Expectations round XRP exchange-traded funds had been seen as a turning level that would unlock new institutional demand and alter XRP’s value construction in favor of consumers. Nevertheless, current on-chain knowledge suggests the value response has diverged immensely from that narrative.

Metrics tracked by the on-chain analytics platform CryptoQuant level to a really completely different dynamic unfolding beneath the floor, one which explains why the altcoin continues to wrestle for traction regardless of headline optimism and inflows into Spot XRP ETFs.

Associated Studying

Whale Trade Inflows Expose Provide Strain

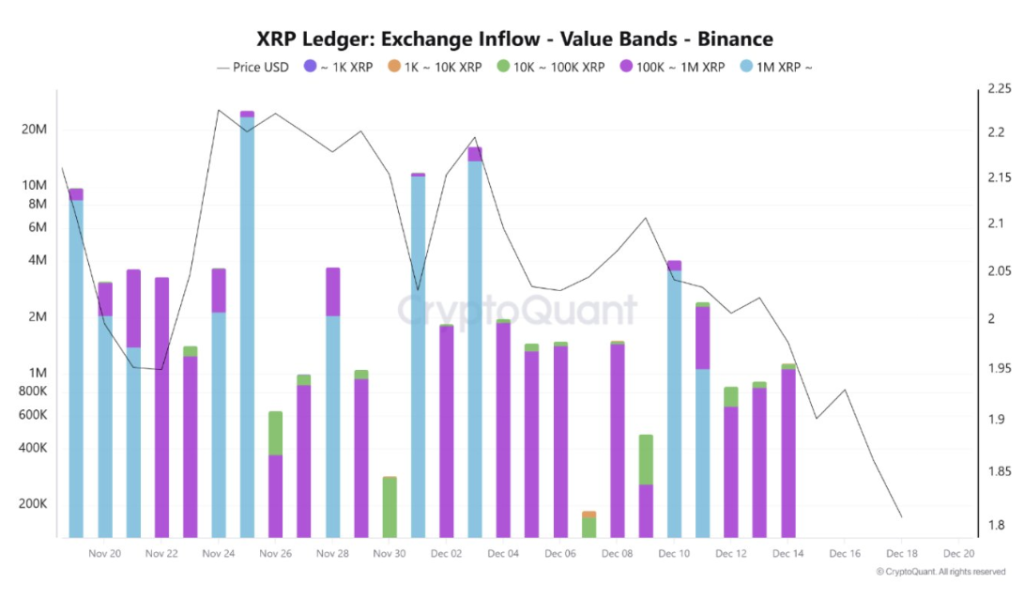

Knowledge from on-chain analytics platform CryptoQuant reveals an attention-grabbing pattern amongst XRP whale addresses and their exercise on crypto change Binance. A more in-depth take a look at the Binance Influx-Worth Band chart exhibits that current XRP deposits to exchanges are overwhelmingly concentrated within the 100,000 to 1 million XRP vary and transactions exceeding 1 million cash.

These usually are not retail-sized actions. They mirror exercise from massive holders transferring vital balances onto exchanges, and this habits aligns with distribution or preparation for promoting. The chart displaying the change influx into Binance makes this sample clear, with repeated influx spikes pushed nearly fully by these higher-value bands, whereas smaller transaction sizes are comparatively decrease.

The chart picture beneath exhibits inflows in chunks between 100,000 XRP and 1 million XRP in purple and inflows of chunks greater than 1 million XRP in mild blue. A lot of the inflows into Binance up to now few days have been characterised by these two cohorts, with just a few situations of inflows in chunks between 10,000 XRP and 100,000 XRP.

XRP Ledger: Trade Influx Worth Bands – Binance. Supply: CryptoQuant

This imbalance implies that provide is being added to the market by whales at a tempo that smaller consumers can’t take in, and because of this inflows into Spot XRP ETFs have did not have a optimistic impact on the altcoin’s value motion.

Decrease Highs, Decrease Lows Affirm Provide Overpowering Demand

As proven within the value motion overlaid within the chart above, the coin printed repeatedly decrease highs and decrease lows after main change deposits. This occurs due to the comparatively low numbers of latest spot consumers on Binance, and even average promoting strain has been sufficient to cap rallies.

Because it stands, the crypto is dealing with promoting strain each time it approaches $1.95. Based mostly on the depth of change inflows and the market’s response, the first significant assist zone is between $1.82 and $1.87. Nevertheless, if massive inflows persist, the information suggests the XRP value might proceed declining to the $1.50 to $1.66 vary.

Associated Studying

The interpretation is that the ETF pattern didn’t translate into sustained spot demand for XRP. As a substitute, whales who gathered XRP forward of ETF approval expectations seem to have used the ensuing consideration as a chance to dump their holdings.

That mentioned, inflows into Spot XRP ETFs could have helped restrict deeper draw back, as knowledge from SoSoValue exhibits these funds recorded $82.04 million in inflows over the current week.

Featured picture from Unsplash, chart from TradingView