- Solana community exercise cooled as market worry spiked, however indicators level to sentiment-driven slowdown fairly than structural weak point.

- Whales elevated accumulation beneath $120, repeating previous conduct that beforehand led to worthwhile exits.

- Spot Solana ETFs posted inflows through the dip, serving to soak up promoting stress as technical momentum started to stabilize.

Even with volatility shaking the broader crypto market, stronger networks have continued to tug in capital. Retail participation has thinned out noticeably as worry took over, dragging down utilization metrics throughout chains. Nonetheless, Solana has held up higher than most Layer-1s, at the same time as threat urge for food retains fading.

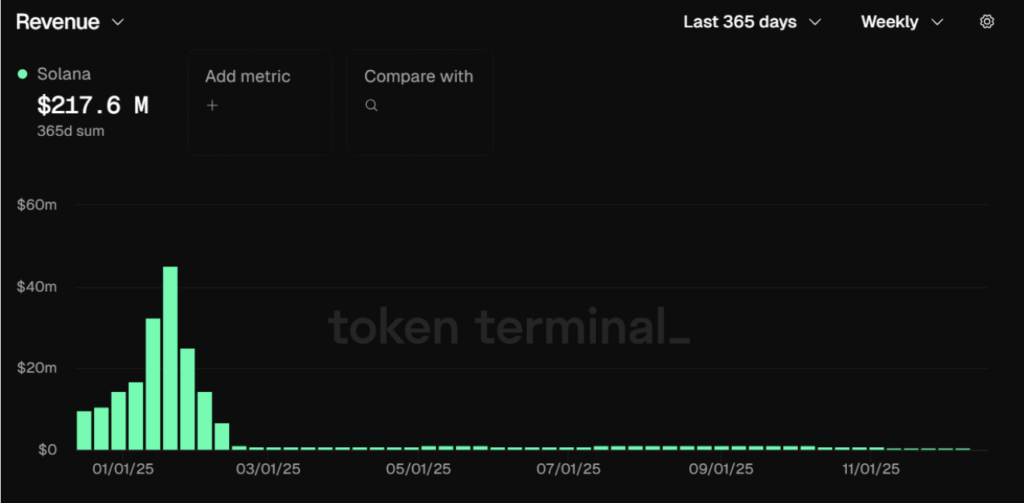

On-chain information exhibits that Solana’s community income spiked onerous again in January, then slowly slid to yearly lows as exercise cooled off. That drop erased earlier features, however the timing issues. It lined up with excessive worry throughout the market, not with any apparent breakdown within the community itself. In different phrases, this appears extra like sentiment-driven contraction than structural harm.

Community Exercise Slows, However the Core Stays Intact

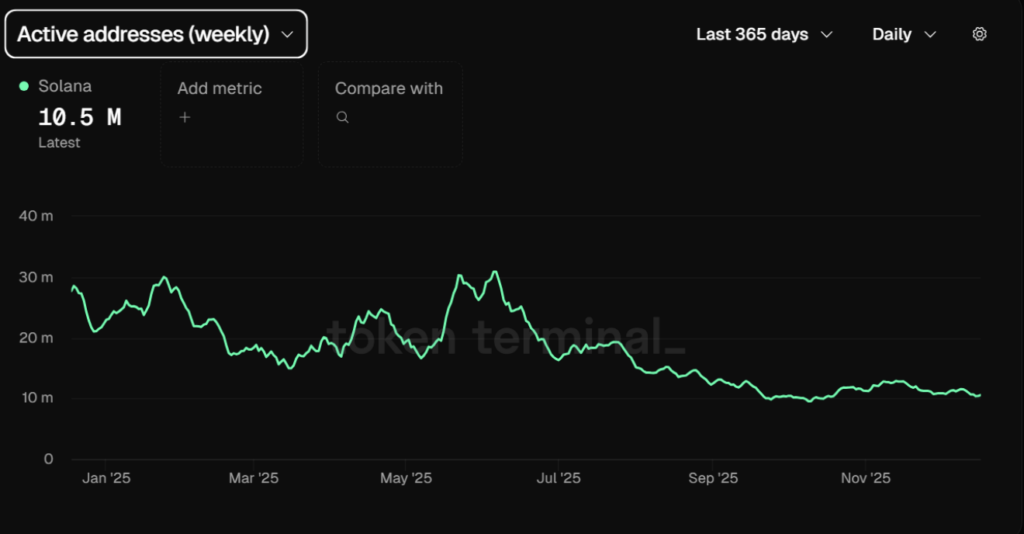

Weekly lively addresses adopted an identical path. As volatility picked up and merchants backed away, utilization dropped throughout the board. That decline mirrors what’s occurring throughout crypto, not one thing distinctive to Solana.

What stands out is that exercise has begun to stabilize close to current lows. The bleeding hasn’t accelerated, and that often hints the worst of the panic would possibly already be priced in. It’s quiet, sure, however not collapsing.

Whales Step In Beneath $120

When SOL slipped beneath $120 on December 18, bigger gamers didn’t run. They leaned in.

One pockets, labeled G6gemN, scooped up round 41,000 SOL, roughly $5 million price, proper into the weak point. That type of shopping for doesn’t look reactive, it appears deliberate.

There’s historical past right here too. About eight months earlier, the identical pockets gathered slightly below 25,000 SOL close to $122, then later offered close to $175 for a wholesome revenue. Seeing that pockets reload round related ranges suggests confidence, not worry. Value dips are attracting capital fairly than forcing exits, which says rather a lot about underlying conviction.

ETF Inflows Quietly Take in Provide

Whereas spot markets seemed shaky, institutional flows advised a unique story. Solana spot ETFs pulled in roughly $11 million in internet inflows on the identical day value dipped.

That demand helped offset spot promoting stress and added a layer of help beneath the market. Establishments seem snug accumulating throughout fear-driven pullbacks, not chasing energy. This type of circulate doesn’t often present up at market tops.

Assist Holds as Momentum Begins to Flip

Technically, Solana traded close to $124 at press time after briefly dipping as little as $117. Consumers defended that zone and pushed value again into the broader $122–$145 accumulation vary.

Momentum indicators are beginning to cooperate. MACD is hinting at a growing bullish crossover, and RSI printed a bullish divergence as promoting stress light close to the lows. Nothing explosive but, however the tone has shifted barely.

For now, Solana stays range-bound, absorbing provide fairly than breaking down. The following transfer seemingly is determined by whether or not broader sentiment stabilizes, however the construction suggests this pullback is being met with persistence, not panic.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.