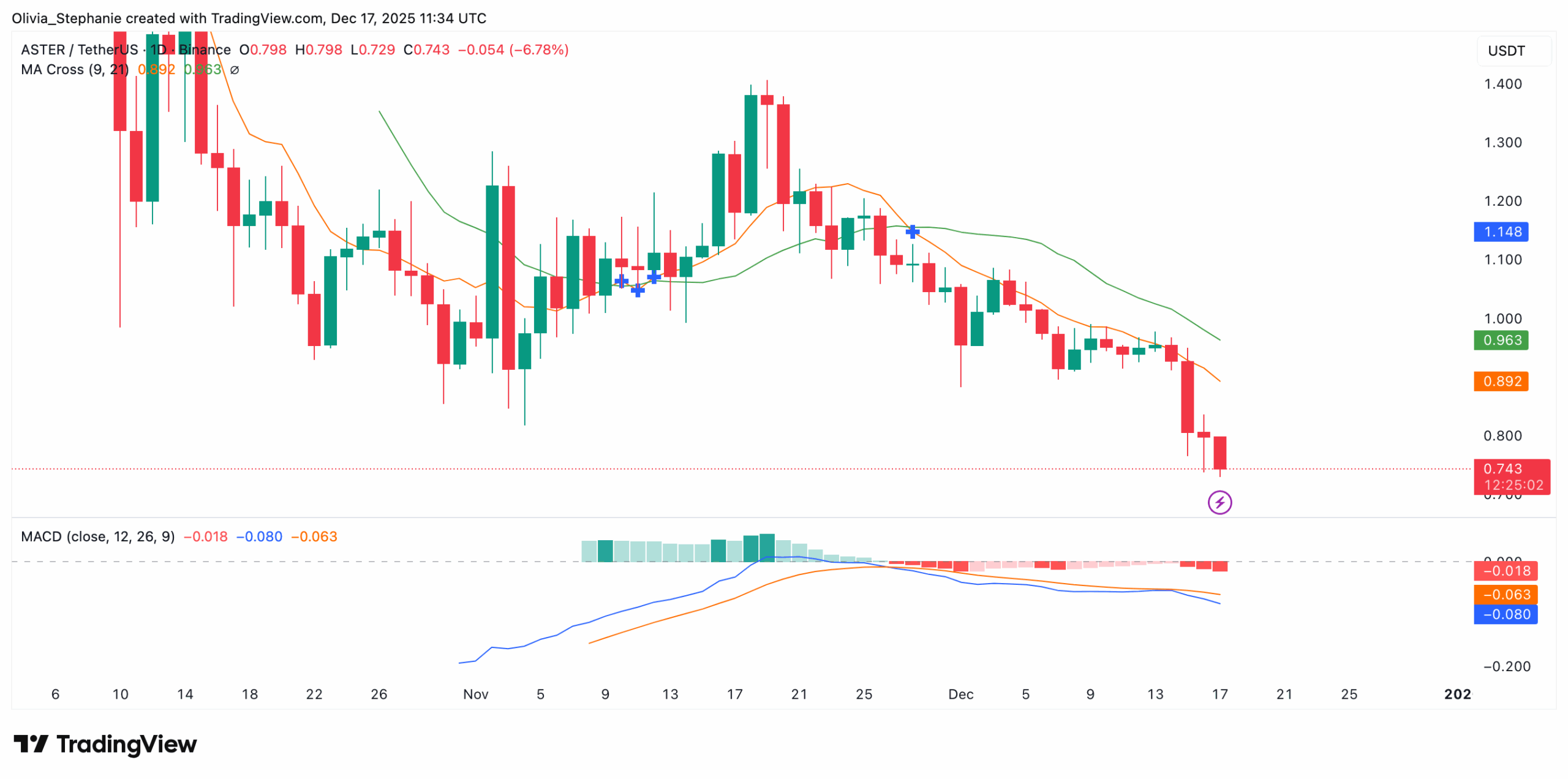

ASTER is buying and selling at round $0.74 after falling over 22% during the last seven days. The drop continued with an 8% decline up to now 24 hours.

Consequently, the current swap occurred after a noticeable technical failure as the worth dumped under its necessary help space of $0.85 to $0.9. The promoting stress was excessive all by way of the week, and there has not been any restoration but.

Breakdown Confirms Downtrend

The chart exhibits a gradual sample of decrease highs over a number of weeks, with a descending trendline guiding the transfer down. That development ended with the help stage breaking cleanly, with none robust rebound or wick.

Cirus described the transfer as a “textbook breakdown,” including, “That wasn’t panic promoting. That was acceptance of decrease costs.” The submit warned that any short-term bounce shouldn’t be mistaken for a reversal, saying “Bounces ≠ reversals in damaged construction.” The development stays in place till power returns above the previous help.

In the meantime, ASTER trades nicely under each the 9-day and 21-day transferring averages. The 9-day MA is now at $0.89, whereas the 21-day is at $0.96. A bearish crossover confirms continued draw back stress.

The MACD additionally stays unfavorable. The MACD line is at -0.080, with the sign line at -0.063. The histogram is widening to the draw back. Momentum remains to be pointing decrease, with no indicators of divergence or restoration.

As well as, futures open curiosity has dropped to $420 million, down from over $600 million in November, per CoinGlass information. This decline got here as the worth declined and suggests merchants are exiting positions.

The info displays decrease participation reasonably than panic. Quantity has not surged, and the transfer seems to point out merchants stepping again reasonably than speeding out. The value and open curiosity falling collectively typically sign decrease conviction out there.

Product Launch and Whale Accumulation

On December 15, Aster DEX launched Protect Mode. The brand new function presents as much as 1001x leverage, immediate execution, and no slippage. It additionally contains off-book buying and selling and one-tap lengthy or quick orders.

Nonetheless, whale wallets stay lively. BeingInvested reported high-volume accumulation over the previous 24 hours. “Huge influx into $ASTER,” the submit mentioned, itemizing prime consumers, together with one buy of 1.34 million tokens valued over $1 million.

The submit ASTER Tanks 22% as Key Help Breaks: What’s Subsequent? appeared first on CryptoPotato.