- VeChain surged in the course of the 2021 bull run however has struggled to get well since.

- Value forecasts recommend VET might stay under $0.01 even by 2030.

- The danger-to-reward ratio seems unfavorable, making VET a tough funding case.

VeChain was one of many standout performers in the course of the 2021 bull market, a interval when practically each main crypto asset appeared unstoppable. VET surged aggressively, topping out close to $0.28 in April of that 12 months as Bitcoin, Ethereum, Dogecoin, Shiba Inu, Cardano, XRP, and Solana all hit their very own cycle highs. Again then, VeChain regarded like a transparent winner driving each hype and momentum.

Quick ahead to right this moment, and the image seems far much less thrilling. The bull run that when lifted VET has lengthy pale, changed by years of sideways motion and regular stress from sellers. For practically 4 years now, bears have largely dictated worth motion, leaving little room for significant upside or sustained restoration.

VeChain’s Struggles Because the Bull Market

Since 2022, VeChain has remained comparatively weak on the charts, with just one notable spike in December 2024 when the broader crypto market briefly rallied. That transfer coincided with macro-driven optimism slightly than something VeChain achieved by itself. Outdoors of that short-lived surge, VET has did not generate impartial momentum or stand out towards competing altcoins. Its efficiency continues to reflect the market slightly than lead it.

This lack of particular person power has develop into a rising concern for long-term holders. When the market slows, VET slows with it — and when the market rebounds, VET struggles to capitalize in a significant manner. That sample has made it tough for merchants to justify contemporary positions.

Value Forecasts Level to Extra Ache

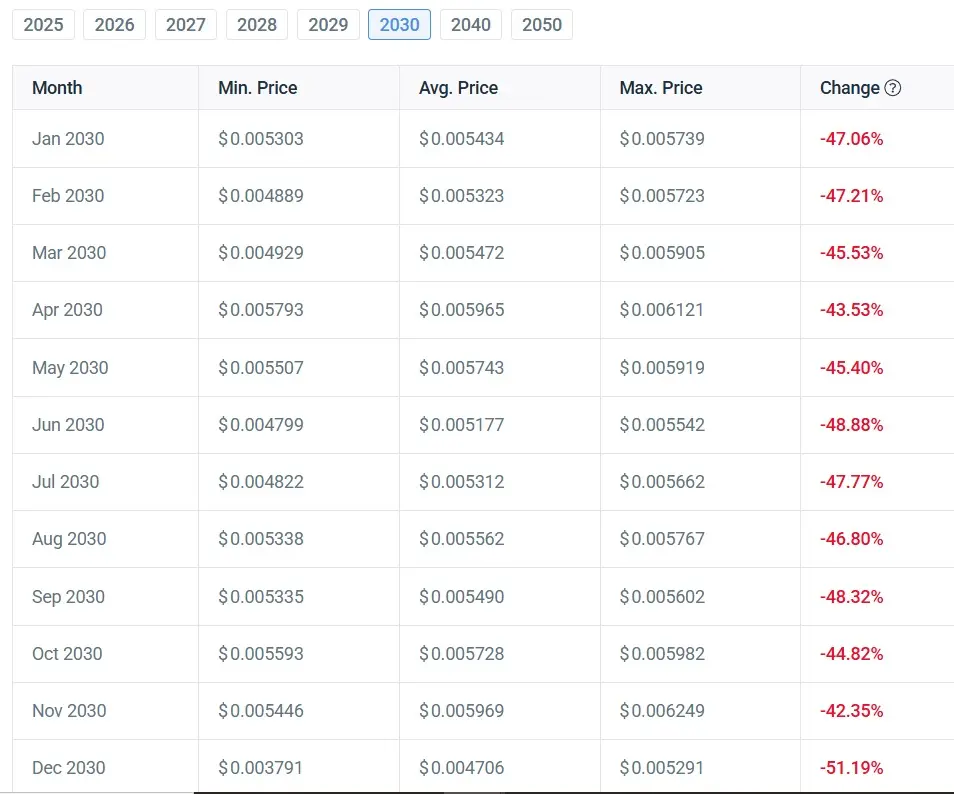

Including to the pessimism, on-chain knowledge and forecasting platform CoinCodex has issued a notably bleak outlook for VeChain. Their projections recommend VET might proceed slipping under its present $0.01 degree and will not reclaim that worth even by 2030. In sensible phrases, which means anybody shopping for now might nonetheless be sitting on losses years down the road.

Some estimates point out VET might lose one other 40% to 50% of its worth by the tip of the last decade. Beneath that situation, a $1,000 funding right this moment is perhaps price nearer to $500 5 years from now. It’s not precisely the sort of risk-reward profile most buyers are in search of, particularly in a market full of different alternatives.

Purchase or Ignore VeChain Going Ahead?

Given the info, VeChain’s outlook seems unfavorable for these chasing long-term positive aspects. The token’s dependence on broader market cycles, mixed with weak impartial efficiency and adverse long-range forecasts, makes it a tricky promote. Whereas VET nonetheless has title recognition from its 2021 run, that alone will not be sufficient to justify holding or accumulating going ahead.

For buyers targeted on capital preservation and progress, VeChain at the moment seems extra like a threat than a chance. Till the challenge demonstrates clear, sustained power of its personal, ignoring VET would be the safer transfer.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.