Be part of Our Telegram channel to remain updated on breaking information protection

New York Inventory Trade (NYSE) proprietor Intercontinental Trade (ICE) is eyeing a stake within the crypto agency MoonPay at a valuation of about $5 billion.

In accordance with a Dec. 18 Bloomberg report that cited sources accustomed to the matter, ICE’s potential funding within the agency comes as MoonPay nears the completion of its newest funding spherical.

MoonPay Has Embarked On An Growth Spree This Yr

MoonPay was based in 2019 and provides software program that helps customers swap extra simply between crypto and fiat currencies. Its final funding spherical at a valuation of $3.4 billion was in direction of the top of 2021, proper across the peak of a bull marketplace for the crypto area on the time.

MoonPay’s newest share sale comes after the corporate engaged in an growth push this 12 months, which noticed the agency purchase a minimum of 4 startups earlier than launching a stablecoin enterprise. This adopted the passing of the GENIUS Act by the US Congress and President Trump’s transfer to signal the invoice into legislation, paving the way in which for the broader use of stablecoins.

Along with the acquisitions, growth, and newest funding spherical, MoonPay has additionally introduced this week that Caroline Pham, the Performing Chair on the US Commodity Futures Buying and selling Fee (CFTC), will be part of the agency after Mike Selig is sworn in because the company’s new chief.

I’m trying ahead to a profitable affirmation of Mike Selig because the @CFTC’s subsequent chairman and a clean transition as soon as he’s sworn in. The long run is vivid. Onward and upward 🚀

— Caroline D. Pham (@CarolineDPham) December 17, 2025

ICE Increasing Into Crypto Markets

ICE’s reported curiosity in MoonPay shouldn’t be the NYSE proprietor’s first transfer into the crypto area. Earlier this 12 months, the inventory change proprietor introduced that it made a strategic funding into the decentralized prediction markets platform Polymarket.

Beneath the phrases of the settlement, ICE will make investments as much as $2 billion within the firm. This capital injection valued Polymarket at roughly $8 billion pre-investment. It additionally positions ICE as a significant institutional backer of what was beforehand a largely crypto-native market.

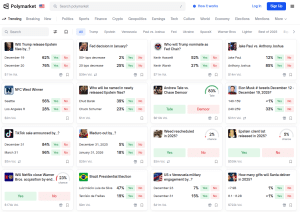

Platforms like Polymarket give customers the flexibility to wager on the outcomes of a wide range of real-world occasions. These occasions span politics, sports activities, and extra.

Polymarket dwelling display (Supply: Polymarket)

ICE stated that its funding is aimed toward integrating Polymarket’s event-driven likelihood knowledge into conventional finance workflows. As such, the deal will see ICE develop into a world distributor of Polymarket’s knowledge to institutional buyers.

The 2 firms additionally plan to collaborate on future tokenization initiatives.

2025 Has Been A Huge Yr For Crypto Offers And VC Funding

This 12 months has seen a number of massive offers introduced by crypto corporations and has additionally been a robust 12 months when it comes to enterprise capital (VC) funding.

To this point, crypto and blockchain corporations have raised virtually $19 billion in VC funding. That is essentially the most since 2022, in keeping with knowledge from PitchBook.

Ripple managed to lift $500 million from buyers in November in a spherical that included funds affiliated with Fortress Funding Group and Citadel Securities. This elevate was carried out at a valuation of $40 billion.

On the acquisition entrance, Ripple has made a number of strategic buys. Its purchases included prime brokerage and treasury administration corporations. In the meantime, US crypto change Coinbase has led the cost as the corporate goals to create a crypto “the whole lot app.”

That’s possible because of the friendlier regulatory local weather across the digital asset area within the US, as President Trump works in direction of making the US the world’s crypto capital.

Since getting into the White Home for a second time period, Trump has positioned pro-crypto leaders at key businesses such because the Securities and Trade Fee (SEC), the Workplace of Comptroller of the Forex (OCC), and the US Treasury.

Yesterday, the Senate accepted Trump’s picks for the Commodity Futures Buying and selling Fee (CFTC) and the Federal Deposit Insurance coverage Company (FDIC) as effectively.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection