The funding panorama in 2025 has delivered an uncommon final result that few would have anticipated in the beginning of the 12 months. Property historically considered as sluggish movers have risen because the clear winners, whereas the cryptocurrency market has quietly slipped to the underside of the efficiency rankings.

Because the 12 months attracts to a detailed, information from throughout commodities, equities, and digital property reveals an imbalance in returns, revealing that cryptocurrencies now sit behind each main asset class in year-to-date efficiency.

Clear Cut up Between Conventional Property And Crypto

The efficiency information for 2025 reveals a robust divergence between conventional markets and digital property, with the hole widening as the 12 months progressed. In line with the figures revealed on the social media platform X by ‘Bull Principle,’ silver is the top-performing asset for 2025, posting features of about 130% year-to-date. Gold is the second-best-performing asset of 2025, with a rise of about 65%, whereas copper has climbed near 35%. These numbers replicate sustained energy throughout the commodities sector.

Fairness markets are additionally at present buying and selling in optimistic territory. The Nasdaq is up round 20% on the 12 months, the S&P 500 has gained roughly 16%, and the Russell 2000 is increased by about 13%.

The one unfavourable numbers are from the crypto trade. In distinction, the crypto market sits on the backside of the efficiency rankings. Bitcoin is at present down by about 6% from its 2025 opening worth, Ethereum has declined round 12%, and the complete altcoin market (eradicating Ethereum) has suffered a a lot deeper drawdown of about 42%. Due to this fact, the crypto market is now formally the worst-performing asset class in 2025.

Chart Picture From X. Supply: @BullTheoryio

From Mid-Yr Rally To This autumn Breakdown

The present weak point of the crypto market could be very completely different from the optimism that dominated the start and center of 2025. Throughout that interval, the crypto market skilled a robust restoration that reignited bullish sentiment throughout the board. Bitcoin, Ethereum, XRP, and several other large-cap tokens pushed to new all-time highs.

Bitcoin’s rally peaked in October, when it set its standing document of $126,000 after months of regular accumulation and powerful momentum. Ethereum, alternatively, registered a brand new all-time excessive of $4,946 in August, whereas XRP’s all-time excessive got here earlier in July. XRP’s document worth of $3.65 was probably the most notable, because it was its first time breaking into a brand new all-time excessive since 2018.

That bullish development started to unravel because the fourth quarter bought underway, beginning with the crypto market flash crash on October 10. The decline has prolonged since then, and Bitcoin and the broader crypto market have now fallen into unfavourable territory from their 2025 opening ranges.

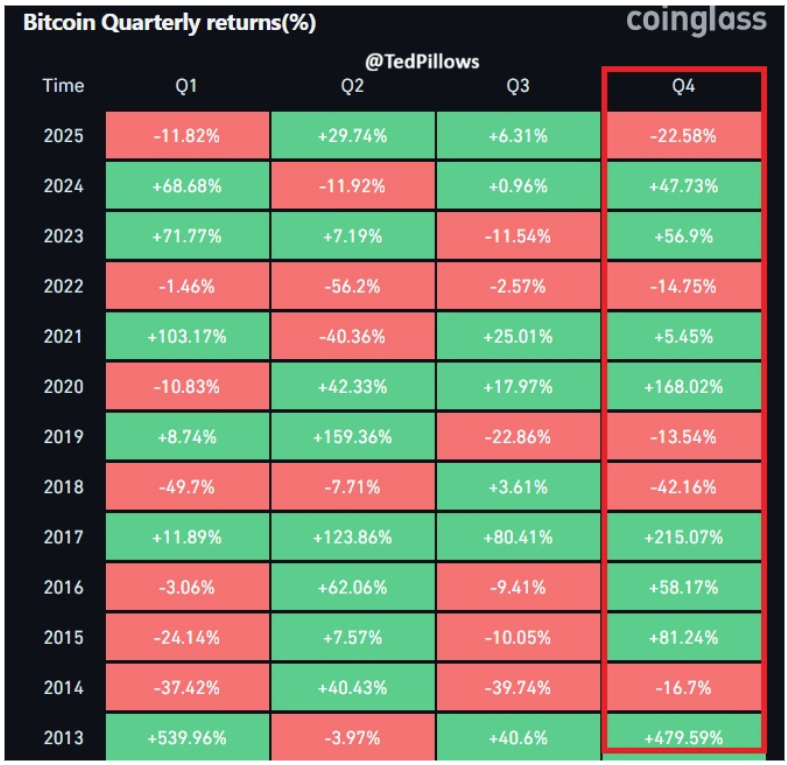

Quarterly returns information reveals that Bitcoin simply recorded its worst fourth-quarter efficiency in seven years. The result’s a 12 months by which digital property, regardless of a robust mid-year rally, are closing out because the worst-performing main asset class.

Bitcoin Quarterly Returns. Supply: @TedPillows On X

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.