- Bitcoin value weak point has pushed fundamentals again into focus this cycle

- MicroStrategy continues to build up BTC regardless of market volatility

- Tokenized Bitcoin development is strengthening long-term institutional adoption indicators

This cycle has quietly shifted the main focus again to fundamentals, and it’s beginning to present. Value motion throughout crypto has been messy, sharp drops adopted by quick rebounds, with no actual sense of stability sticking round for lengthy. That form of motion tends to mess with sentiment, and it did.

The Concern and Greed Index mirrored precisely that. Confidence saved flipping between excessive concern and plain previous concern, virtually week to week, as merchants struggled to search out strong footing.

Bitcoin diverges from danger belongings

What stood out this time was the divergence. On the charts, Bitcoin started shedding relative energy in opposition to conventional risk-on belongings and even legacy markets. The S&P 500, for instance, climbed roughly 2.18% quarter-to-date, whereas BTC slid round 22%, sitting simply 7% away from wiping out the prior quarter’s good points fully.

That hole issues. It indicators that value isn’t telling the entire story proper now, and that’s the place fundamentals begin creeping again into the dialog, whether or not the market likes it or not.

Saylor doubles down on the lengthy sport

That is the place Michael Saylor’s latest feedback begin to land. In a latest interview, he argued that Bitcoin’s fundamentals stay sturdy this 12 months, regardless of the ugly value motion. In accordance with AMBCrypto, that assertion carries weight, largely as a result of the large gamers appear to agree.

MicroStrategy didn’t decelerate. The corporate added roughly 31,000 BTC this quarter, sticking firmly to its thesis and ignoring short-term volatility. That form of conviction suggests one thing greater, a doable shift in how the market processes concern, uncertainty, and doubt, with fundamentals doing extra of the heavy lifting.

Bitcoin because the next-generation retailer of worth

Wanting forward, MicroStrategy’s roadmap is clearly constructed for the lengthy haul. Saylor has pointed to AI-driven monetary modeling, an expanded digital gold narrative, regulatory easing, and even quantum-related fears as catalysts that might reshape Bitcoin’s position. In his view, MSTR might find yourself holding 5–7% of Bitcoin’s whole provide over the approaching years.

On the coronary heart of that confidence are two tendencies: rising Bitcoin tokenization and enhancing regulatory readability. Collectively, they kind the spine of what Saylor believes will unlock the following wave of institutional adoption.

Tokenized Bitcoin strengthens the thesis

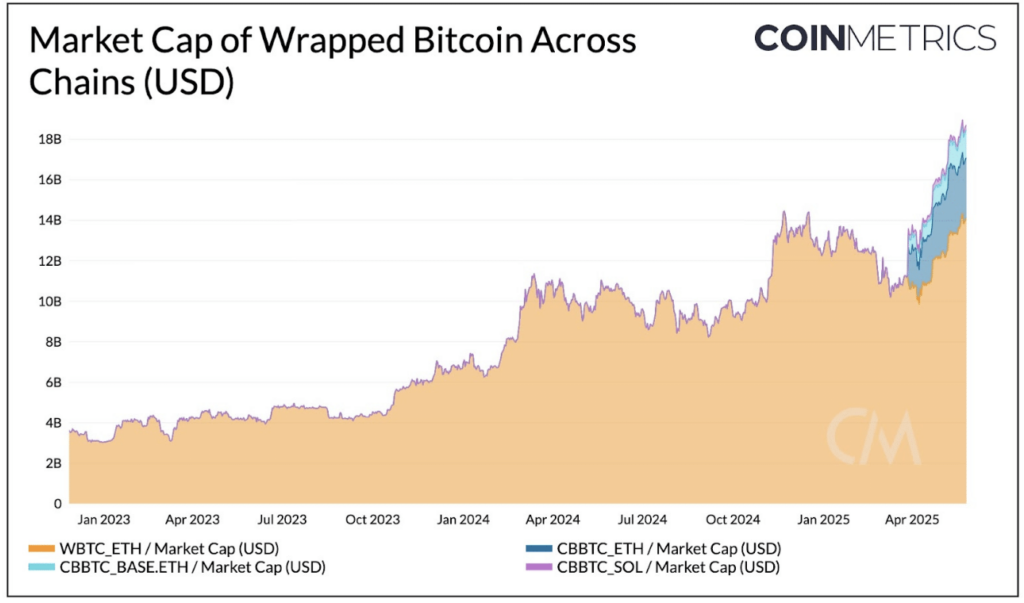

Information backs this up. The 2025 Coin Metrics report exhibits that the market cap of wrapped Bitcoin throughout a number of chains has grown fivefold since January 2023. The 2 largest variations, WBTC and cbBTC, now characterize a mixed 172,130 BTC.

That surge highlights how Bitcoin is increasing past its base layer, quietly deepening its DeFi presence by tapping into different Layer 1 ecosystems. Seen by means of that lens, MicroStrategy’s technique feels much less aggressive and extra… inevitable.

With fundamentals strengthening and tokenization accelerating, institutional curiosity in Bitcoin might solely be getting began. In that case, MicroStrategy’s strikes might find yourself setting the tempo for the remainder of the market, whether or not they’re prepared or not.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.