- XRP trades under a bearish EMA ribbon, a setup traditionally linked to deep drawdowns

- Institutional ETF inflows are strengthening the long-term provide and demand outlook

- The $2.00 assist zone stays vital for stopping additional near-term draw back

XRP value prediction is beginning to really feel tense, with warning indicators flashing simply as institutional demand ramps up. On one aspect, new spot XRP ETFs are pulling in regular capital and reshaping how the asset is seen by conventional traders. On the opposite, the chart construction itself is leaning bearish, displaying stress that hasn’t totally performed out but.

This places XRP in a clumsy spot. The outlook now relies on whether or not long-term accumulation can overpower historic danger patterns which have not often failed up to now. Proper now, neither aspect has totally gained.

EMA Ribbon Flips Bearish, Historical past Isn’t Sort

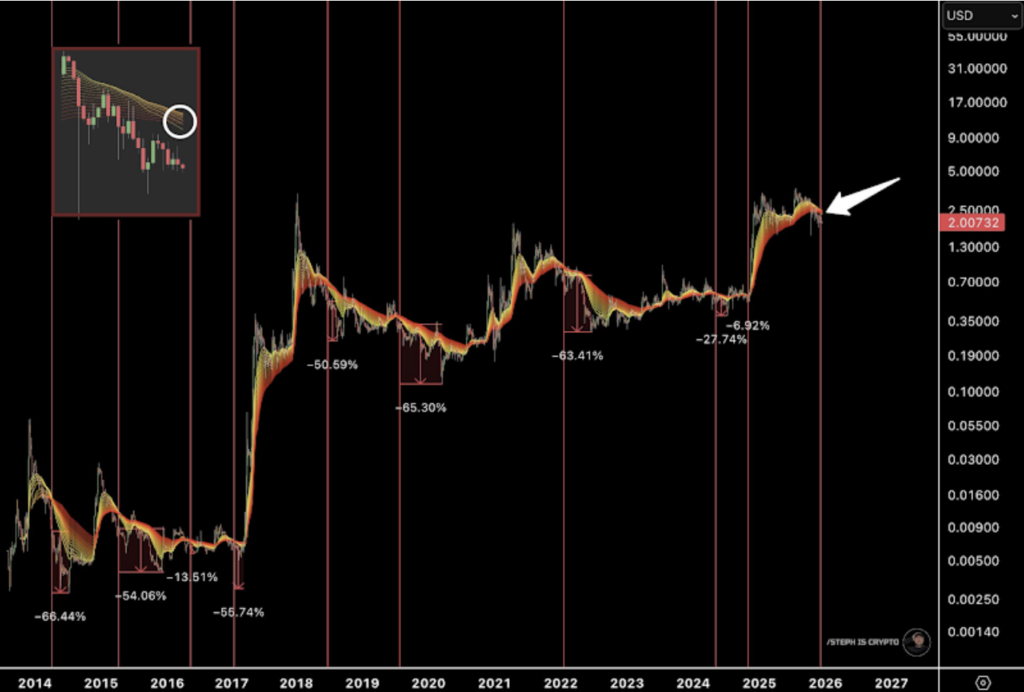

In keeping with evaluation shared by Steph Is Crypto, the three-day EMA ribbon has turned bearish once more, a setup that has a troubling observe document for XRP. Traditionally, when value sits under a bearish EMA ribbon, the outcome hasn’t been a fast dip. As a substitute, it’s typically been the beginning of prolonged drawdowns.

Previous cycles present losses starting from roughly 27% to as a lot as 66%. The sample repeats with uncomfortable consistency throughout 2014, 2017, 2019, and 2022. Every time adopted the identical script, breakdown first, consolidation after, and restoration a lot later. Greater declines tended to occur when the ribbon stayed bearish longer, which provides weight to the present sign.

In the mean time, XRP continues to be buying and selling under this ribbon. Till value reclaims it, draw back danger stays energetic. From a structural standpoint, the setup stays fragile, even when sentiment improves elsewhere.

ETFs and Establishments Strengthen the Lengthy Recreation

Zooming out modifications the tone fairly a bit. Institutional inflows by means of spot XRP ETFs are constructing quick, providing a regulated gateway for big capital to enter. In a comparatively quick interval, ETF inflows have pushed towards the $1 billion mark, outpacing early adoption seen in a number of main crypto funds.

This issues as a result of ETF shopping for steadily removes XRP from energetic change circulation. Over time, that tightens provide, which may amplify value reactions as soon as demand picks up once more. Regulatory readability has additionally helped, giving establishments the arrogance to deal with XRP as a portfolio-ready asset as an alternative of a authorized grey space.

There’s additionally the basic layer. Ripple’s increasing function in cross-border funds offers XRP actual utility past hypothesis. That underlying demand doesn’t present up instantly on short-term charts, but it surely strengthens the longer-term case significantly.

Brief-Time period Value Motion Nonetheless Leans Defensive

Within the close to time period, warning nonetheless dominates. Information from CoinStats exhibits XRP slipping about 1.35% in the latest session, retaining value nearer to assist than resistance. On decrease timeframes, consumers have struggled to regain momentum, and rallies proceed to fade rapidly.

If that weak point persists, a transfer towards the $1.98 space turns into seemingly. That’s the closest short-term assist. On the each day chart, the $2.00 degree carries much more weight, appearing as each a psychological and structural line. A clear break under it might speed up draw back stress into the approaching weeks.

For now, XRP value prediction stays defensive within the quick run, whereas the long-term story quietly improves beneath the floor.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.