Solana (SOL) witnessed substantial good points in late summer season, however over the previous a number of months, it has been in a steep decline.

In accordance with some famend analysts, the asset might expertise an additional collapse within the brief time period, with sub-$70 ranges now in focus.

Brutal Crash on the Horizon?

The X consumer, Ali Martinez, noticed SOL’s efficiency from March 2024 till now. He believes the value construction resembles a textbook “head and shoulders” sample, with the top taking form late final 12 months when Solana reached $240.

Primarily based on this formation, Martinez argued that the valuation might proceed to sink to as little as $66.20, representing a 50% collapse from the present $132 mark.

“Head and shoulders” is a bearish sample and kinds when the value makes three peaks. The primary is the left shoulder, the second is the top, and the third is the proper shoulder. If the valuation breaks beneath a important help degree, referred to as “the neckline,” merchants view it as an indication of additional decline.

Martinez isn’t the one analyst envisioning bearish instances for SOL. X consumer Crypto Tony recommended there could be a minor uptick to $134, adopted by a plunge.

“Enjoying this vary till we break. Transfer as much as $134, after which I can be trying to brief down,” they mentioned.

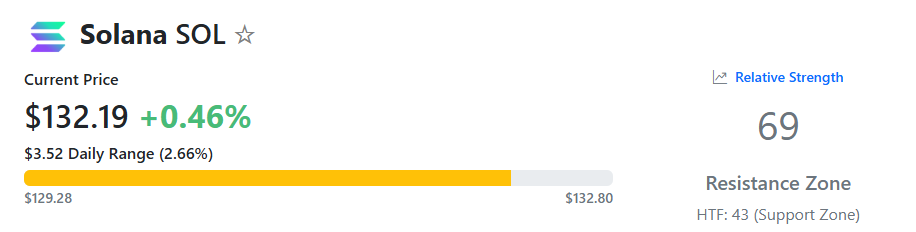

In the meantime, SOL is nearing overbought territory, which signifies further issues for the bulls. The asset’s Relative Power Index (RSI) measures the velocity and magnitude of the token’s latest worth modifications and ranges from 0 to 100. Something above 70 is taken into account bearish territory, whereas readings beneath 30 could possibly be interpreted as a shopping for alternative. SOL’s present RSI stands at round 69.

The Bullish State of affairs

Regardless of the downtrend and the pessimism coming from the aforementioned analysts, others suppose SOL might nonetheless stage a comeback. X consumer TraderSZ (who has virtually 700,000 followers) predicted the value may surpass $160 within the following days, whereas James set a possible goal of $152.

SOL’s latest trade netflow helps the optimistic theories. Over the previous a number of months, outflows have considerably exceeded inflows, that means buyers have switched from centralized platforms to self-custody strategies. That is thought of bullish because it decreased the quick promoting strain. Quite the opposite, flocking to exchanges is usually seen because the transfer earlier than an enormous money out.

The submit Solana (SOL) Worth Alert: Is a 50% Collapse on the Manner? appeared first on CryptoPotato.