Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth rose greater than 1% prior to now 24 hours to commerce at $87,803 as of two:45 a.m. EST on buying and selling quantity that rose 24% to $61.9 billion.

BTC topped the $87k degree after the Bureau of Labor Statistics reported that the US Shopper Value Index (CPI) for November rose 2.7% from a 12 months earlier, under consensus expectations of three.1%

That bolstered hopes that the Federal Reserve can have extra scope to ship extra rate of interest cuts in 2026.

🚨 BREAKING 🚨

US #CPI inflation softens to 2.7% in November vs. 3.1% expectedhttps://t.co/2Qa6NLRqO5 pic.twitter.com/s8UfIHhDSy

— FXStreet Information (@FXStreetNews) December 18, 2025

Core CPI additionally undershot forecasts, growing 2.6% versus estimates of three%.

Financial institution Of Japan Hikes Charges To 30-12 months Excessive, Yen Slides

However there was unfavourable information from Asia, the place the Financial institution of Japan (BOJ) introduced a 25-basis-point rate of interest hike to 0.75%, its highest since 1995.

The choice handed unanimously in a 9-0 vote, made after a two-day coverage assembly. The hike aligned with market expectations.

BOJ Governor Kazuo Ueda cited rising confidence within the financial outlook as a key purpose behind the hike.

🚨 BREAKING: 🇯🇵 BOJ DELIVERS THE HIKE

Charges raised 25 bps to 0.75%, marking a 30-year excessive.

Japan’s period of ultra-easy cash retains fading.

It is a main world LIQUIDITY shift… watch yen and threat property intently. 👀 pic.twitter.com/vfciRH84WJ

— Smart Recommendation (@wiseadvicesumit) December 19, 2025

It was Japan’s second charge hike this 12 months, following a 25-bps hike in January, with policymakers signaling additional will increase to return.

Regardless of the hike, the yen slid to round 156 towards the greenback, with markets have already absolutely factored within the charge hike.

Bitcoin Value Exhibits Indicators Of Bullish Reversal

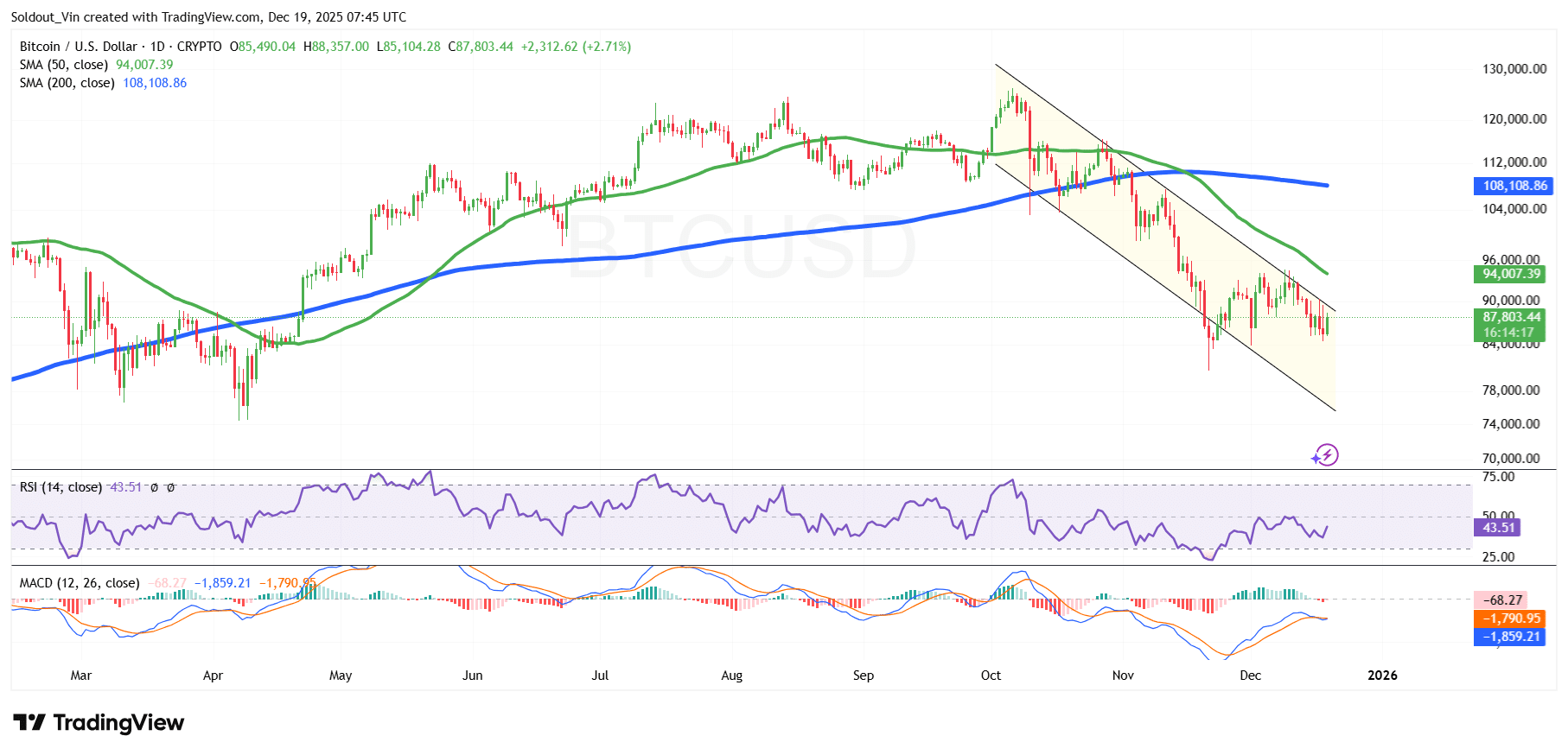

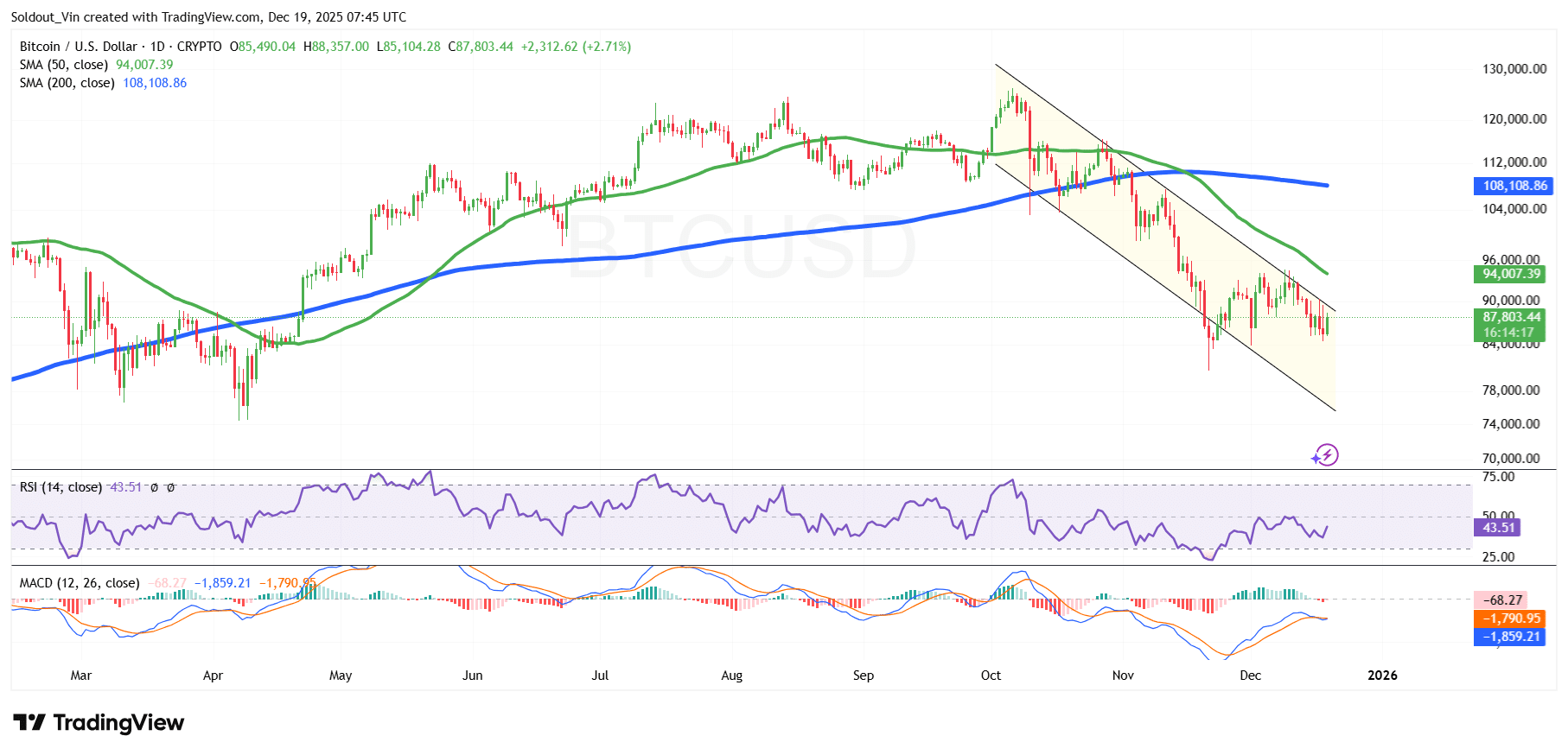

The BTC worth traded above the $108,000 help degree from July to October, a transfer that allowed the asset to the touch its all-time excessive (ATH) round $126,230.

Nevertheless, the Bitcoin worth then went by way of a correction inside a falling channel sample to the decrease boundary across the $84,000 help space. This space has allowed the worth of BTC to consolidate throughout the higher boundary, with $94,000 performing as a barrier on the upside.

The bearish stance has pushed BTC to commerce under each the 50-day and 200-day Easy Transferring Averages (SMAs). This pattern has been fueled by the SMAs forming a dying cross round $111,035.

In the meantime, the Relative Energy Index (RSI) is displaying indicators of a rebound, presently at 43 and climbing, a sign that patrons are regaining some management.

BTC Value Prediction

Based on the BTC/USD chart evaluation on the each day timeframe, the BTC worth is nearing a breakout above the falling channel sample because it goals for a bullish pattern reversal in the long run.

If the worth of BTC climbs above the channel, the following goal could possibly be across the SMAs, first at $94,007 (50-day SMA) and $108,108 (200-day SMA).

Nevertheless, the Transferring Common Convergence Divergence (MACD) has turned unfavourable, with the orange sign line crossing above the blue MACD line. The pink bars on the histogram are additionally beginning to kind under the zero line, a sign of unfavourable momentum.

If the BTC worth bears act on the unfavourable momentum, the worth might drop again to the decrease boundary of the channel and kind help round $78,000.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection