XRP has delivered certainly one of its most intriguing intervals in latest reminiscence, marked by a transparent disconnect between strengthening fundamentals and restrained value motion.

Whereas the broader crypto market has been beneath stress, with Bitcoin falling under $86,000 and Ethereum sliding beneath $2,900, XRP has continued to quietly construct momentum beneath the floor.

Regardless of buying and selling in a comparatively tight vary between roughly $1.70 and $1.91 and struggling to reclaim the psychological $2 degree, developments round Ripple and XRP counsel that the asset could also be laying the groundwork for a a lot bigger transfer within the years forward.

This backdrop retains XRP value prediction centered on gradual accumulation and endurance, with $XRP more and more seen as a finest crypto to purchase now candidate for traders wanting past short-term market noise.

XRP Sees Document ETF Inflows Regardless of Broader Crypto Outflow

Some of the compelling narratives supporting XRP proper now’s the surge in institutional participation. Spot XRP exchange-traded merchandise have surpassed $1 billion in complete internet inflows since launch, recording weeks of consecutive inflows with no single day of internet outflows.

This streak stands in stark distinction to Bitcoin and Ethereum ETFs, which collectively skilled billions of {dollars} in outflows over the identical interval.

Such consistency alerts deliberate, long-term positioning relatively than speculative buying and selling, reinforcing the concept institutional capital is quietly accumulating publicity to XRP whilst broader market sentiment stays cautious.

Supply – Whale Insider X

Regulatory progress has additional strengthened this thesis. U.S. banking regulators have granted conditional approval to a number of crypto-related companies, together with Ripple, to pursue nationwide belief financial institution charters.

This improvement is critical as a result of belief banks function a bridge between conventional monetary establishments and digital asset infrastructure, enabling regulated custody, asset administration, and deeper integration with legacy finance.

Relatively than remaining on the perimeter, XRP and Ripple look like embedding themselves instantly into the evolving monetary system, a transfer that might have long-term implications for adoption and liquidity.

Supply – Cilinix Crypto YouTube Channel

Why XRP Worth Stays Vary-Sure Regardless of Institutional Inflows

Nonetheless, the query stays: why hasn’t value responded extra aggressively? On-chain information provides a transparent clarification. Lengthy-dormant XRP provide has begun re-entering circulation, with older holders benefiting from renewed curiosity to promote into energy.

This promoting stress has partially offset ETF inflows, retaining value range-bound. Traditionally, such stress between accumulation and distribution usually precedes sharp breakouts as soon as provide overhang diminishes and sentiment flips decisively bullish.

Including to the speculative upside are rising discussions round potential mainstream integrations and impressive long-term projections, together with the potential of XRP considerably closing the hole with Ethereum’s market capitalization by 2026.

Whereas such outcomes are removed from assured, the convergence of institutional inflows, regulatory readability, and infrastructure growth means that XRP’s present consolidation could also be much less an indication of weak spot and extra a interval of quiet preparation.

If broader market circumstances enhance and resistance ranges give manner, XRP may transition quickly from subdued efficiency to an aggressive upside part.

XRP Worth Prediction

XRP value prediction stays impartial to cautiously bearish within the brief time period because the market continues to soak up latest promoting stress. Worth motion reveals XRP buying and selling under the important thing $1.98–$2 resistance zone, a degree that should be reclaimed to shift momentum decisively increased.

Till that occurs, the construction favors consolidation relatively than a right away breakout. Robust assist is forming within the $1.84–$1.82 vary, which has to date restricted deeper draw back strikes.

A failure to carry this space may expose $XRP to a pullback towards the $1.75 area, the place patrons beforehand stepped in. Regardless of near-term weak spot, XRP’s broader construction stays constructive after clearing main cycle highs earlier within the yr.

The present $1.80–$1.90 zone is critical, because it acted as resistance earlier than a robust rally prior to now. If market circumstances enhance and resistance breaks, a transfer again towards the $3.60 space would characterize substantial upside from present ranges.

Analysts Spotlight High Crypto to Purchase Now as Options to XRP

At current, ETF inflows by themselves are proving inadequate to drive a sustained transfer increased. As demand cools and on-chain indicators stay blended, $XRP’s value continues to hover between agency assist and progressively growing promoting stress.

This surroundings has pushed some market members to discover alternate options equivalent to crypto presales. Beneath are two rising tasks that analysts have already highlighted among the many finest crypto to purchase now.

Maxi Doge (MAXI)

Maxi Doge has been gaining traction within the meme coin house regardless of a usually fearful market all through 2025. The coin, positioned as a pure meme coin, has seen regular exercise with 55 patrons during the last 24 hours, which is notable during times of low retail curiosity.

Its presale has already surpassed $4.3 million. Market circumstances, together with volatility and prolonged worry cycles, have created alternatives for selective accumulation within the dog-themed coin sector.

Supply – Alessandro De Crypto YouTube Channel

Traditionally, comparable cash have rebounded strongly after dips, usually outpacing bigger counterparts like Dogecoin. Maxi Doge advantages from this sample and the general resurgence of curiosity in meme cash as sentiment improves.

Analysts word that the coin’s easy method and timing in the course of the market’s bottoming part could place it for significant good points within the months forward. To participate within the $MAXI token presale, go to maxidogetoken.com.

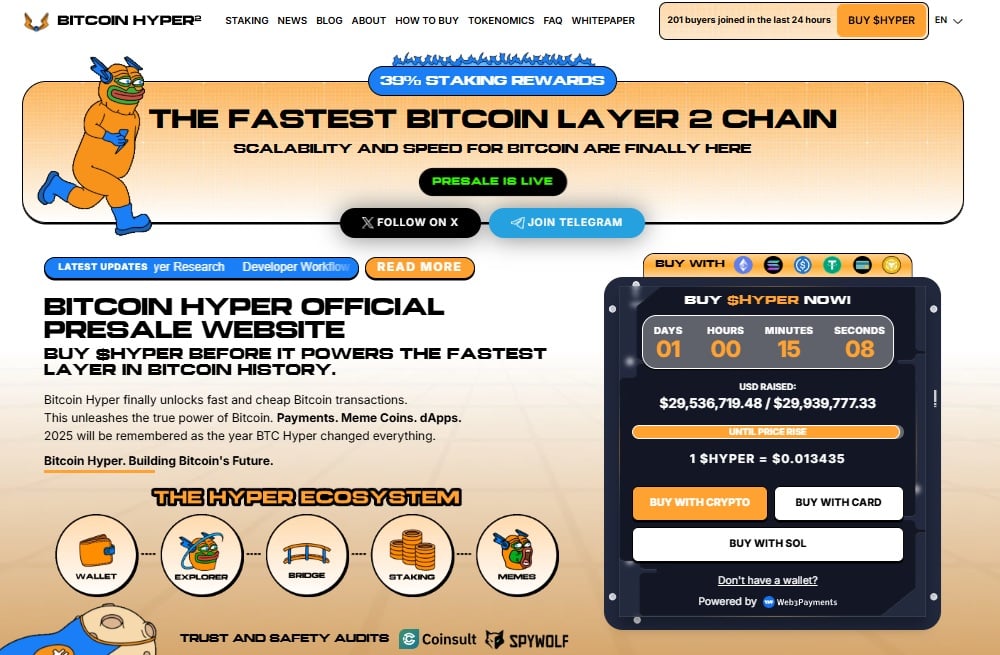

Bitcoin Hyper (HYPER)

Bitcoin has just lately skilled a notable pullback from its all-time highs close to $126,000 all the way down to round $87,000, creating widespread worry regardless of being a comparatively modest decline.

This drop highlights the market’s sensitivity, but it surely additionally underscores the rising curiosity in options that improve Bitcoin’s utility, equivalent to layer 2 networks like Bitcoin Hyper which already raised practically $30 million.

By permitting near-instant transactions whereas sustaining the safety of the Bitcoin blockchain, these networks intention to handle Bitcoin’s gradual transaction occasions and restricted on a regular basis usability. Such developments are influencing market sentiment and serving to diversify choices for traders.

For these looking for alternate options or broader publicity, Bitcoin Hyper and comparable tasks are more and more mentioned as a part of one of the best crypto to purchase now for potential development. This mix of innovation and strategic funding may reshape Bitcoin’s sensible worth.

Go to Bitcoin Hyper

This text has been offered by certainly one of our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues by the hyperlinks on this text.