- Ethereum stays locked in a broader downtrend as whale promoting and ETF outflows weigh on value

- A serious ETH whale locked in over $15 million in revenue whereas establishments pulled greater than $500 million from spot ETFs

- Worth is testing a key Fibonacci help zone, with early indicators that promote stress could also be easing

Ethereum hasn’t caught a break recently, and the broader market isn’t serving to. As danger urge for food light throughout altcoins, ETH stayed pinned below stress, unable to construct something greater than short-lived bounces. After topping out close to $4,900 earlier within the cycle, the pattern slowly rolled over. At press time, Ethereum was buying and selling round $2,856, down 2.36% on the day and roughly 10% over the week, a stretch that’s clearly testing endurance.

That extended slide appears to be altering conduct on the high finish of the market. Each giant holders and establishments are beginning to step again, and the info is displaying it fairly clearly.

Whales begin locking in income

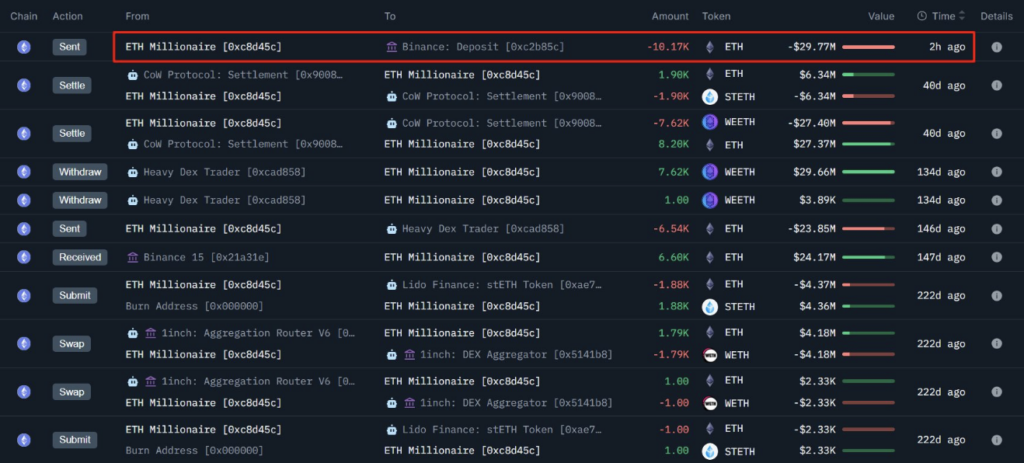

On-chain exercise revealed that not less than one main Ethereum whale determined it was time to take cash off the desk. In line with Onchain Lens, the deal with deposited 7,654 ETH, price about $21.6 million, into Binance. Lookonchain later confirmed that this transfer locked in near $4 million in revenue.

What’s extra attention-grabbing is that this wasn’t a one-off. Simply hours earlier, the identical whale had already despatched 10,169 ETH, valued close to $29.8 million, to the trade, realizing one other $11.3 million achieve. Mixed, that’s 17,823 ETH, roughly $51.4 million, moved to Binance in a brief window.

Digging deeper, the technique appears to be like calculated. The whale initially withdrew 19,505.5 ETH, staked the property, and later redeposited 20,269 ETH, choosing up round 763 ETH in staking rewards alongside the best way. After the newest transfers, complete realized revenue sits close to $15.4 million.

Traditionally, this sort of promoting throughout a longtime downtrend typically indicators warning relatively than panic. Large holders are likely to exit after they see restricted upside forward and need to defend positive aspects, not after they anticipate a fast rebound.

Establishments pull again even tougher

Whereas particular person whales are trimming publicity, establishments look like heading for the exit in a extra coordinated approach. Knowledge from SoSoValue reveals Ethereum spot ETFs have now recorded web outflows for 5 straight periods. Over that brief span, cumulative outflows reached roughly $533 million.

On December 17 alone, ETFs noticed about $22.4 million go away the market. In simply 5 days, complete property throughout Ethereum spot ETFs dropped from round $21 billion to $17 billion, a $4 billion contraction that’s exhausting to disregard.

Sustained outflows like this often level to decreased conviction. Establishments don’t rush out and in frivolously, so a gentle sell-side bias suggests many are bracing for continued weak spot, or not less than selecting to sit down this part out.

Breakdown danger meets early stabilization indicators

Worth motion displays that uneasy steadiness. Sellers proceed to defend larger ranges aggressively, whereas patrons wrestle to maintain rallies alive. That tug-of-war has stored ETH locked in its broader downtrend.

Momentum indicators lean bearish. The Stochastic Momentum Index has slipped deep into oversold territory, an indication that draw back stress has been intense and protracted. ETH is at the moment hovering simply above the 0.618 Fibonacci retracement close to $2,807. If that degree offers approach, the subsequent main zone sits nearer to the 0.786 retracement round $2,633.

Nonetheless, there’s a small shift price noting. Change netflows flipped sharply destructive, dropping to roughly -47,100 ETH from about +46,000 ETH the day earlier than. That swing suggests fewer cash shifting onto exchanges, and probably, decreased instant promoting stress.

If patrons can defend the $2,807 space, Ethereum could try a short-term rebound towards $2,929. Any stronger restoration would probably run into resistance close to the $3,200 area. For now although, ETH stays caught between heavy skepticism and early indicators that sellers could lastly be slowing down, only a bit.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.