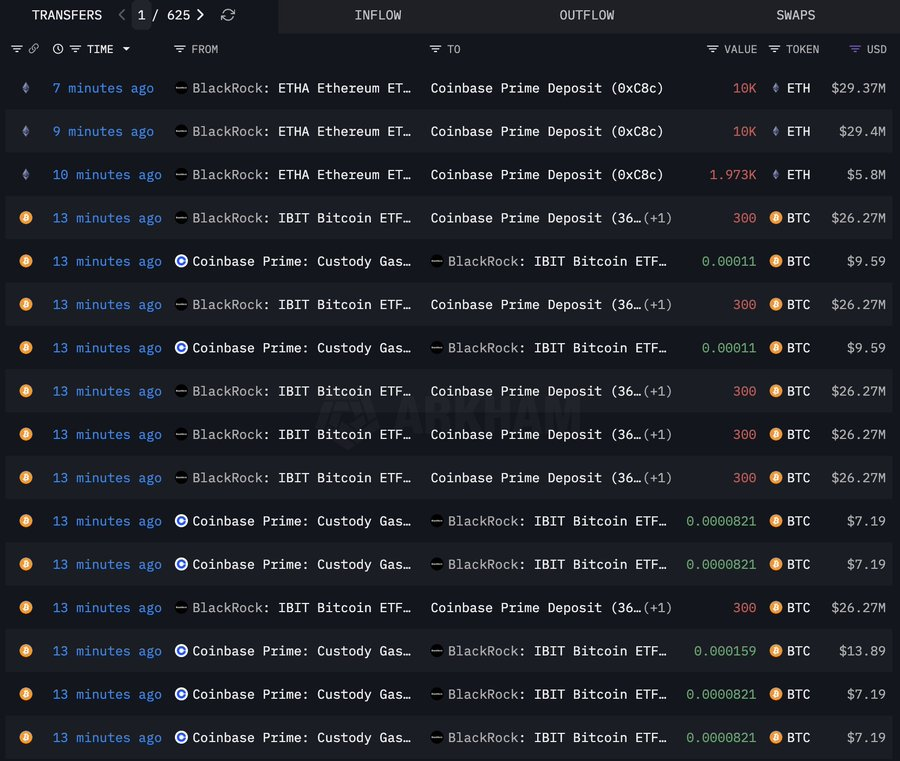

- BlackRock deposited roughly $600M value of BTC and ETH to Coinbase Prime.

- The transfer adopted sizable outflows from BlackRock’s Bitcoin and Ethereum ETFs.

- ETF move knowledge typically lags actual market exercise and doesn’t at all times sign rapid promoting.

BlackRock transferred a large batch of digital belongings to Coinbase Prime in the present day, depositing 74,973 Ethereum value roughly $220 million alongside 4,356 Bitcoin valued close to $382 million, in line with Arkham Intelligence. The timing of the transfer instantly drew consideration, particularly as crypto markets proceed to wrestle with uneven institutional flows. Whereas massive transfers typically spark hypothesis, the context round BlackRock’s ETF exercise provides a couple of further layers to unpack.

ETF Outflows Paint a Combined Image

The deposits comply with a day of notable outflows throughout BlackRock’s crypto ETFs. On Tuesday, the agency’s Bitcoin ETF noticed greater than $210 million in web redemptions, whereas its Ethereum ETF recorded outflows exceeding $220 million. On the floor, these numbers recommend cooling demand, however ETF flows don’t at all times mirror real-time buying and selling strain within the underlying belongings. They observe share creation and redemption, not essentially rapid shopping for or promoting in spot markets.

How Approved Members Form the Information

Approved individuals play a crucial position in how ETF flows translate to on-chain exercise. These intermediaries can maintain ETF shares in stock, look forward to liquidity to enhance, or redeem shares for Bitcoin or Ethereum at a later stage. Due to that flexibility, inflows and outflows typically lag precise market habits. A big redemption in the present day doesn’t mechanically imply aggressive promoting occurred in the present day, even when it appears to be like that manner at first look.

Why the Transfers Matter Anyway

Even with these nuances, BlackRock’s choice to maneuver a whole bunch of hundreds of thousands in BTC and ETH to Coinbase Prime remains to be value noting. Prime accounts are sometimes used for custody, execution, or settlement, that means the belongings are positioned for potential exercise. Whether or not that exercise turns into promoting, rebalancing, or inner fund administration stays unclear. For now, the transfers spotlight how institutional positioning can shift quietly behind the scenes, properly earlier than value reacts.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.