US inflation delivered its greatest draw back shock in months. But as an alternative of a sustained rally, each Bitcoin and US equities offered off sharply throughout US buying and selling hours.

The value motion puzzled many merchants, however the charts level to a well-known rationalization rooted in market construction, positioning, and liquidity quite than macro fundamentals.

What Occurred After the US CPI Launch

Headline CPI slowed to 2.7% 12 months over 12 months in November, effectively under the three.1% forecast. Core CPI additionally undershot expectations at 2.6%.

Sponsored

Sponsored

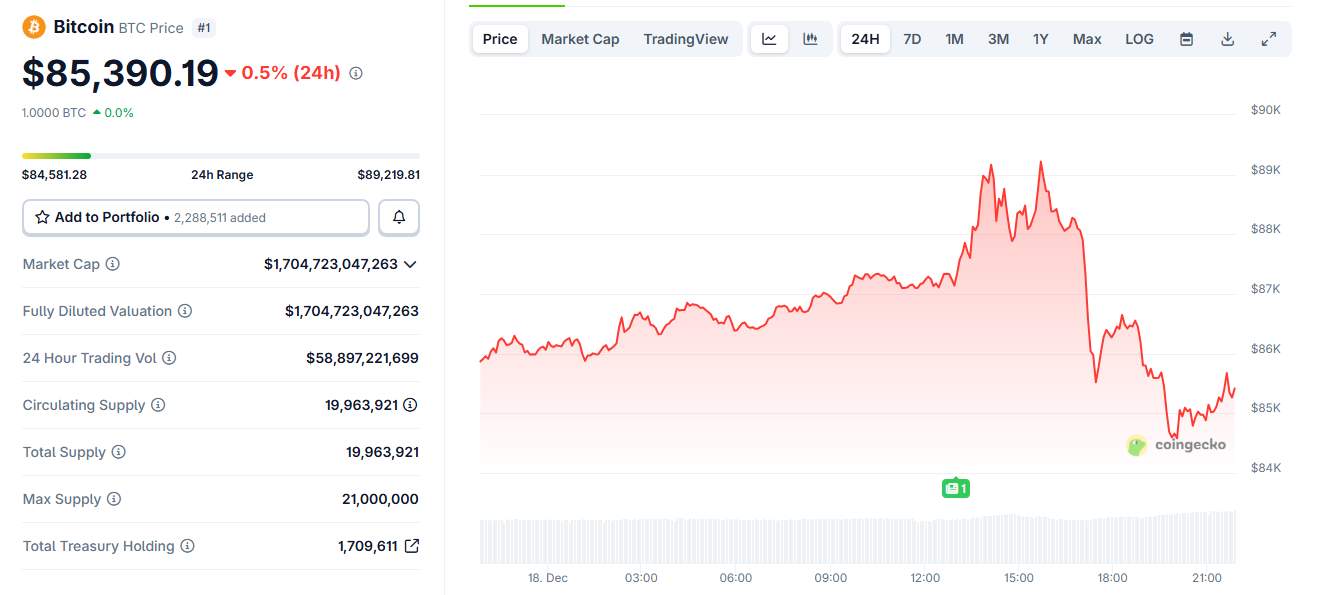

On paper, this was one of the risk-positive inflation prints of 2025. Markets initially reacted as anticipated. Bitcoin jumped towards the $89,000 space, whereas the S&P 500 spiked increased shortly after the information hit.

That rally didn’t final.

Inside roughly half-hour of the CPI print, Bitcoin reversed sharply. After tagging intraday highs close to $89,200, BTC offered off aggressively, sliding towards the $85,000 space.

The S&P 500 adopted an analogous path, with sharp intraday swings that erased a lot of the preliminary CPI-driven positive factors earlier than stabilizing.

This synchronized reversal throughout crypto and equities issues. It alerts that the transfer was not asset-specific or sentiment-driven. It was structural.

Bitcoin Taker Promote Quantity Tells the Story

The clearest clue comes from Bitcoin’s taker promote quantity knowledge.

Sponsored

Sponsored

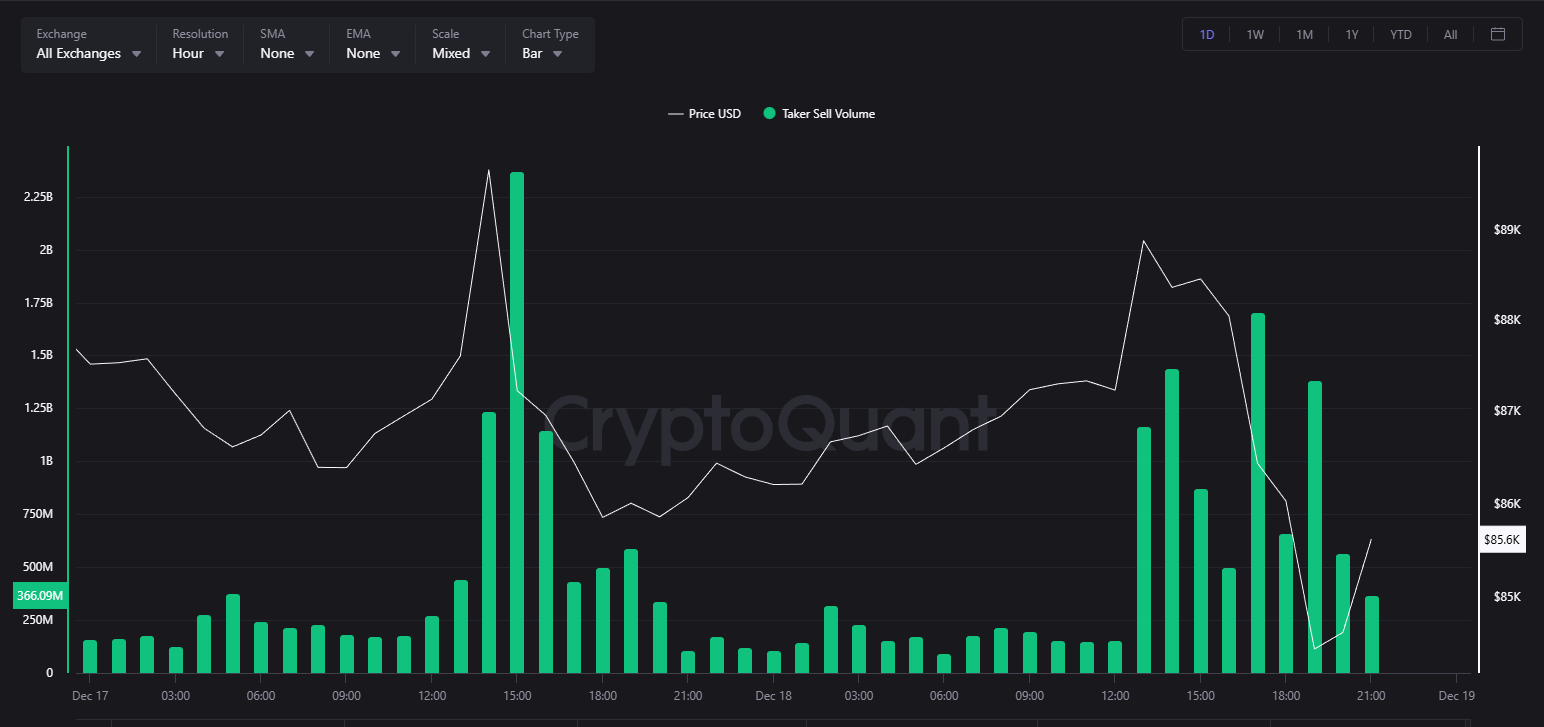

On the intraday chart, giant spikes in taker promote quantity appeared exactly as Bitcoin broke decrease. Taker sells mirror market orders hitting the bid — aggressive promoting, not passive profit-taking.

These spikes clustered throughout US market hours and coincided with the quickest a part of the decline.

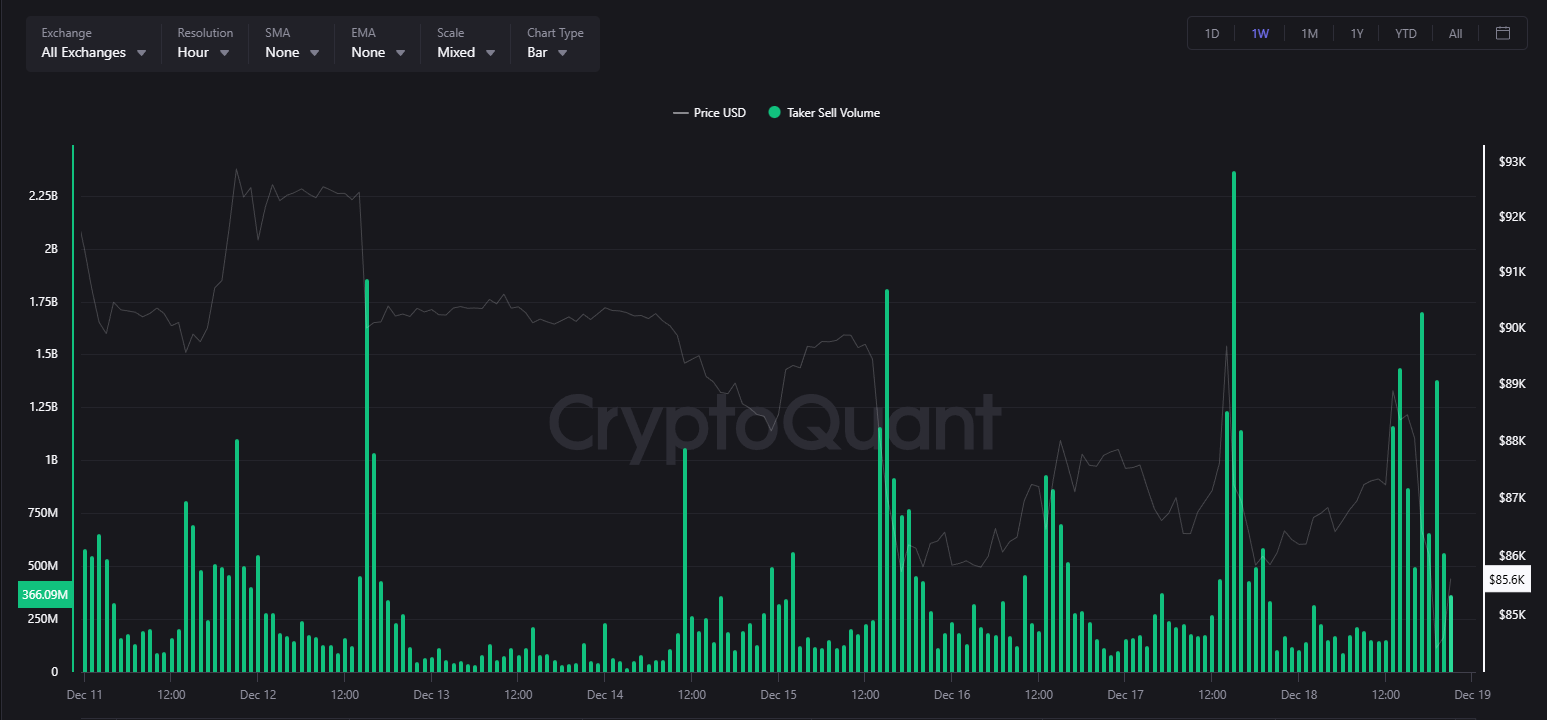

The weekly view reinforces this sample. Related sell-side bursts appeared a number of occasions over the previous week, usually throughout high-liquidity home windows, suggesting repeated episodes of compelled or systematic promoting quite than remoted retail exits.

This conduct is in line with liquidation cascades, volatility-targeting methods, and algorithmic de-risking — all of which speed up as soon as value begins transferring towards leveraged positions.

Sponsored

Sponsored

Why ‘Good Information’ Turned the Set off

The CPI report didn’t trigger the selloff as a result of it was unhealthy. It brought about volatility as a result of it was good.

Softer inflation briefly elevated liquidity and tightened spreads. That setting permits giant gamers to execute measurement effectively.

Bitcoin’s preliminary spike seemingly ran right into a dense zone of resting orders, cease losses, and short-term leverage. As soon as upside momentum stalled, value reversed, triggering lengthy liquidations and stop-outs.

As liquidations hit, compelled market promoting amplified the transfer. For this reason the decline accelerated quite than unfolded progressively.

The S&P 500’s intraday whipsaw exhibits an analogous dynamic. Fast draw back and restoration patterns throughout macro releases usually mirror vendor hedging, choices gamma results, and systematic flows adjusting danger in actual time.

Sponsored

Sponsored

Does This Look Like Manipulation?

The charts don’t show manipulation. However they present patterns generally related to stop-runs and liquidity extraction:

- Quick strikes into apparent technical ranges

- Reversals instantly after liquidity improves

- Giant bursts of aggressive promoting throughout breakdowns

- Tight alignment with US buying and selling hours

These behaviors are typical in extremely leveraged markets. The probably drivers are usually not people, however giant funds, market makers, and systematic methods working throughout futures, choices, and spot markets. Their objective isn’t narrative management, however execution effectivity and danger administration.

In crypto, the place leverage stays excessive and liquidity thins shortly exterior key home windows, these flows can look excessive.

What This Means Going Ahead

The selloff doesn’t invalidate the CPI sign. Inflation genuinely cooled, and that continues to be supportive for danger property over time. What the market skilled was a short-term positioning reset, not a macro reversal.

Within the close to time period, merchants will watch whether or not Bitcoin can stabilize above latest help and whether or not sell-side strain fades as liquidations clear.

If taker promote quantity subsides and value holds, the CPI knowledge should assert itself over the approaching classes.