Be part of Our Telegram channel to remain updated on breaking information protection

The UK will regulate crypto like conventional monetary merchandise beneath Monetary Conduct Authority (FCA) oversight from 2027.

Its authorities will introduce laws into parliament at this time that will see crypto corporations, together with exchanges, digital wallets and stablecoins, going through the identical regulatory framework as banks and brokers. They may also be topic to the identical transparency requirements.

“Bringing crypto into the regulatory perimeter is a vital step in securing the UK’s place as a world-leading monetary centre within the digital age,” mentioned Chancellor Rachel Reeves. “By giving corporations clear guidelines of the highway, we’re offering the knowledge they should make investments, innovate and create high-skilled jobs right here within the UK, whereas giving thousands and thousands robust shopper protections, and locking dodgy actors out of the UK market.”

🚨 UK goes all-in on crypto 🇬🇧

By 2027, the UK plans to completely combine crypto into its monetary regulatory framework, bringing exchanges beneath FCA oversight, boosting shopper safety, and pushing out dangerous actors.

A significant step towards world digital finance management. 🚀 pic.twitter.com/TX69m2cYBJ

— SWFT Blockchain (@SwftCoin) December 15, 2025

The FCA and Financial institution of England intention finalize guidelines by the top of 2026. This builds on related laws, the Markets in Crypto Property (MiCA) framework, which was launched by the European Union a yr in the past.

About 12% Of UK Adults Personal Crypto

The transfer comes as FCA information exhibits that roughly 12% of UK adults maintain some type of crypto.

On account of the growing adoption, the UK has formally acknowledged Bitcoin and different crypto property as authorized property beneath a brand new Act of Parliament, which signifies that digital property might be owned, recovered, and inherited.

The FCA can be planning guidelines for buying and selling and market abuse, custody and issuance. The Financial institution of England additionally unveiled proposals for regulating stablecoins final month.

UK Plans To Lead The World In Crypto Adoption

The UK’s push to ascertain rules for digital property is a part of a broader effort to be a market chief in crypto adoption.

Financial secretary Lucy Rigby instructed the Monetary Occasions that the UK Treasury’s push to manage crypto like different monetary merchandise “is a milestone.”

“Our intention is to steer the world in digital asset adoption,” she mentioned. “The foundations we’re putting in are going to be proportionate and honest.”

Rigby mentioned the brand new guidelines could be “good for development, and that they’ll encourage corporations to put money into the UK whereas additionally offering customers with the required protections. “I don’t see any battle between these issues.”

US Pushing To Get Its Personal Crypto Regulation Out

Because the UK strikes forward with its crypto regulation, lawmakers within the US are drafting their very own laws.

This yr, the US has already signed the GENIUS Act into legislation. Now, lawmakers are engaged on a draft proposal for the Digital Asset Market (CLARITY) Act, which goals to make clear how digital property needs to be categorized and controlled.

Lawmakers search to cut back jurisdictional confusion between the US Commodity Futures Buying and selling Fee (CFTC) and the Securities and Alternate Fee (SEC).

In October, the US and UK additionally introduced a joint initiative known as the “Transatlantic Taskforce for Markets of the Future,” which is designed to strengthen cooperation on monetary markets, together with crypto.

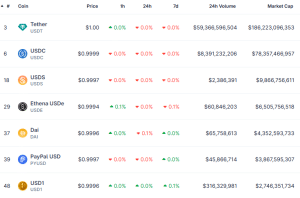

One of many most important focuses of that joint initiative is stablecoins, that are cryptos pegged to an underlying asset, often fiat currencies. Presently, the most important stablecoins by market cap are pegged to the US greenback, in keeping with CoinGecko information.

High stablecoins by market cap (Supply: CoinGecko)

The market cap of those tokens has grown to greater than $300 billion after the US handed the GENIUS Act, offering a regulatory framework for stablecoins within the US for the primary time.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection