- Solana’s community exercise has fallen practically 97% from its 2024 peak, dragging SOL sharply decrease.

- The collapse of memecoin buying and selling uncovered how reliant latest development had develop into on speculative demand.

- Institutional curiosity stays, however SOL’s subsequent transfer is determined by whether or not actual utilization replaces misplaced exercise.

Solana’s on-chain exercise has taken a pointy hit in This fall 2025, and the worth didn’t escape the fallout. Community utilization is down roughly 97% from its peak, and SOL adopted with a heavy drawdown of its personal.

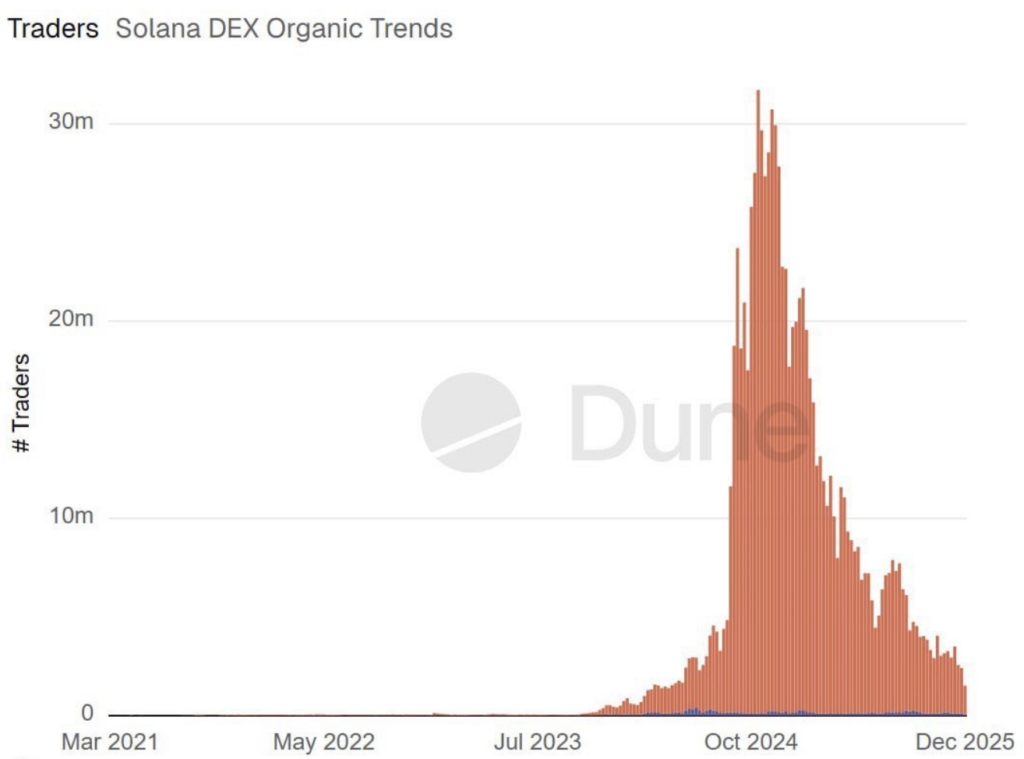

At its peak in late 2024, Solana was buzzing with greater than 30 million lively merchants. Quick ahead to 2025 and that quantity has collapsed to underneath 1 million month-to-month customers. It’s no shock some analysts are beginning to ask the uncomfortable query out loud — is that this only a cooldown, or one thing deeper breaking beneath?

To be truthful, late-2025 hasn’t been form to crypto general. Bitcoin dropped greater than 30% throughout the identical stretch. However Solana’s state of affairs feels a bit extra particular, and that’s what has individuals watching intently.

Memecoins: Stress Check or Structural Threat?

Solana and Hyperliquid have been two of the largest winners of this cycle. SOL itself surged from round $8 to just about $300, an enormous 35x transfer from the depths of the 2022 bear market.

A giant a part of that development got here from memecoins. They drove site visitors, charges, and a spotlight, even because the community improved stability and reduce down on outages. When markets turned risk-off in 2025, memecoins have been the primary domino to fall. Exercise vanished quick.

Nonetheless, long-time Solana supporters argue this wasn’t wasted development. Commentators like Marty Celebration have framed memecoins as a sort of “liveness check” for the chain. In that view, gamblers stress the system, then depart, making room for extra severe customers afterward. Fairness merchants, stablecoin flows, and real-world use circumstances are alleged to observe.

The issue is timing. As memecoin exercise dried up, SOL slid from practically $300 all the way down to the $120 help zone, a painful 58% drop. That uncovered how dependent near-term demand had develop into on speculative site visitors.

Institutional Curiosity vs. Utilization Actuality

There are indicators Solana isn’t being written off totally. Visa’s involvement in stablecoin settlements is commonly cited as proof the chain nonetheless issues at an institutional stage. If community utilization progressively shifts away from pure hypothesis, Solana might stabilize in a more healthy approach.

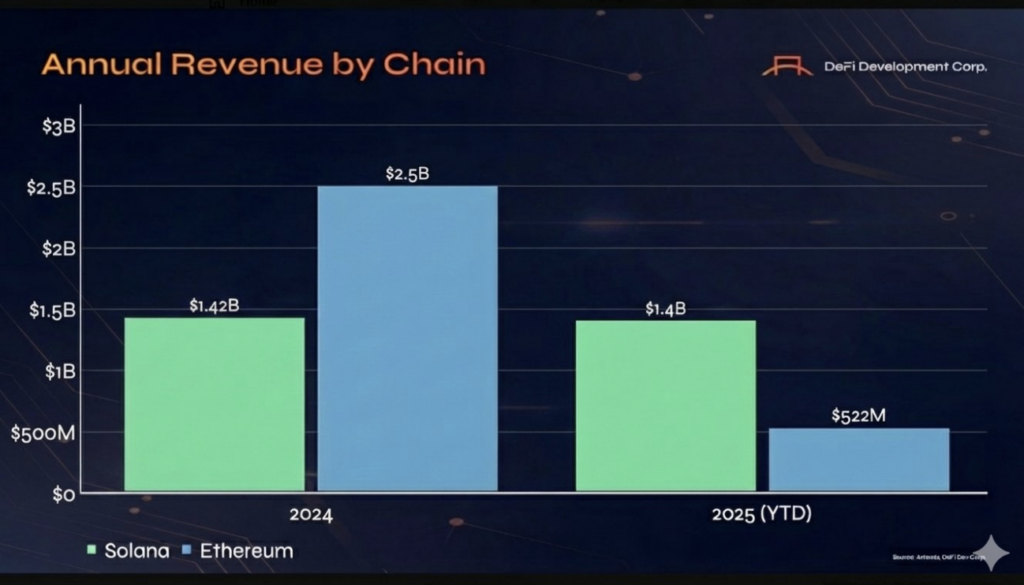

That shift additionally issues when evaluating Solana to Ethereum. ETH stays the clear chief in institutional adoption and income. In 2025 alone, Ethereum generated greater than $1.4 billion, whereas Solana introduced in roughly $502 million — a few threefold hole.

What’s extra regarding is the development. In 2024, Solana reportedly generated round $2.5 billion in income. That suggests a steep, nearly fivefold drop this yr. Even Solana co-founder Anatoly Yakovenko admitted it’s been an odd experience, noting that whether or not permissionless protocols can develop and maintain income remains to be very a lot an open query.

Worth Efficiency and What Comes Subsequent

From an investor perspective, the story hasn’t been fairly. SOL has underperformed ETH by about 56% this yr, a pointy reversal from 2024 when Solana outpaced Ethereum by greater than 24%.

Some forecasts are blunt. Fundstrat has prompt SOL might revisit the $50–$75 vary within the first half of 2026 if weak spot persists. Others are much less pessimistic. Analyst Ted Pillows sees a better likelihood of a short-term rebound, pointing to just about $1 billion in upside liquidity tied to leveraged brief positions. In that state of affairs, a 15% transfer towards the $134–$140 vary wouldn’t be stunning.

For now, Solana sits at a crossroads. The memecoin wave is gone, exercise is quiet, and value has corrected exhausting. Whether or not the following chapter brings actual adoption or additional erosion will probably depend upon what fills the hole left behind.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.