Solana founder Anatoly Yakovenko has shared new information that exhibits Solana has outperformed Ethereum in yearly income, highlighting what he sees as a pivotal shift in how worth could also be distributed throughout the crypto market.

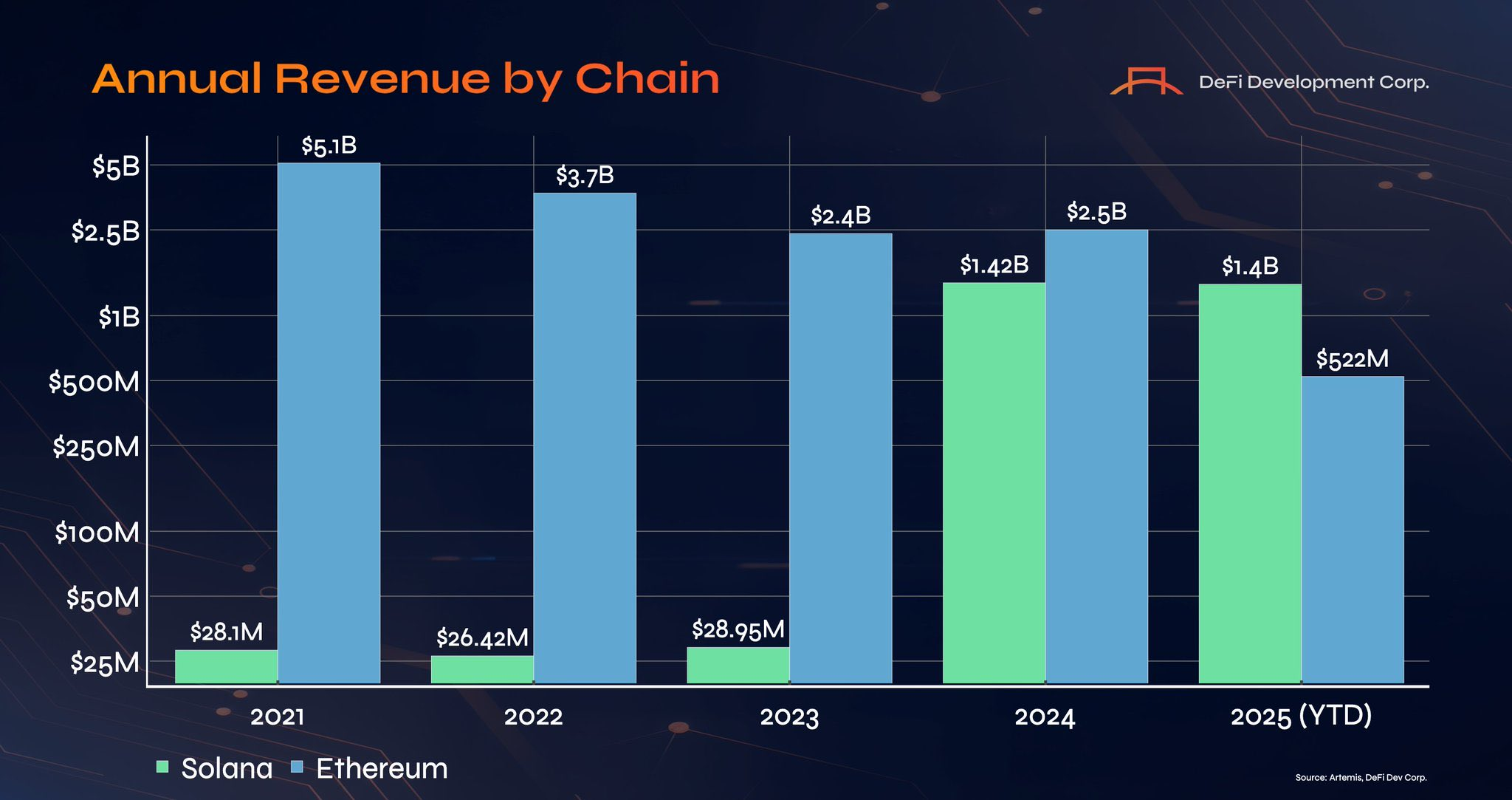

The infographics by DeFi Growth Corp. present the projected chain income comparability of Ethereum and Solana. Based on the analyses, Solana income is anticipated to achieve $1.4 billion towards $522 million by Ethereum.

In one other submit on X, Yakovenko described the previous 12 months as “loopy” and questioned whether or not open, permissionless protocols can sustainably develop and preserve revenues over time. He argued that this problem stays unresolved for a lot of the trade.

Yakovenko mentioned he believes the overall cryptocurrency market capitalization will proceed to develop, however added that it’s going to ultimately must be “cut up by revenues,” quite than purely by narratives or hypothesis. In that context, he instructed that Layer-1 blockchains have a single clear path to long-term relevance.

“L1s’ solely shot at that is within the execution layer,” Yakovenko wrote, including that probably the most profitable networks will probably be people who present “world, decentralized, low-latency, high-throughput censorship resistance.”

The feedback come amid rising debate over income era and actual financial exercise throughout main blockchains, together with Ethereum, as buyers more and more deal with fundamentals quite than utilization metrics alone.

Solana institutional adoption

Based on the American financier, a slew of large-scale corporations of the likes of BlackRock, Blackstone, and JPMorgan might begin utilizing the community for transactions.

Earlier this month, Scaramucci predicted that Solana can be among the many “massive winners” in relation to tokenization. He has publicly predicted that Solana might surpass Ethereum in market cap.

The info from Farside exhibits that the Solana ETFs have recorded practically $700 million in cumulative flows since their emergence just a few months in the past. This fast development will not be a shock because the ETFs have been seeing sturdy demand because the launch of the primary Solana