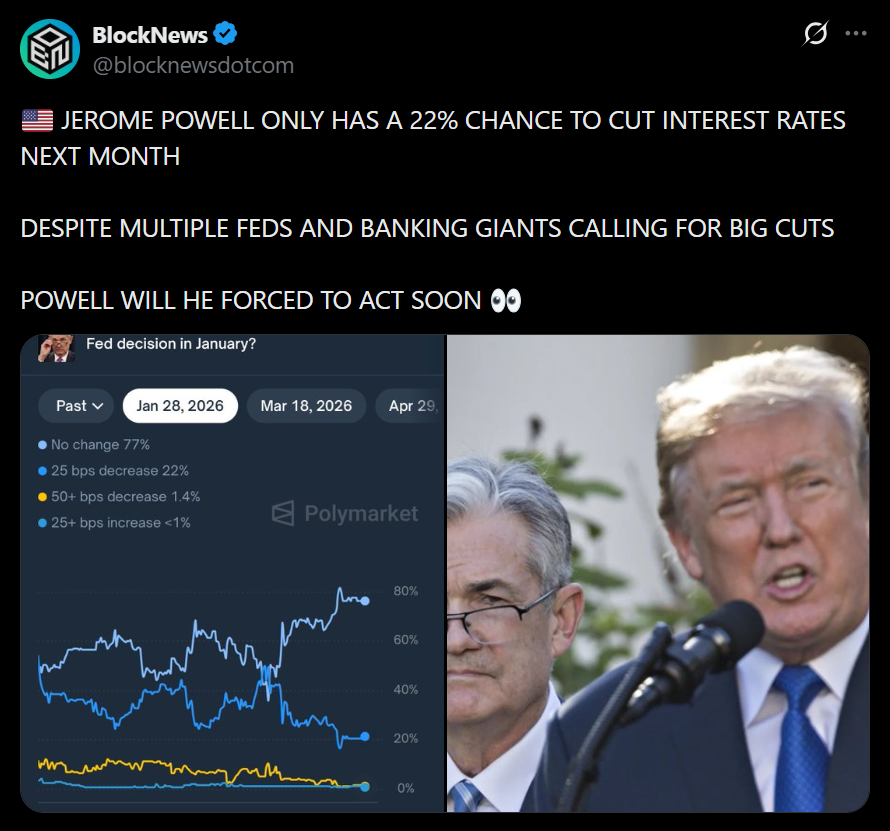

- Markets see solely a 22% probability Jerome Powell cuts charges on the January Fed assembly.

- Inflation cooled greater than anticipated, however Powell stays cautious.

- Merchants nonetheless anticipate two cuts subsequent 12 months, however not instantly.

Regardless of recent indicators that inflation is cooling, markets stay largely unconvinced that Federal Reserve Chair Jerome Powell will transfer rapidly on rates of interest. Merchants are presently pricing in solely a 22% probability of a quarter-point price minimize on the Fed’s January assembly, underscoring how cautious expectations stay. Even after softer inflation information, Powell seems dedicated to persistence relatively than speeding into additional easing.

Inflation Cools, However Powell Stays in Wait-and-See Mode

New information from the Bureau of Labor Statistics confirmed U.S. inflation rising simply 2.7% 12 months over 12 months in November, properly beneath forecasts calling for 3.1%. Core inflation additionally slowed to its weakest tempo since early 2021. The information sparked a rally in Treasuries, with the two-year yield dropping to three.45% and the 10-year sliding to 4.12%. Nonetheless, the response in price expectations was muted, suggesting markets consider Powell wants extra affirmation earlier than appearing.

Markets Worth Solely Restricted Close to-Time period Easing

Curiosity-rate swaps now mirror roughly six foundation factors of easing for January, translating to that 22% chance of a price minimize. Whereas merchants proceed to anticipate two quarter-point cuts subsequent 12 months, they don’t see Powell shifting instantly. The truth is, a full price discount isn’t priced in till mid-2026, highlighting how slowly the market expects coverage to unwind from restrictive ranges.

Powell Overshadows Dovish Voices Contained in the Fed

The restrained outlook persists at the same time as different Fed officers lean dovish. Fed Governor Christopher Waller lately reiterated that charges could also be greater than impartial, whereas international central banks just like the Financial institution of England have already begun easing. But Powell’s management continues to anchor expectations, significantly after final week’s Fed assembly revealed inner divisions, together with dissents each for no minimize and for a bigger one.

What Powell’s Warning Means for Markets

For now, Powell’s cautious stance suggests financial coverage will stay a headwind relatively than a tailwind within the close to time period. Bonds might profit from cooling inflation, however threat belongings searching for speedy reduction could also be dissatisfied. Till Powell sees clearer labor market weak point or sustained disinflation, January seems to be extra like a pause than a pivot.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.