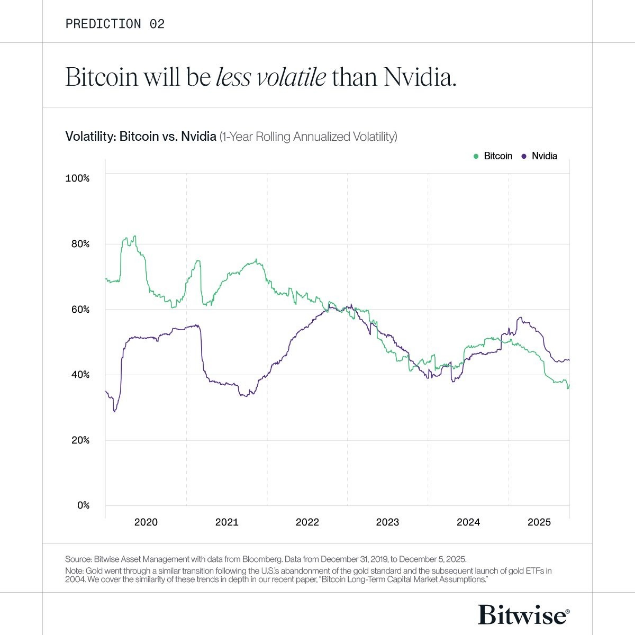

In line with Bitwise, Bitcoin’s value swings are getting smaller, and that change is already exhibiting up in comparison with a fast-moving chip inventory like Nvidia.

From an April low of $75,000 to an early October excessive of $126,000, Bitcoin moved about 68%. Nvidia, in contrast, swung roughly 120% from a low close to $94 in April to $207 in late October. These numbers present a transparent hole in how tough the journey has been this yr.

Volatility Comparability Reveals Shift

Based mostly on studies from Bitwise, Bitcoin will doubtless be calmer than Nvidia in 2026. “BTC already much less unstable than Nvidia in 2025 … because of institutional inflows & ETFs,” Bitwise stated in an X submit.

That change is linked to extra conventional cash coming in by way of merchandise akin to spot ETFs and different institutional channels. In brief: extra large, regular buyers are within the combine now, and that tends to easy out wild swings.

🚀Bitcoin maturing quick!

Bitwise : BTC already much less unstable than Nvidia in 2025 (68% vs 120% value swing) because of institutional inflows & ETFs.

Volatility to remain decrease in 2026 + new all-time excessive forward as crypto shares outperform tech! 🐂 #Bitcoin #BTC #Crypto… pic.twitter.com/TEyzoZQrYv

— ChartSage (@CryptoChartSage) December 18, 2025

Institutional Entry And The Bull Case

Bitwise additionally put ahead a bullish view for subsequent yr. It expects a brand new all-time excessive and a break from the outdated four-year cycle. The agency listed a number of causes: the halving, shifts in interest-rate cycles, and weaker boom-and-bust forces than in previous runs.

The corporate named large establishments — Citigroup, Morgan Stanley, Wells Fargo and Merrill Lynch — as potential new entrants, and it stated allocations to identify crypto ETFs ought to rise. Bitwise added that onchain work may pace up too, and that crypto equities may beat tech shares in returns.

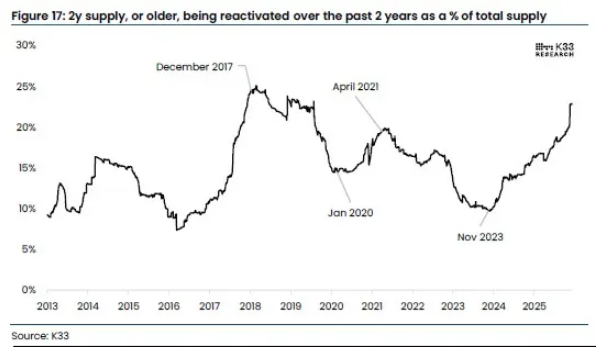

Lengthy-Time Holders Are Promoting

Stories have disclosed heavy promoting from long-term holders, a pattern that complicates the bullish story. K33 Analysis discovered about 1.6 million cash that had been idle for not less than two years moved since early 2023.

That quantity is price roughly $140 billion. In 2025 alone, almost $300 billion of cash that had been dormant for over one yr returned to the market, based on K33 and CryptoQuant knowledge.

CryptoQuant additionally flagged one of many heaviest long-term holder distributions seen in additional than 5 years up to now 30 days.

Chris Newhouse, director of analysis at Ergonia, described the move as a “gradual bleed” attributable to regular promoting into skinny bids, which might create a protracted, grinding fall that’s not simple to reverse.

Market Divergence And Close to-Time period Stress

The break up with equities is obvious. Nvidia shares are up about 27% year-to-date. Bitcoin, alternatively, is down roughly 8% to date this yr and has dropped almost 30% from its file above $126,000.

That hole exhibits crypto just isn’t all the time shifting with large tech. Promoting by long-term holders is one cause costs are underneath stress even whereas some buyers push for contemporary good points.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.