Wanting again on 2025, the sound cash, or debasement commerce, was decisively received by the metals over bitcoin. Gold delivered considered one of its finest years on file, up 65%, whereas bitcoin thus far is down 7%.

Till August, the 2 belongings had related returns, each up roughly 30%. From that time, gold surged whereas bitcoin rolled over sharply.

This divergence bolstered that gold received the debasement commerce narrative leaving bitcoin firmly behind.

Bitcoin stays in restoration mode after a 36% correction from its October all-time excessive, struggling within the $80,000 vary.

Regardless of the value weak point, capital flows inform a unique story.

Bitwise managing director Bradley Duke identified that that flows in bitcoin trade traded product’s (ETP) outpaced gold ETP flows in 2025 regardless of gold’s blockbuster yr.

The debut of U.S. spot bitcoin ETFs in January 2024 marked yr considered one of institutional adoption, whereas yr two noticed continued robust participation whilst value didn’t observe.

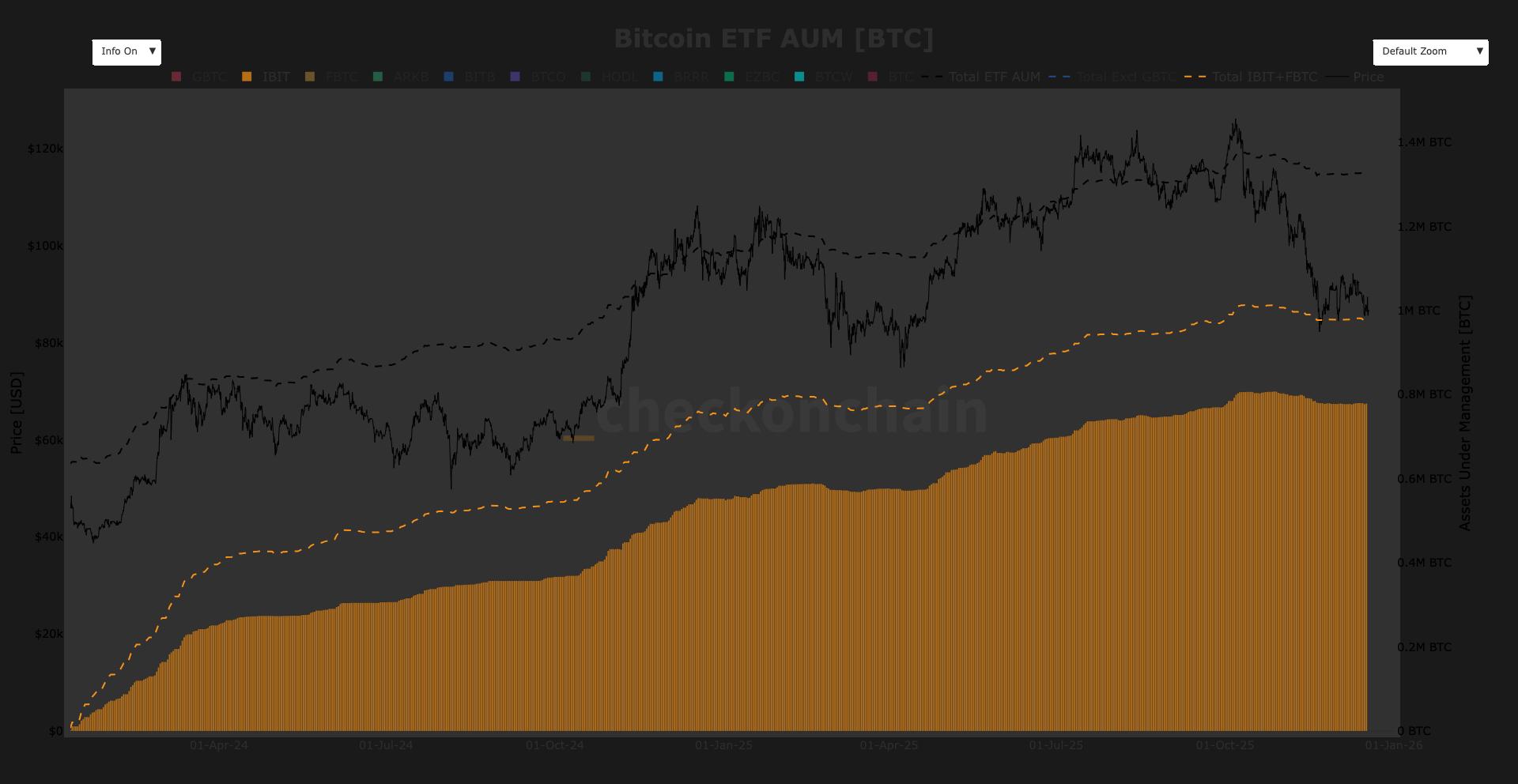

Probably the most notable takeaway from this present correction in bitcoin is the ETF investor resilience. Regardless of a 36% value drawdown, complete bitcoin ETF belongings underneath administration (AUM) declined lower than 4%.

Information from Checkonchain reveals U.S. ETFs held 1.37 million BTC on the October peak and nonetheless maintain round 1.32 million on Dec. 19. This means the majority of the dump didn’t come from ETF holders. BlackRock’s iShares Bitcoin Belief (IBIT) has elevated its dominance throughout this correction, now holding slightly below 60% market share with roughly 780,000 BTC underneath administration.

It’s clear to see bitcoin’s correction was not pushed by ETF outflows.