Bitcoin’s “demise cross” is again within the group chat. And sure, the emails too. Matthew Sigel, head of digital property analysis at VanEck, stated he’s been “getting questions from purchasers” concerning the newest demise cross print — the 50-day transferring common slipping below the 200-day — and answered with the sort of knowledge dump that tends to calm individuals down.

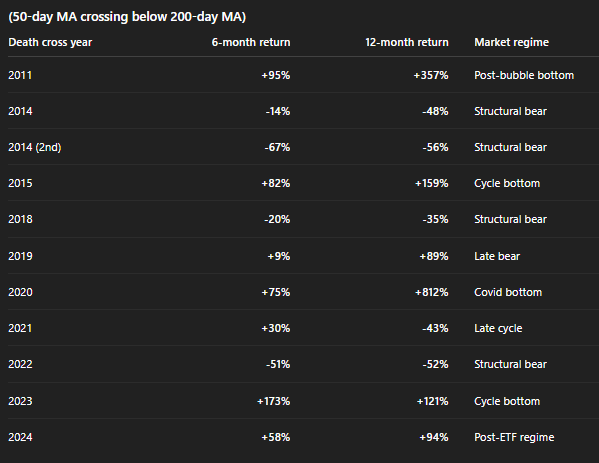

“Lagging indicator,” Sigel wrote on X, alongside a desk of each Bitcoin demise cross going again to 2011. The abstract stats are clear: the 6-month median return after a demise cross is +30%, the 12-month median is +89%, and the “constructive hit charge” is 64%.

One other Bitcoin Dying Cross, One other Missed Backside?

However the fascinating bit isn’t simply the returns. It’s Sigel’s market regime column — mainly a touch that the identical technical sign can imply wildly various things relying on the place you might be within the cycle.

Take those tagged as some model of “backside.” In 2011 (“post-bubble backside”), the demise cross confirmed up across the wreckage of an early-cycle blow-off, and the subsequent 12 months have been +357%. In 2015 (“cycle backside”), it was +82% at six months and +159% at 12 months — traditional post-capitulation habits the place pattern indicators catch up late, after worth has already stabilized and began to show.

Associated Studying

2020 (“Covid backside”) is the intense instance: pressured liquidation, coverage response, then a monster rebound (+812% over 12 months). And 2023 can be tagged “cycle backside,” with +173% at six months and +121% at 12 months — the sort of “that is terrible till it isn’t” regime crypto does higher than any asset class.

Now take a look at “structural bear.” That label reveals up in 2014 (twice), 2018, and 2022 — and the ahead returns are principally ugly: 2014 prints -48% and -56% over 12 months, 2018 is -35%, and 2022 is -52%. Completely different atmosphere. Much less “washout and bounce,” extra “pattern is down as a result of the system is deleveraging,” whether or not that’s miners, credit score, exchanges, or macro liquidity tightening. In these regimes, a demise cross isn’t a late alarm — it’s the transferring averages confirming that the downtrend is actual and protracted.

Associated Studying

The in-between tags matter too. 2019 is marked “late bear,” with +9% at six months and +89% at 12 — uneven, uneven, however bettering because the cycle turns. 2021 is “late cycle”: +30% at six months, then -43% at 12, which inserts a regime the place pattern alerts can whipsaw whereas distribution and macro tightening creep in.

After which there’s 2024: “post-ETF regime,” with +58% at six months and +94% at 12. That tag is doing a variety of work. It suggests the backdrop isn’t simply “worth vs. transferring averages,” however structural demand (ETFs), totally different liquidity plumbing, and a market that will behave much less like pure reflexive leverage and extra like a hybrid of trad-fi flows plus crypto-native positioning.

So the takeaway isn’t “demise crosses are bullish.” That’s not true. It’s that the sign is generally a trailing mirror — and the regime you’re truly in (bottoming, late bear, structural deleveraging, late cycle, post-ETF stream market) is what decides whether or not it’s a fake-out, a affirmation, or simply noise with a scary title.

At press time, Bitcoin traded at $86,631.

Featured picture created with DALL.E, chart from TradingView.com