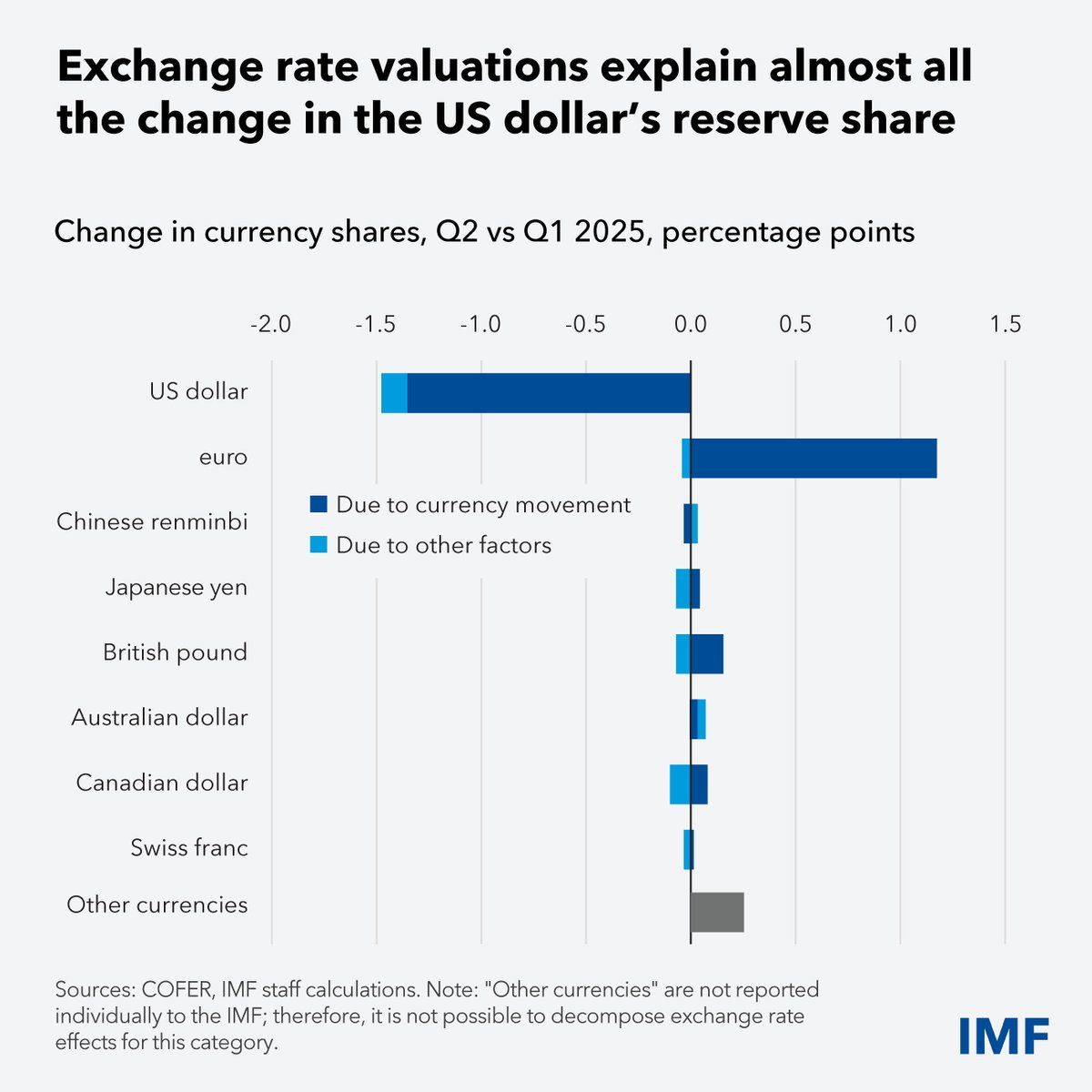

The US greenback’s international reserve share dropped to 56.32% in Q2 2025, however 92% of that decline was pushed by exchange-rate results, not central financial institution portfolio modifications. Foreign money changes present a marginal decline to simply 57.67%, indicating central banks largely maintained their USD holdings.

The Worldwide Financial Fund’s new Foreign money Composition of Official Overseas Trade Reserves (COFER) report supplies vital insights for crypto traders monitoring macroeconomic tendencies. The information reveals that central banks stored greenback allocations regular, even amid notable foreign money swings in the course of the quarter.

Sponsored

IMF: Central Banks Stayed Greenback-Heavy Regardless of Depreciation

The IMF’s COFER dataset tracks foreign money reserves from 149 economies in US {dollars}. In Q2 2025, main foreign money actions appeared like massive portfolio reallocations.

Based on the report, the DXY index declined by greater than 10% within the first half of 2025, its largest drop since 1973.

The US greenback declined 7.9% towards the euro and 9.6% towards the Swiss franc in Q2. These swings lowered the USD reserve share from 57.79% to 56.32%. Nevertheless, this discount mirrored exchange-rate results reasonably than energetic reallocation.

Adjusted for fixed change charges, the greenback’s reserve share edged down solely 0.12% to 57.67%. This means that central banks made minimal modifications to their greenback reserves in the course of the quarter, difficult tales of worldwide dedollarization.

Equally, the euro’s reserve share appeared to rise to 21.13%, a rise of 1.13 factors. But, this was additionally pushed completely by foreign money valuations.

Sponsored

At fixed change charges, the euro’s share declined barely by 0.04 factors, exhibiting central banks truly trimmed euro holdings.

What This Means for Bitcoin and Altcoins

This evaluation provides muted macro indicators for Bitcoin and different digital property marketed as hedges towards US greenback weak point. Central banks didn’t diversify away from the greenback even because the foreign money depreciated considerably.

Sponsored

Dedollarization tendencies are sometimes highlighted as doable drivers of institutional adoption of crypto. Nevertheless, the COFER knowledge, as soon as adjusted for change charges, counsel that these tendencies may be deceptive with out correct context.

The British pound additionally noticed its reserve share seem to develop in Q2, however this was one other valuation impact protecting up an actual lower in holdings. These findings display why traders ought to look past headline numbers to grasp the precise shifts in liquidity.

The IMF’s examine supplies traders a extra correct view of financial coverage throughout risky markets. By distinguishing between true coverage strikes and non permanent valuation modifications, crypto traders can higher consider international macro tendencies.

Sponsored

Central Financial institution Reserve Methods and Outlook

Greenback holdings remained secure in Q2 2025, exhibiting central banks nonetheless depend on conventional currencies at the same time as digital options achieve consideration. The IMF emphasised that exchange-rate changes are essential for understanding reserve shifts precisely.

Central banks prioritize liquidity, returns, and danger when managing reserves. The greenback’s sturdy place is linked to deep markets, excessive transaction utility, and established techniques. These points are nonetheless hurdles for digital property to beat.

The IMF’s methodology reveals how foreign money modifications can distort reserve knowledge. In Q2, almost all reported shifts in main currencies resulted from valuation swings, not precise portfolio rebalancing. Central banks maintained a cautious stance in the course of the market’s turbulence.

These findings assist make clear international tendencies shaping crypto markets. Traders involved in dedollarization as a Bitcoin catalyst ought to depend on exchange-rate-adjusted numbers.