Hyperliquid (HYPE) is buying and selling close to $24 at press time, exhibiting a pointy drop of greater than 60% from its all-time excessive. The token has misplaced over 10% within the final 24 hours and practically 13% prior to now week. Market knowledge exhibits weak momentum and additional draw back dangers until consumers return quickly.

Consequently, its 24-hour quantity is over $550 million, whereas its market cap stands round $6.6 billion. HYPE is ranked #25 amongst cryptocurrencies by market worth.

Breakdown Beneath Channel Help

HYPE/USDT has fallen by way of the decrease boundary of its descending value channel. This trendline had beforehand held for a number of months however has now been damaged, as proven in latest charts shared by analyst Duo 9. He famous that the value motion displays an “extraordinarily bearish sample,” and added, “$22 is on the books subsequent.”

The asset is now sitting under the 50% Fibonacci retracement stage of $26. That stage has become resistance. Thus far, there isn’t a sturdy response from consumers.

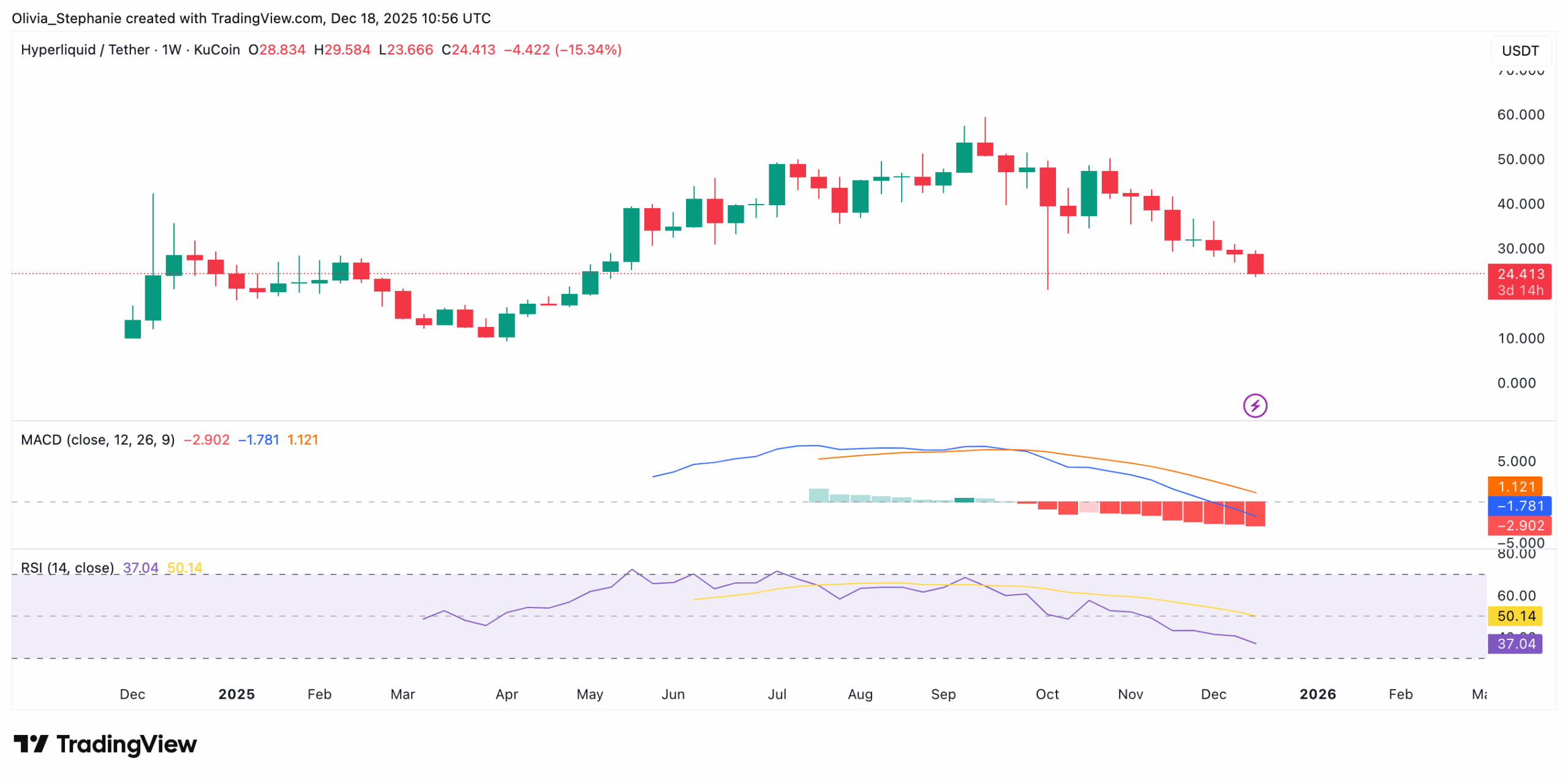

Apart from, the weekly chart presents adverse momentum in main indicators. MACD depicts a broader hole between MACD and the sign line, with the values at -1.78 and 1.12. The bars within the histogram are pink and rising, which suggests that downward momentum is accumulating.

In the meantime, the RSI is at 37, which exhibits weak shopping for curiosity. Though this stage shouldn’t be but oversold, it’s nearing that territory. Merchants are looking ahead to indicators of an area backside, however there isn’t a clear sign of reversal at this stage.

Whales Accumulate Amid Provide Occasions

On-chain knowledge exhibits elevated whale curiosity. In response to Bitcoinsensus, three massive consumers deposited a mixed $37 million USDC into Hyperliquid, inserting massive purchase orders between $15 and $25.6. One pockets alone now holds over $22.4 million price of HYPE.

As well as, the Hyper Basis has recommended burning 37 million HYPE tokens or roughly 10% of the availability in circulation. This might have a long-term provide affect in the marketplace, within the occasion that it’s handed.

Moreover, Ali Martinez reported that one other 10 million HYPE tokens will unlock this month, including to the ten million already launched since November. This provides extra provide to the market, which might stress the value additional.

CryptoPotato additionally reported that Hyperliquid Methods, a fund launched beneath the ticker $PURR, started buying and selling in early December. The fund holds 12.6 million HYPE tokens and over $300 million in money, serving as a treasury reserve linked to the Hyperliquid ecosystem.

The put up Hyperliquid (HYPE) Crashes 60% From ATH: What’s the Subsequent Cease? appeared first on CryptoPotato.