Ethereum’s derivatives market is exhibiting indicators of a decisive shift beneath the floor, and worth motion is about to return above the $3,000 mark. On-chain information suggests dealer conduct on main exchanges is shifting right into a extra accumulative part.

At the same time as ETH continues to linger beneath the psychologically vital $3,000 worth stage, this metric signifies that market members are already getting ready for a bullish transfer and a take a look at of route within the days forward.

Associated Studying

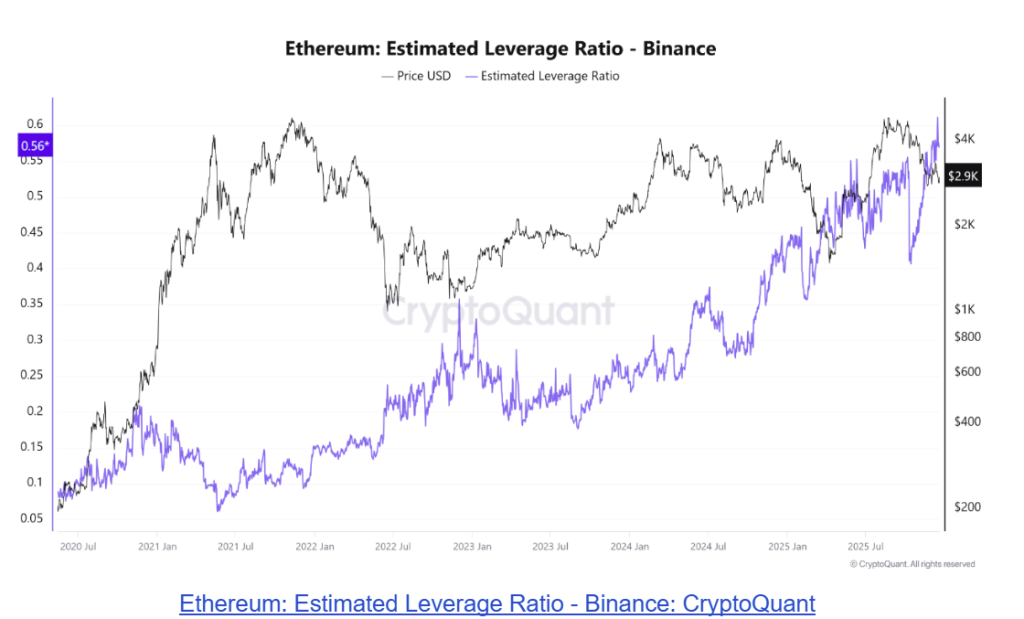

Ethereum Leverage Ratio Prints New All-Time Excessive

Information from on-chain analytics platform CryptoQuant exhibits that Ethereum’s Estimated Leverage Ratio on Binance has climbed to 0.611, the very best stage ever recorded for this metric. The Estimated Leverage Ratio compares open curiosity to trade reserves, and this provides perception into how a lot borrowed capital merchants are deploying relative to obtainable liquidity.

Sustained will increase on this ratio are a mirrored image of a rise in threat urge for food from buyers. It implies that merchants are committing bigger leveraged positions in anticipation of favorable worth motion. The present studying surpasses earlier cycle peaks, and this setting can amplify worth strikes, since even modest spot worth modifications can set off massive liquidations when leverage is elevated.

Ethereum: Estimated Leverage Ratio – Binance: CryptoQuant

One other vital metric factors to an enhance in Ethereum demand alongside document leverage. This metric is within the type of the Taker Purchase Promote Ratio, which just lately spiked to 1.13 on Binance. That is attention-grabbing as a result of this stage was final noticed in September 2023. A studying above 1 signifies that market members are executing extra purchase orders than promote orders.

This mixture of robust taker demand and rising leverage reveals optimism is now dominating short-term sentiment. The chart beneath exhibits the spikes within the Taker Purchase Promote Ratio have most of the time coincided with durations of elevated volatility. This shopping for stress is now notable, with Ethereum buying and selling round $2,900 previously few hours, and which means that many merchants are positioning forward of a possible try and reclaim $3,000.

Ethereum: Taker Purchase Promote Ratio – Binance. Supply: CryptoQuant

Analyst Maps Out Ethereum’s Path Again Above $3,000

Including a price-based perspective to the on-chain alerts, crypto analyst Ted Pillows has outlined a transparent technical roadmap for Ethereum’s subsequent transfer. In keeping with his evaluation, ETH just lately tapped into an vital demand zone between $2,700 and $2,800 and has began to rebound from that space. This transfer occurred when Ethereum broke beneath $3,000 once more this week to achieve a low of $2,781 on December 18, which is highlighted on the chart beneath as a significant assist band.

Ethereum Value Chart. Supply: @TedPillows On X

Pillows famous that holding this assist zone retains the bullish construction intact. If consumers proceed to defend the $2,700-$2,800 vary, Ethereum might construct sufficient momentum for a push to the $3,100 to $3,200 area. That zone additionally sits simply above the psychologically vital $3,000 stage.

Associated Studying

The draw back state of affairs is equally clear. A failure to carry the present assist would expose Ethereum to a deeper pullback, with the chart pointing towards a possible retest of the $2,500 stage.

Featured picture from Pexels, chart from TradingView