- A brand new prediction suggests XRP might surpass Ethereum’s market cap by 2026.

- Critics argue Ethereum faces inflation and centralization challenges resulting from Layer 2 development.

- XRP’s fastened provide and payment-focused use instances are central to the bullish argument.

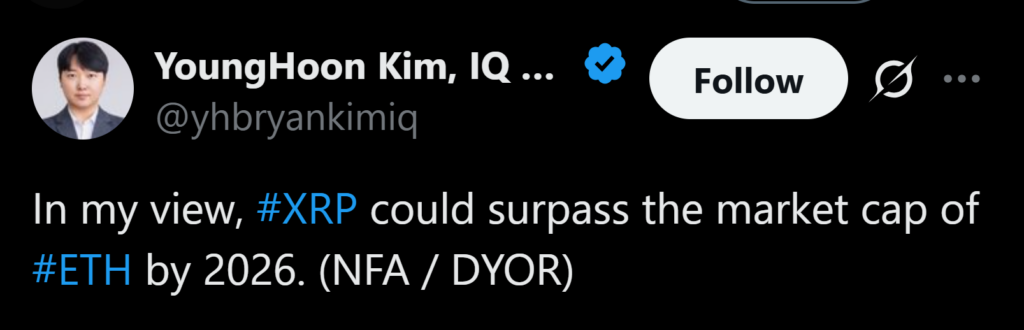

A daring declare is making the rounds in crypto circles after YoungHoon Kim, who publicly states he has an IQ of 276, advised that XRP might overtake Ethereum’s market capitalization by 2026. In a social media put up, Kim clarified that the remark mirrored his private view somewhat than monetary recommendation, however the assertion rapidly sparked dialogue. The thought of XRP difficult Ethereum’s long-held second-place place is controversial, although not totally new.

The place Ethereum and XRP Stand As we speak

Ethereum stays the second-largest cryptocurrency behind Bitcoin, with ETH buying and selling close to $2,927 on the time of writing and a market capitalization of roughly $353 billion. XRP, in the meantime, is priced round $1.91 with a market worth near $116 billion. Whereas the hole between the 2 property continues to be vital, XRP’s supporters argue that structural variations might enable that distance to shrink sooner than many count on.

Structural Issues Round Ethereum

Related arguments surfaced earlier this yr from Austin King, a Harvard-educated engineer and co-founder of the Omni Basis. In an interview on the Good Morning Crypto podcast, King claimed Ethereum faces deep structural challenges that would restrict its long-term development. He pointed to Ethereum’s shift away from a deflationary mannequin, arguing that heavy utilization of Layer 2 networks has made ETH inflationary once more, rising complete provide as an alternative of decreasing it.

King additionally raised considerations round centralization, noting that many Layer 2 options are managed by single operators. In his view, this undermines Ethereum’s decentralization and has contributed to slower progress, which he believes is mirrored in ETH’s weaker efficiency relative to Bitcoin.

Why Some See XRP as a Challenger

Against this, King described XRP as structurally easier and extra predictable. XRP has a set provide of 100 billion tokens, and whereas Ripple releases roughly 200 million XRP into circulation every month, he argued that the asset stays extra steady than Ethereum. Use instances tied to cross-border funds and asset tokenization proceed to anchor XRP’s narrative, particularly as establishments discover blockchain-based settlement techniques.

What Would It Take for XRP to Flip ETH?

For XRP to surpass Ethereum’s present market worth, its worth would want to rise sharply. King estimated that an XRP worth round $6 may very well be enough to overhaul Ethereum’s market cap, assuming ETH stays close to present ranges. Whether or not that state of affairs performs out relies on adoption, regulatory readability, and whether or not Ethereum can tackle the considerations critics proceed to boost.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.