Be a part of Our Telegram channel to remain updated on breaking information protection

The US Senate Banking Committee pushed again markup hearings on crypto market laws to 2026 even after lawmakers had hoped for a listening to a while this week.

A spokesperson for Senate Banking chair Tim Scott confirmed in a Monday assertion that the committee won’t maintain a market construction markup this 12 months, noting that Scott needs the hassle to be bipartisan.

“Chairman Scott and the Senate Banking Committee have made robust progress with Democratic counterparts on bipartisan digital asset market construction laws,” the spokesperson stated.

“He has constantly and patiently engaged in good-faith discussions to provide a robust bipartisan product that gives readability for the digital asset trade and likewise makes America the crypto capital of the world,” he added.

The spokesperson then stated that the committee will decide up the place it left off after the vacation break and “seems to be ahead to a markup in early 2026.”

Democrats Nonetheless Have Some Considerations About The Laws, Primarily Due To Trump’s Crypto Pursuits

The market construction invoice that US lawmakers are engaged on goals to take away jurisdictional confusion between the Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC).

Extra particularly, the laws seeks to designate the CFTC a main spot market regulator for crypto whereas additionally extra clearly defining how securities legal guidelines would possibly apply to the sector.

The Banking Committee oversees the SEC, and has produced a number of drafts for the laws. In the meantime, the Senate Agriculture Committee, which oversees the CFTC, has solely produced one dialogue draft to date. It’s going to additionally want to carry its personal markup listening to.

There was forwards and backwards between Democrats and Republicans relating to the laws. Among the details of concern for Democrats relate to monetary stability, market integrity, and ethics.

That final level of concern is basically resulting from US President Donald Trump and his household’s rising involvement within the digital asset house.

Along with launching meme cash at first of the 12 months, the Trumps are additionally linked to the decentralized finance (DeFi) platform World Liberty Monetary. The household is concerned within the stablecoin, Bitcoin mining, and prediction market sectors as effectively.

Total, the Trump household has managed to spice up its wealth to the tune of billions of {dollars} via crypto this 12 months.

Lawmakers have repeatedly voiced their considerations about Trump being concerned in crypto, given his capability to affect coverage. Amongst them is Senator Elizabeth Warren, who has accused the President of lining his personal pockets via crypto.

Reminder: Trump is pushing for crypto laws to maintain lining his personal pocket.

President Bush’s former ethics lawyer says we’ve by no means had a president for the reason that Civil Struggle with such a battle of curiosity.

We must always not cross any crypto laws with out shutting this down. pic.twitter.com/GIIv9UapZc

— Elizabeth Warren (@SenWarren) July 10, 2025

Not Clear How Lengthy Senate Banking Committee Will Take With Crypto Market Construction Invoice Negotiations

Whereas Scott’s spokesperson stated that the committee plans to renew negotiations for the crypto market construction laws “early” subsequent 12 months, it stays unclear how lengthy the negotiations will take.

That’s primarily resulting from the truth that Congress’s most important focus subsequent month might be on funding the US authorities after it returns from the vacation break. The present funding invoice is about to run out on Jan. 30.

That funding invoice got here after the US authorities entered the longest shutdown in historical past. Assuming the federal government doesn’t shut down once more on the finish of January, lawmakers will nonetheless have a restricted period of time to work on the crypto market construction laws earlier than the midterm elections subsequent 12 months develop into a prime precedence.

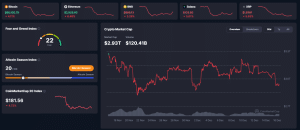

Whereas the delay of the crypto market construction invoice was anticipated by many, the digital asset market dipped on the confirmed postponement. Previously 24 hours, the whole crypto market cap plunged over 4%, information from CoinMarketCap reveals.

Crypto market overview (Supply: CoinMarketCap)

Throughout the previous day of buying and selling, market leaders Bitcoin and Ethereum additionally dropped over 4% and 6%, respectively.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection