- Solana is down over 50% from September highs, with key help ranges damaged.

- TVL, community charges, and memecoin exercise have all declined sharply.

- A bearish chart sample factors to a possible transfer towards the $90–$100 zone.

Solana’s native token has taken a heavy hit over the previous few months, with SOL down roughly 52% between Sept. 18 and Nov. 21. The drop adopted a broader altcoin selloff that additionally dragged Bitcoin to a seven-month low close to $80,000. Because of this, SOL has misplaced a number of key long-term help ranges, and each onchain metrics and technical patterns are pointing towards the danger of a deeper correction, probably under the $100 mark.

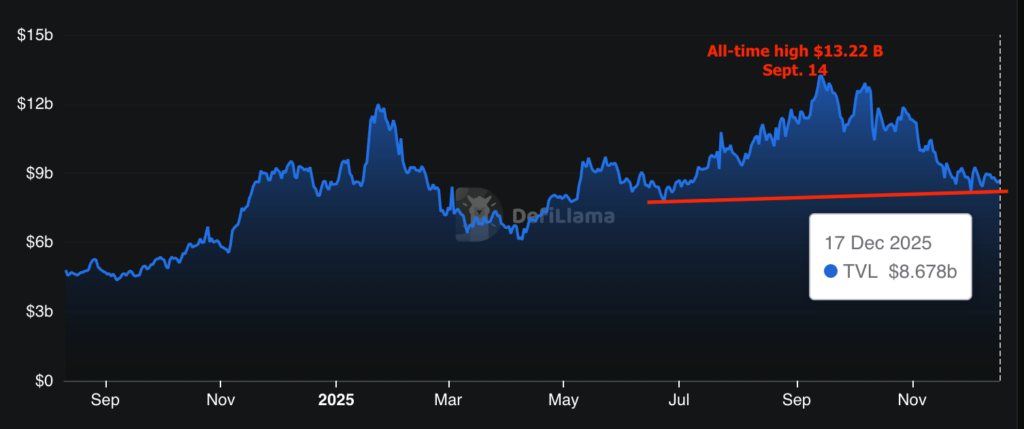

Solana’s TVL Falls Again to Mid-Yr Ranges

One of many clearest warning indicators is the sharp decline in Solana’s complete worth locked. TVL has fallen greater than 34% from its September peak of $13.22 billion to about $8.67 billion, marking a six-month low. Over the previous 30 days, TVL has remained caught under $10 billion, signaling persistent capital outflows from the ecosystem.

Knowledge from DefiLlama exhibits that the decline has been led by Jito liquid staking, which is down 53% since mid-September. Different main protocols haven’t been spared both. Jupiter DEX, Raydium, and Sanctum have every seen drops starting from roughly 30% to almost 46%, reinforcing the view that exercise is slowing throughout the board.

Community Exercise Continues to Cool

The stress on SOL can also be mirrored in falling community utilization. Solana’s chain charges totaled round $3.43 million over the previous week, down 11% from the earlier week and 23% in comparison with final month. On the identical time, energetic addresses declined by almost 8% over seven days, whereas transaction counts fell greater than 6%.

Collectively, decrease charges, fewer customers, and declining transaction quantity level to decreased onchain demand. That lack of exercise provides overhead stress on SOL’s worth and makes it more durable for bulls to regain management.

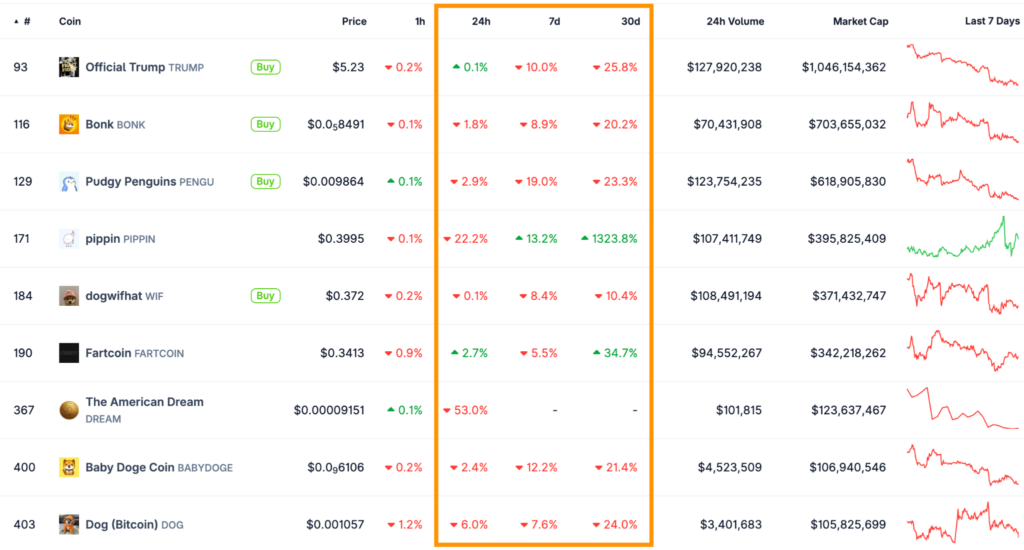

Memecoin Collapse Weighs on the Ecosystem

The stoop in Solana’s TVL intently mirrors what’s taking place in its once-booming memecoin sector. Most Solana-based memecoins are actually posting double-digit losses on each weekly and month-to-month timeframes, with many down 10% to 25% from current highs.

DEX exercise tied to memecoins has collapsed as effectively. Weekly memecoin buying and selling quantity on Solana has plunged by roughly 95%, falling to about $2.7 billion from a peak close to $56 billion recorded in January. That collapse in speculative exercise has eliminated a significant supply of demand that beforehand helped help the community and SOL’s worth.

Bear Pennant Indicators Additional Draw back

From a technical perspective, SOL stays below stress. Chart information exhibits the token buying and selling under a bear pennant formation, a continuation sample that always seems after a pointy decline adopted by temporary consolidation. The current break under the pennant’s help close to $135 opened the door for one more leg decrease.

The measured goal of the sample sits round $86, representing a possible 32% drop from present ranges. Earlier than reaching that zone, SOL may discover interim help close to the 200-week EMA round $118, the place patrons could try a protection. Nonetheless, a number of merchants warn {that a} transfer into the $90–$100 vary is more and more believable if present situations persist.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.