- American Bitcoin director Richard Busch purchased 175,000 ABTC shares after a pointy decline.

- The inventory is down about 68% over the previous month resulting from share unlock stress.

- American Bitcoin holds over 5,000 BTC, rating among the many high public Bitcoin treasuries.

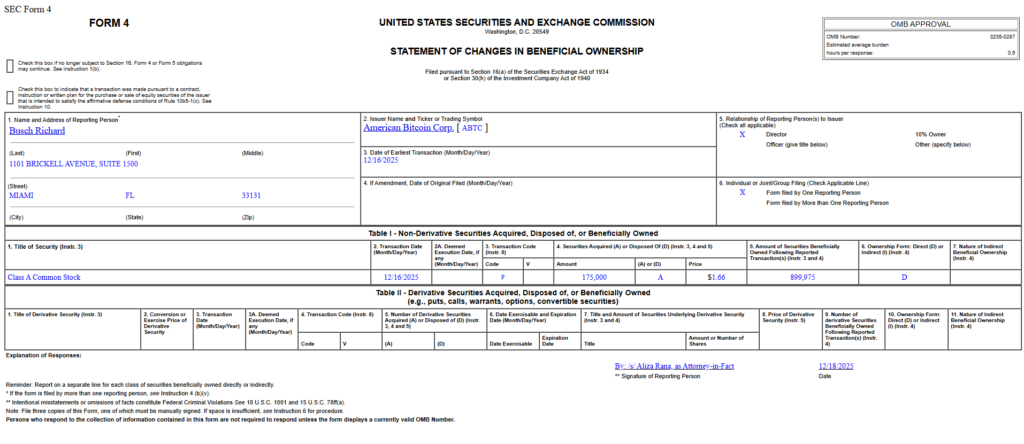

Richard Busch, a board member and director at American Bitcoin, has stepped in with a notable insider buy after the corporate’s inventory endured a steep selloff. In keeping with a latest SEC submitting, Busch acquired 175,000 ABTC shares for roughly $290,500, signaling confidence at a time when sentiment across the inventory has been beneath stress. The transfer comes as American Bitcoin continues to place itself as a significant company holder of BTC.

Insider Purchase Lifts Sentiment

Following the acquisition, Busch now holds near 900,000 ABTC shares, valued at roughly $1.4 million based mostly on Thursday’s closing worth. The market responded shortly, with shares rising round 5% in premarket buying and selling on Friday, in response to Yahoo Finance. Insider shopping for typically attracts consideration in periods of weak spot, as it may possibly recommend conviction from these closest to the enterprise.

Inventory Pressured by Share Unlocks

Regardless of the bounce, ABTC has struggled in latest weeks. The inventory has dropped roughly 68% over the previous month, largely because of the launch of pre-merger non-public placement shares into the general public market. That inflow added promoting stress, weighing closely on worth motion and testing investor endurance.

A Rising Bitcoin Treasury

Past short-term volatility, American Bitcoin continues to develop its steadiness sheet publicity to BTC. The corporate has now entered the highest 20 listing of publicly traded corporations holding Bitcoin treasuries, reporting reserves of 5,098 BTC value round $447 million. These holdings have been constructed by means of a mixture of mining operations and strategic purchases, reinforcing the agency’s id as a Bitcoin-first car.

What It May Sign Subsequent

Busch’s buy doesn’t erase the latest drawdown, nevertheless it does add a layer of confidence throughout a troublesome stretch. With insider accumulation, a rising Bitcoin treasury, and shares already deeply discounted, traders can be watching intently to see whether or not sentiment can stabilize or if additional volatility lies forward.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.