- Ethereum slipped right into a short-term downtrend after shedding $3,400, triggering heavy derivatives losses

- Whale longs on Hyperliquid are deep in drawdown, however liquidation ranges stay far under present value

- Cascading liquidations and falling open curiosity counsel continued draw back stress until $3,000 is reclaimed

Ethereum’s latest slide didn’t come out of nowhere, nevertheless it nonetheless caught loads of merchants leaning the flawed means. About six days in the past, ETH failed to carry above the $3,400 degree, and that rejection flipped the short-term construction bearish. Since then, value has drifted decrease inside a modest descending channel, briefly tagging a neighborhood low close to $2,800 earlier than trying to stabilize.

At press time, Ethereum was buying and selling round $2,926, down almost 7% on the day and increasing a week-long run of weak point. That transfer didn’t simply damage spot holders. It despatched unrealized and realized losses surging throughout derivatives markets, the place leverage had quietly piled up.

Whale Drawdowns Develop on Hyperliquid

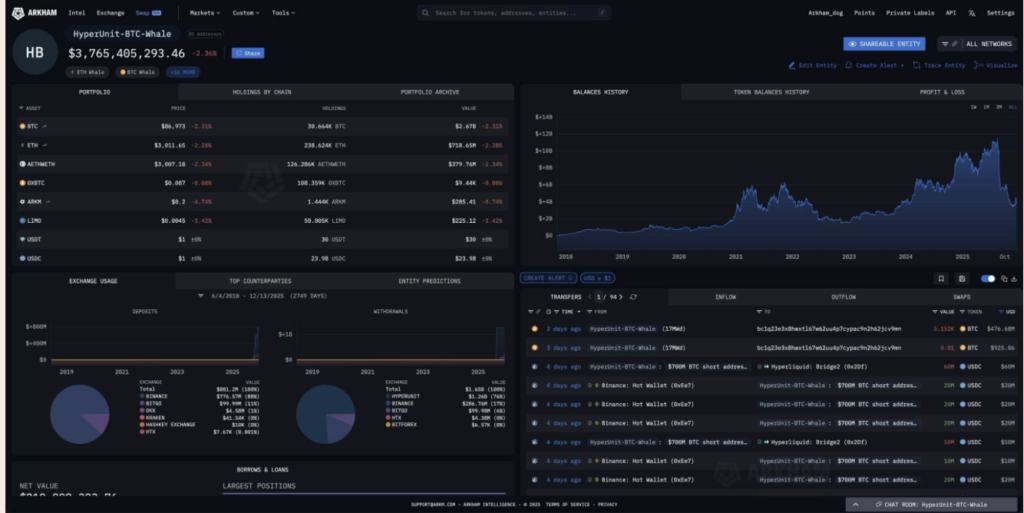

One of many extra eye-catching developments got here from a big Ethereum whale on Hyperliquid. As ETH slipped under $3,000, this whale’s unrealized losses ballooned previous $54 million. The place traces again to a post-April crash restoration section, when a widely known Bitcoin whale rotated capital into Ethereum.

Labeled “BitcoinOG” on Arkham, the entity shifted out of BTC and opened aggressive leveraged ETH longs. In whole, the whale constructed near $700 million in lengthy publicity, making it the only largest ETH lengthy holder on Hyperliquid.

As costs fell, unrealized revenue shrank dramatically, dropping from round $119.6 million to roughly $54 million. Even so, there was no signal of panic. The estimated liquidation degree sat close to $2,082, leaving a large buffer. Regardless of the rising drawdown, the whale hasn’t closed positions, an indication of conviction, or stubbornness, relying on the way you have a look at it.

Liquidations Spike as Merchants Exit in Drive

Past particular person whale losses, the broader derivatives market confirmed clear indicators of stress. CoinGlass information revealed that derivatives quantity surged 53.5% to $87.15 billion, whereas open curiosity collapsed by greater than 55% to $37.67 billion.

That mixture normally indicators mass place unwinding. Merchants weren’t including danger, they had been getting out. As positions had been closed and liquidated, Ethereum noticed a pointy leap in pressured exits. Liquidations hit $196 million on December 15, adopted by one other $58 million the subsequent day. Lengthy positions took the brunt, with whole lengthy liquidations topping $213 million over that stretch.

On-chain trackers even flagged repeated blowups. In accordance with Onchain Lens, dealer Machi Massive Brother suffered one more pressured liquidation on a 25x SETH lengthy, marking his tenth liquidation in latest weeks. For the reason that October 10 market crash, that account has logged greater than 200 liquidations, with cumulative losses exceeding $22.9 million. Ultimately verify, the stability sat at simply over $53,000.

Momentum Breaks Down as Promoting Accelerates

Worth motion mirrored the chaos unfolding in derivatives. As cascading liquidations hit, Ethereum slid decrease, reinforcing draw back momentum. The Stochastic RSI plunged deep into oversold territory, hovering close to 17 at press time.

Readings like that normally level to intense promoting stress and really weak short-term momentum. If liquidation-driven promoting continues, ETH may drift again towards the $2,700 space, the place Parabolic SAR help beforehand appeared.

On the flip aspect, any significant restoration doubtless requires bulls to reclaim $3,000 with conviction. Till that occurs, upside appears to be like capped, with resistance clustering close to $3,436, the place Parabolic SAR final aligned. For now, Ethereum stays beneath stress, and the market continues to be digesting the injury left behind by leverage.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.