October 2025 was presupposed to be “Uptober” as soon as once more, the month traditionally favorable to crypto. As a substitute, it grew to become synonymous with one of many worst crashes of the final decade. Between October fifth and seventh, Bitcoin reached new all-time highs within the $124,000-$126,000 vary, solely to start a decline that, by the tip of November, worn out a few third of its worth and over $1 trillion in market capitalization.

Determine 1 – Bitcoin Crash in October 2025.

The height of pressure was concentrated over the weekend of October 10-12. In just some hours, Bitcoin plummeted beneath $105,000, Ethereum misplaced round 11-12 %, and plenty of altcoins skilled drawdowns between 40 and 70 %, in some circumstances with flash crashes practically to zero on much less liquid pairs. Greater than only a easy correction, it was a brutal deleveraging occasion that uncovered the structural vulnerabilities of the market.

As we enter the ultimate a part of 2025, Bitcoin is now fluctuating properly beneath its highs, round $90,000-93,000, roughly 25-27 % beneath the October peak, in a macro context marked by charge cuts from the Fed, but in addition by a sentiment that continues to be clearly cautious throughout the whole crypto sector.

The query everyone seems to be asking is easy: has the worst handed, or might the tip of the yr carry one other bearish leg?

To know what to anticipate by the tip of the yr, it’s important to first clearly define what has occurred. A number of reviews agree on some key factors. Between October tenth and eleventh, the market skilled some of the violent sell-offs ever: inside lower than 24 hours, leveraged positions value between 17 and 19 billion {dollars} have been liquidated, involving as much as 1.6 million merchants worldwide.

The quick set off was political and exterior to the crypto world. The shock announcement of tariffs as much as one hundred pc on Chinese language imports by the Trump administration sparked a wave of danger aversion in international markets. Cryptos, sometimes among the many property most delicate to sentiment, have been on the forefront: these with excessively leveraged positions didn’t have time to react earlier than margin calls and computerized liquidations took over.

This mechanism turned a macro information occasion right into a technical avalanche. Costs broke by means of help ranges one after one other, algorithms accelerated gross sales, and plenty of exchanges discovered themselves managing orders in a all of the sudden a lot thinner liquidity atmosphere. The consequence was a panic ambiance paying homage to the “crypto winter” of 2022, with the distinction that this time it wasn’t a single main challenge collapsing, however the whole complicated of leveraged exposures.

The true causes of the crypto crash: macro, leverage, and political elements

Lowering the crash to only the announcement of tariffs could be deceptive. That information was the spark, however the powder keg was already set. For months, the market had been pricing in a fragile steadiness between a super-cycle bull narrative and a macro actuality full of blended indicators. On one hand, the Fed’s charge cuts and asset buy packages urged a return of liquidity. On the opposite, official communications remained cautious, with a transparent message: don’t count on new “simple cash” with out situations.

On this context, the large use of leverage has made the system extraordinarily fragile. When the value started to fall, the pressured unwinding of those positions amplified the motion far past what the macro information alone would have justified.

There may be additionally a psychological aspect. After months of discussing Bitcoin surpassing $150,000 and the crypto market capitalization reaching $5 or $10 trillion, a good portion of merchants had change into satisfied that the trail was nearly inevitable, with timing being the one uncertainty. When actuality contradicted these expectations, the misalignment between the “narrative” and “actual costs” turned doubt into panic, particularly amongst those that entered late and in full euphoria.

Bitcoin and Crypto After the Crash: Doable Situations for the Finish of 2025

Waiting for the approaching weeks, it’s helpful to assume by way of situations, not exact forecasts.

The primary state of affairs envisions a market progressively absorbing the shock. Some reviews already counsel a sluggish return of accumulation by long-term holders and rebalancing methods that improve publicity to Bitcoin and some giant caps on the expense of extra speculative altcoins.

The second state of affairs is that of a chronic part of nervous lateralization. Primarily, the market stops crashing however struggles to actually rebound. That is the everyday part the place these with a short-term horizon endure, as false indicators multiply and intraday volatility doesn’t translate into real medium-term directionality.

The third state of affairs, essentially the most feared one, anticipates a brand new bearish leg. In such a context, it could not be stunning to see Bitcoin testing the $70,000-$80,000 space extra decisively, whereas a portion of the altcoin market would possibly expertise depressed volumes and few optimistic catalysts within the brief time period.

As typically occurs, actuality would possibly lie in a dynamic mixture of those situations: a partial restoration adopted by phases of congestion and new waves of volatility linked to choices by the Fed, ECB, and political information.

Bitcoin Seasonality: What Historic Information Says Concerning the Final Quarter

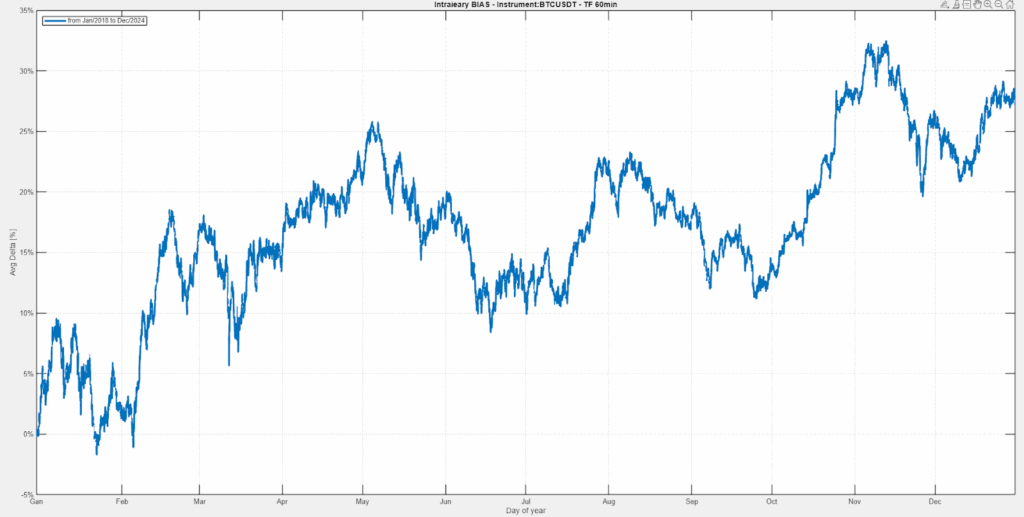

From the angle of a scientific dealer, counting on statistics and information evaluation, one would possibly think about using the value of Bitcoin (BTC) as a reference and analyze its month-to-month seasonality, significantly within the latter a part of the yr. The chart beneath exhibits the typical development of BTC from 2017 to 2024 (calculated with Bias FinderTM, proprietary software program of the Unger Academy®).

Determine 2 – Month-to-month seasonality of Bitcoin from 2017 to 2024.

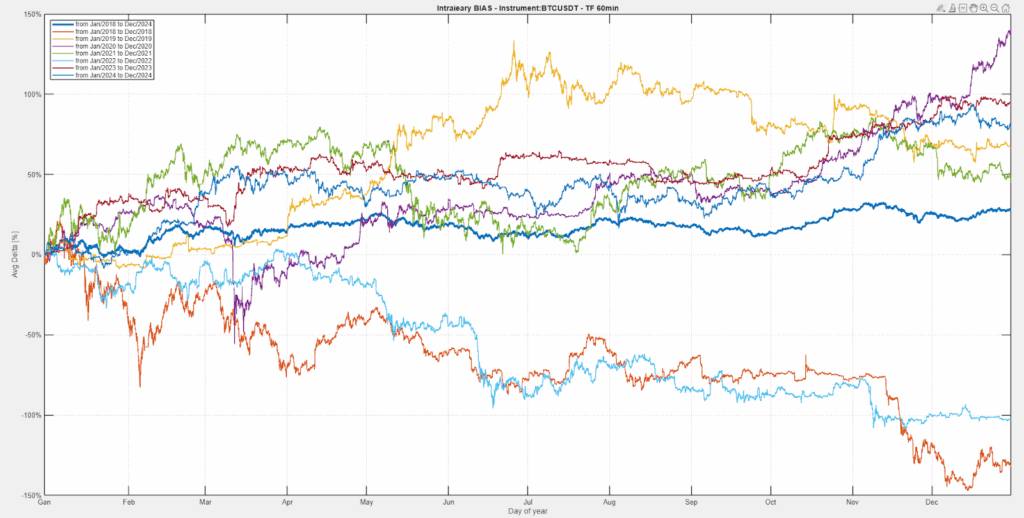

It’s evident that the tip of the yr tends to be bullish on common over the past 8 years, albeit with some volatility, which is justified when particular person years individually (see Determine 3), the place we observe remaining quarters with sturdy rallies mixed with others experiencing important declines.

Determine 3 – Month-to-month seasonality of Bitcoin by yr.

How Institutional Buyers and the Crypto Sector are Reacting

A brand new aspect in comparison with earlier cycles is the extra structured presence of institutional capital. Many funds that in 2021-2022 handled cryptocurrencies nearly solely from a speculative perspective now incorporate them into broader macro and diversification methods. Regardless of the October drawdown, indications from varied desks counsel extra about rebalancing and hedging relatively than a definitive exit from the asset class.

On the identical time, the October incident has shone multiple highlight. Authorities already engaged on frameworks for spot ETFs and stablecoins see what occurred as affirmation that the difficulty is now not whether or not to control the sector, however how to take action with out stifling innovation. Some proposals contain better transparency on leverage, stricter danger administration necessities for exchanges, and uniform reporting requirements for institutional operators uncovered to cryptocurrencies.

Conclusions: What to Anticipate from the Crypto Market on the Finish of 2025

The October 2025 crash isn’t just one other chapter within the lengthy historical past of crypto volatility. When it comes to magnitude, causes, and penalties, it’s a essential check of the sector’s maturity. It demonstrated how a single political shock can propagate inside minutes throughout a globalized, extremely interconnected ecosystem nonetheless dominated by very aggressive leverage dynamics. Nonetheless, it additionally reminded us that the market is able to remaining liquid and operational even underneath excessive stress, and that the presence of institutional gamers tends to rework the “all or nothing” method of the previous right into a extra gradual rebalancing course of.

Trying in the direction of the tip of the yr, the important thing for buyers is to not guess the precise value of Bitcoin in December, however to acknowledge the character of this part. On one hand, there’s a tangible danger of recent shocks, fueled by macro-uncertainty and geopolitics. Then again, there are indicators that the crash has accelerated the pure choice between stable tasks and pure hypothesis that the market had been suspending for a while.

Cryptocurrencies stay a high-risk asset, the place leverage have to be dealt with with excessive warning, particularly when the macro context is complicated. And exactly as a result of volatility is intrinsic, those that resolve to remain within the recreation should achieve this with a transparent horizon, rigorous danger administration, and the notice that moments like October 2025 are usually not a bump within the highway, however a structural part of the crypto cycle.

Till subsequent time, and glad buying and selling!

Andrea Unger