- Litecoin misplaced the important $80–$84 help zone, reinforcing a broader bearish market construction.

- Liquidation knowledge suggests a short-term bounce is feasible, however momentum stays weak.

- Except LTC reclaims key resistance, sellers are more likely to goal $66 and probably $59 subsequent.

Litecoin noticed a pointy jolt of volatility on Thursday, April 18, monitoring Bitcoin’s sudden swings nearly tick for tick. BTC briefly pushed towards $89.5k earlier than rolling over arduous and printing a brand new native low close to $84.5k. That transfer rippled rapidly into the altcoin market, and LTC didn’t escape the harm. In simply 5 hours, Litecoin dropped roughly 7.5%, tagging a recent decrease low at $72.64 earlier than stabilizing barely round $75.89.

What made this transfer extra regarding wasn’t simply the velocity of the drop, however the place it occurred. Over the previous two weeks, Litecoin bulls quietly misplaced management of the $80–$84 zone, a degree that had acted as long-term structural help. Earlier evaluation already warned that patrons have been dropping power there, and the newest breakdown appears to substantiate that concern. Even Litecoin’s inclusion in Bitwise’s 10 Crypto Index ETF didn’t spark any significant response on the chart, which says lots about present sentiment.

Every day Construction Exhibits Sellers Nonetheless in Cost

Trying on the each day chart, the broader image hasn’t improved a lot. Utilizing the Fastened Vary Quantity Profile for 2025, Litecoin’s Worth Space Excessive and Low sit round $120 and $83. Again in early October, LTC was buying and selling comfortably above that higher worth zone, till the sharp October 10 crash flipped the construction solely.

Since then, promoting stress has dominated. The On-Stability Quantity reveals that the steadiness between patrons and sellers tilted closely towards distribution, not accumulation. Litecoin did try to defend the $80 area throughout November’s uneven value motion, however these efforts have been skinny and short-lived. As soon as that ground gave manner, the pattern resumed decrease with out a lot resistance.

With $80 now misplaced, the chart exposes a number of deeper ranges that bears are seemingly watching subsequent. Lengthy-term help zones are available in round $73.4, adopted by $66.5, after which a lot decrease close to $59.6 if stress accelerates.

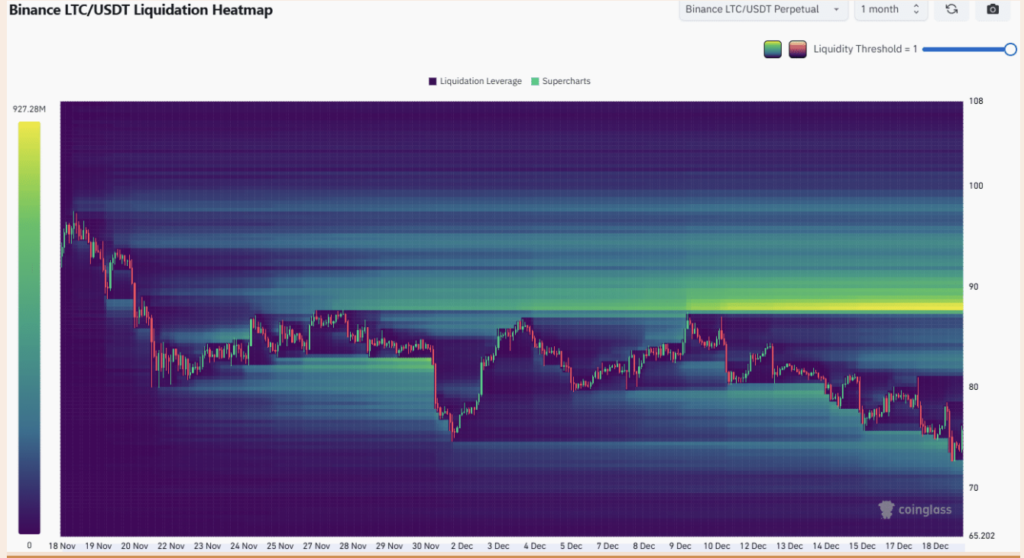

Liquidation Knowledge Hints at a Brief-Time period Bounce

Zooming into derivatives knowledge provides a little bit of nuance. The one-month liquidation heatmap reveals that liquidity clustered across the $73 space has already been cleared. That sweep usually results in a reduction bounce, and Litecoin seems to be doing precisely that proper now.

If this bounce extends, value might drift again towards the $82–$83 area, which strains up with a close-by magnetic liquidity zone. This wouldn’t be uncommon habits. Markets usually retrace after flushing stops, particularly when value strikes rapidly into skinny liquidity.

Nonetheless, it’s essential to maintain expectations in verify. A bounce doesn’t robotically imply a reversal. It could actually simply as simply be a setup for sellers to re-enter at higher ranges.

The Bullish State of affairs Stays a Lengthy Shot

There’s, technically, a extra optimistic path on the chart, although it requires a number of issues to go proper. Above present ranges, the $88 zone is full of quick liquidations. In a state of affairs the place broader market sentiment flips risk-on and shorts begin getting squeezed, Litecoin may very well be pulled towards that space.

In a best-case consequence, a liquidation cascade might even push LTC again above $90, forcing a pattern reassessment. However proper now, that state of affairs seems extra like an outlier than a base case. It will need assistance from Bitcoin and a noticeable shift in market psychology.

Merchants’ Bias Stays Bearish After the Breakdown

For now, the dominant takeaway is straightforward. Litecoin has misplaced an essential long-term help zone, and the higher-timeframe construction stays bearish. There’s no clear proof of sturdy shopping for curiosity stepping in but, simply reactive bounces.

If value revisits the $80–$84 space, that area is more likely to act as heavy resistance fairly than help. From a buying and selling perspective, many will view rallies into that zone as potential quick alternatives, with draw back targets sitting close to $66 and, if momentum builds, nearer to $59.

Till Litecoin can reclaim misplaced construction and present sustained demand, the trail of least resistance nonetheless factors decrease, even when short-term reduction strikes pop up alongside the best way.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.