Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor hinted Technique will purchase extra Bitcoin this week as BTC slid beneath $90k amid fears the Financial institution of Japan is about to hike rates of interest to the very best degree in about 30 years.

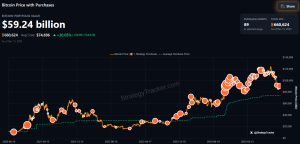

Saylor posted a SaylorTracker chart on X captioned “₿ack to Extra OrangeDots,” a phrase that has regularly preceded new Bitcoin shopping for.

₿ack to Extra Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

The sign got here as Bitcoin plunged as little as $87,634.94 previously 24 hours, with some market observers pointing to macro stress forward of the Financial institution of Japan’s upcoming interest-rate choice later this week.

BTC has since pared losses to commerce at $89,623.51 as of 1:10 a.m. EST, based on CoinMarketCap.

The subsequent rate of interest choice from Japan’s central financial institution can be delivered on Friday, with merchants on the decentralized prediction market platform Polymarket seeing 97% odds that there can be a 25 foundation level enhance.

“Persons are severely underestimating what Japan is about to do to Bitcoin,” stated analyst “NoLimit” on Sunday, citing previous market reactions to Japan price hikes.

Different analysts argue that the rate of interest hike has already been priced in. Amongst them, pseudonymous analyst “Sykodelic” stated that Japan’s subsequent transfer is already recognized.

“Markets are forward-thinking, forward-moving,” the analyst stated. ”They transfer in anticipation of occasions, not when these occasions occur.”

Technique Is Largest Company Bitcoin Holder

Technique’s final Bitcoin purchase was introduced on Dec. 8, when it bought 10,624 BTC for round $963 million, knowledge from Technique’s web site reveals. This was additionally the agency’s largest BTC acquisition since late July.

Presently, the corporate holds 660,624 BTC on its stability sheet, which was bought at a mean worth of $74,696 per coin.

Technique’s BTC purchases (Supply: SaylorTracker)

The agency is sitting on an unrealized acquire of greater than 20%, equating to roughly $9.891 billion.

BTC Could Be Getting ready For An 11% Surge

Whereas merchants wait to see what Japan’s central financial institution will do that week, BTC has been in a consolidation sample over the previous few days. TradingView reveals that Bitcoin has been oscillating between $84,099.37 and $93,757.24 since escaping a downtrend round two weeks in the past.

Every day chart for BTC/USDT (Supply: TradingView)

If the potential Japan rate of interest hike has certainly been priced in, Bitcoin would possibly try to interrupt out of the consolidation channel.

If there’s a breakout in the direction of the upside, BTC will probably attempt to breach the $93,757.24 resistance degree and flip it into help. This might then function a launchpad for a rally to the following resistance at $104,622.34. On this situation, BTC would acquire roughly 11% from present ranges.

Then again, a draw back transfer would possibly see Bitcoin lose the $84,099.37 help and fall to as little as $80,477.67.

Technical indicators on the day by day chart present blended alerts. The Transferring Common Convergence Divergence (MACD) alerts that momentum is presently in favor of patrons. Nonetheless, this momentum appears to have cooled down within the final 48 hours because the MACD line begins to drop in the direction of the MACD Sign line.

In the meantime, the Relative Power Index (RSI) is trying to cross above its Easy Transferring Common (SMA). If this occurs, it will be a significant bullish technical sign, indicating a shift in energy in the direction of patrons.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection