- AAVE fell practically 10% in hours after a whale offered over 230K tokens, triggering heavy sell-side quantity.

- Value is now testing a important higher-timeframe trendline across the $160–$162 zone.

- Holding this degree might spark stabilization, whereas failure could open draw back towards $140–$130.

AAVE noticed a pointy change in tone after worth slipped laborious from the $175–$176 zone and tumbled into the mid-$150s in a matter of hours. The transfer wasn’t sluggish or hesitant. It was quick, heavy, and backed by a surge in quantity of greater than 220%, which often factors to aggressive promoting moderately than informal profit-taking.

At that time, the narrative shifted. Merchants stopped asking what prompted the drop and began specializing in what occurs subsequent. With AAVE now buying and selling under its current worth space, the stress is on consumers to point out up. In the event that they don’t, the market is probably not achieved shifting decrease simply but.

Whale Promoting Sparks The Transfer Decrease

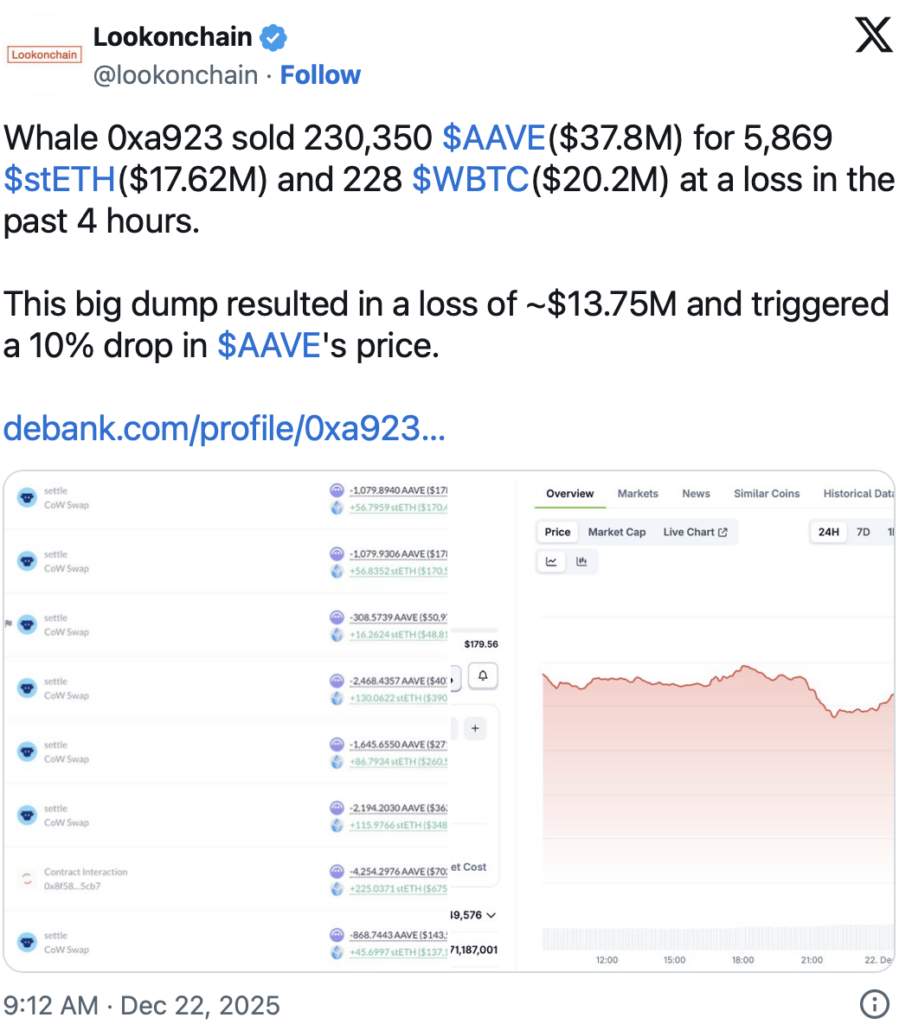

Not lengthy after AAVE cracked under intraday assist, on-chain knowledge started to inform a clearer story. A big holder stepped in and unloaded a large place proper as promote quantity exploded. The timing lined up virtually too completely, suggesting this wasn’t broad market panic however a concentrated provide occasion.

In keeping with Lookonchain, the whale dumped greater than 230,000 AAVE inside a brief window. What stands out is that the promoting occurred at a loss, possible influenced by already weak retail sentiment throughout the market. That wave of provide dragged AAVE down practically 10%, briefly tagging the $155 space earlier than a modest bounce again towards $160.

The velocity of the transfer issues right here. This didn’t appear like rotation or sloppy execution. It appeared like intentional threat discount, quick and decisive, with little regard for short-term worth impression.

The place AAVE Stands Now On Greater Timeframes

After the drop, AAVE is now sitting at a way more essential degree. On the weekly chart, worth is pulling again towards an ascending trendline that has held a number of occasions since mid-2023. Proper now, the $160–$162 zone is performing as a call space moderately than a transparent assist or resistance.

If AAVE manages to carry this trendline and appeal to regular bids, a bounce again towards the $180–$200 area isn’t out of the query. That may look extra like a imply reversion than a full development restart, however it could nonetheless matter. Then again, a weekly shut under this construction might open the door towards the $140–$130 vary, the place stronger historic assist sits.

Momentum indicators are already exhibiting fatigue. OBV has began to roll over, and upside follow-through has been missing. That doesn’t doom the construction, nevertheless it does imply consumers can’t afford to remain passive right here.

So, Was This Simply A Shock Or One thing Greater?

The sell-off clearly broken AAVE’s short-term momentum, there’s no sugarcoating that. Nonetheless, the broader construction hasn’t fully fallen aside but. Value is sitting proper on a higher-timeframe degree the place the market has to select.

If consumers defend this space and AAVE can reclaim its prior worth zone, it could recommend the market has absorbed the whale promoting and is able to stabilize. If not, the current losses may have extra time to settle, and draw back threat stays very actual.

For now, it’s much less about predictions and extra about reactions. Watching how worth behaves round this assist will inform the true story. Endurance, as regular, is doing a lot of the heavy lifting right here.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.