Be part of Our Telegram channel to remain updated on breaking information protection

Wall Road banking big JPMorgan is deepening its presence within the tokenized finance area and has launched its first cash market fund by its $4 trillion asset administration arm.

In a Dec. 15 announcement, the agency mentioned that the My OnChain Internet Yield Fund (“MONY”) is now accessible on the Ethereum blockchain. It added that the fund is powered by JPMorgan’s personal Kinexys Digital Belongings platform, which is a multi-chain asset tokenization resolution.

The tokenized fund offers traders with elevated transparency, peer-to-peer transferability, in addition to the potential for broader collateral utilization throughout the blockchain ecosystem, JPMorgan added.

In keeping with the announcement, JPMorgan is now the biggest globally systemically essential financial institution (GSIB) to launch a tokenized cash market fund on a public blockchain.

MONY Traders Will Be In a position To Obtain Yields And Obtain Tokens At Their Blockchain Tackle

JPMorgan went on to say that MONY is a 506(c) non-public placement fund that gives certified traders the chance to earn US greenback yields by subscribing by the financial institution’s buying and selling platform, Morgan Cash. On the platform, customers will even be capable of obtain tokens at their blockchain addresses, the agency mentioned.

Right now @jpmorgan, the world’s largest financial institution by market cap per @WSJ, introduced they’re launching their first ever tokenized cash market fund—MONY—on Ethereum.

The agency is seeding the fund with $100M of its personal capital earlier than opening to exterior traders on Tuesday. https://t.co/xK0Qp3gFP5

— Ethereum (@ethereum) December 15, 2025

In keeping with a report from the Wall Road Journal, MONY is seeded with $100 million from the financial institution’s asset administration division and is about to open this week.

Within the announcement, JPMorgan mentioned that MONY will solely put money into conventional US Treasury securities and repurchase agreements which might be absolutely collateralized by US Treasury securities.

Day by day dividend reinvestment will even be accessible for traders, permitting them to subscribe and redeem utilizing both money or stablecoins by the Morgan Cash platform.

“Morgan Cash is the primary institutional liquidity buying and selling platform to combine conventional and on-chain property providing traders entry to a full-range of cash market merchandise,” JPMorgan mentioned.

Donohue added that the launch of MONY “marks a big step ahead in how property will likely be traded sooner or later.”

Morgan Cash was launched in 2019, and offers a real-time funding dashboard and a single entry level for operations. This offers traders the flexibility to construct stronger liquidity methods.

JPMorgan Joins Different Main Banks Who Have Launched On-Chain Funds

With the launch of MONY, JPMorgan is the newest high-profile monetary big to launch a tokenized fund on a blockchain. Presently, cash market funds lead the cost.

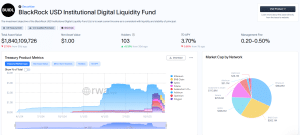

Franklin Templeton was one of many first conventional finance corporations to launch a tokenized fund with the launch of BENJI in 2021. BlackRock adopted with the launch of its BUIDL fund in 2024 with tokenization specialist Securitize. BUIDL at the moment has over $1.8 billion in property, information from RWA.xyz reveals.

BUIDL overview (Supply: RWA.xyz)

These funds allow traders to park idle money on blockchains and earn a yield. That is just like a cash market fund however contains sooner settlement occasions, around-the-clock buying and selling, and the flexibility to view possession in real-time.

The tokenized funds are additionally being more and more used as a reserve asset for decentralized finance (DeFi) protocols and as collateral in buying and selling and asset administration.

The tokenized fund asset class has grown from $3 billion to $9 billion prior to now 12 months, information from RWA.xyz reveals. In a joint report revealed earlier this 12 months, Ripple Labs and Boston Consulting Group projected that the tokenized asset market will develop to $18.9 trillion by 2033.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection