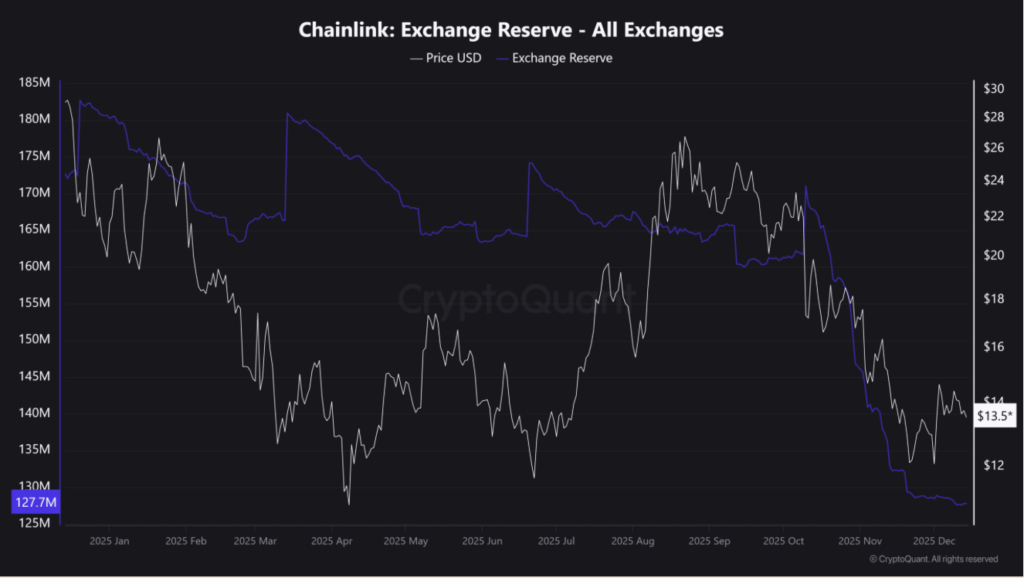

Alternate Reserves Sink to a Yearly Low

In accordance with CryptoQuant, greater than 44.9 million LINK tokens have left exchanges over the previous yr. That regular outflow pushed Chainlink’s trade reserves to their lowest stage in twelve months. In crypto, that often alerts accumulation, with buyers choosing self-custody as an alternative of holding property able to promote.

Decrease reserves usually imply diminished sell-side stress. However this time, value motion instructed a special story. Over the identical stretch, LINK slid onerous, falling from practically $29 to round $13.60. That divergence between accumulation and value has left merchants questioning whether or not macro weak point is solely overpowering every part else.

ETF Inflows Haven’t Sparked a Bounce But

Institutional curiosity has additionally proven up by way of U.S. spot Chainlink ETFs. Knowledge from SoSoValue reveals these merchandise have seen inflows since launching on December 2. Usually, that type of Wall Avenue demand provides regular shopping for stress beneath the hood.

Up to now although, LINK hasn’t responded. Value continued trending decrease, shifting in keeping with the broader market downturn that set in after momentum light round mid-October. Even with contemporary capital coming into by way of ETFs, the broader risk-off surroundings seems to be successful, a minimum of for now.

Quantity Dries Up as LINK Hugs Assist

On the time of writing, LINK was buying and selling close to $13.65, down about 2.25% on the day. Buying and selling exercise thinned out sharply alongside the worth drop. Spot quantity fell greater than 48% to roughly $295 million, signaling hesitation from each patrons and sellers.

On the each day chart, LINK has been caught in a consolidation vary between $13.19 and $14.70 since early December. Value is hovering near the decrease boundary of that vary, proper close to the $13.20 help zone. A clear break under that stage might open the door to a different leg down, doubtlessly round 16%, given the dearth of robust help beneath.

Pattern energy stays weak as effectively. The Common Directional Index sits close to 20.9, under the 25 threshold that usually alerts a robust pattern. In different phrases, momentum is muted, and conviction is low.

Leverage Knowledge Tilts Bearish within the Quick Time period

Derivatives knowledge paints a cautious image. CoinGlass reveals merchants are closely positioned round $13.45 on the draw back and $13.99 on the upside. At these ranges, roughly $2.01 million in lengthy leverage and $3.04 million in brief leverage have constructed up.

That imbalance suggests short-term sentiment leans bearish, with merchants anticipating draw back continuation. Nonetheless, the regular drain of LINK from exchanges and constant ETF inflows trace that longer-term accumulation is occurring quietly beneath the floor, even when value hasn’t caught on but.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.