- Silver surged over 2% to interrupt above $67 for the primary time ever.

- Softer U.S. inflation has boosted expectations for Fed fee cuts.

- Gold and platinum additionally moved greater, whereas palladium lagged.

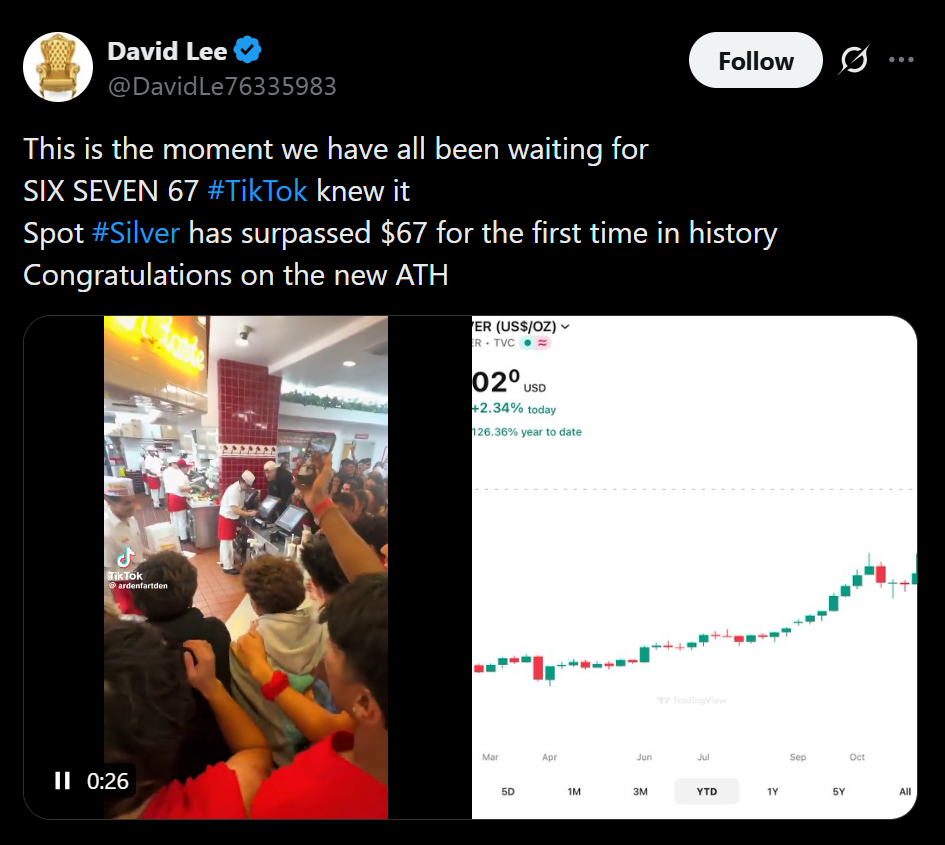

Treasured metals pushed greater on Friday, led by a robust transfer in silver that despatched costs above the $67 mark for the primary time ever. The rally capped off a powerful month, with silver up roughly 30% on a month-to-month foundation. The power throughout metals seems intently tied to renewed optimism round Federal Reserve fee cuts following softer U.S. inflation knowledge.

Inflation Knowledge Reignites Price Minimize Expectations

Investor sentiment shifted after new financial knowledge confirmed U.S. inflation cooling additional. Annual inflation got here in at 2.7% in November, down from 3% in September and beneath analyst expectations. The print has strengthened the view that inflationary pressures could also be easing quick sufficient to offer the Fed extra room to chop rates of interest, a backdrop that sometimes advantages onerous belongings like valuable metals.

Silver Leads as Metals Transfer Larger

Silver briefly touched $67.24 per ounce earlier than settling barely decrease, nonetheless up a powerful 2.42% at round $67.15 by late morning buying and selling. Gold adopted with extra modest good points, rising 0.34% to commerce close to $4,349.56 per ounce. Platinum additionally joined the rally, climbing 2.13% to $1,975.67, whereas palladium was the lone laggard, slipping 0.57% to about $1,675.48.

Why Metals Are Again in Focus

Decrease rate of interest expectations have a tendency to scale back the chance value of holding non-yielding belongings, making metals extra engaging. Mixed with lingering macro uncertainty and powerful momentum, silver’s breakout has drawn contemporary consideration from each merchants and long-term traders. If fee reduce optimism continues to construct, valuable metals might stay firmly within the highlight.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.