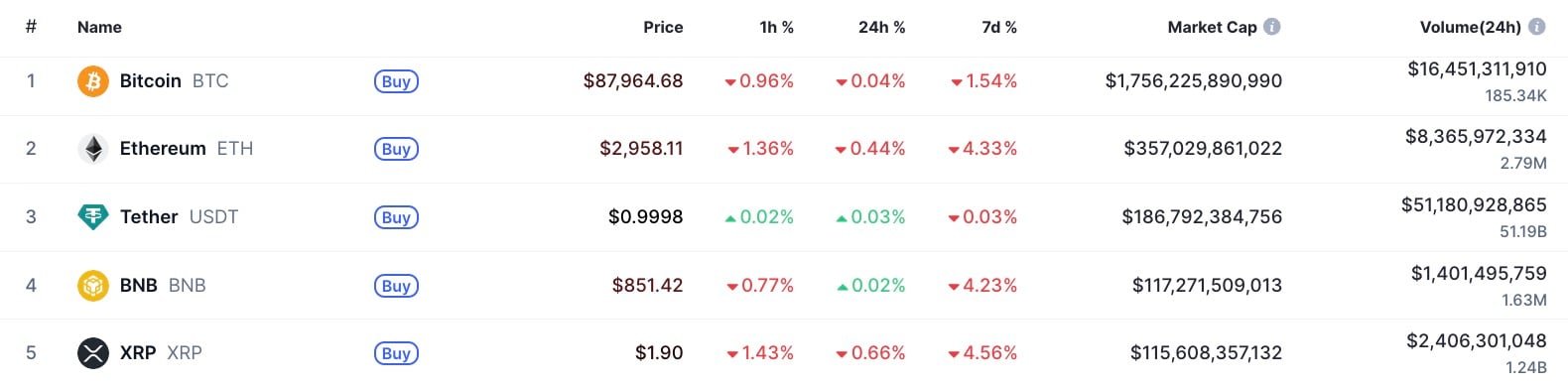

Binance Coin (BNB) and XRP simply turned the top-three race right into a day by day battle on CoinMarketCap: their market caps sit about $1.35B aside, and one 1% transfer can flip the rating in hours, with communities of each watching each tick.

This “top-three” combat will not be about Bitcoin or Ethereum, and it’s not even in regards to the stablecoin sitting third on the principle listing; it’s the race for third place amongst non-stable belongings, and the hole is tiny: BNB close to $117.71 billion in market cap versus XRP round $116.36 billion.

That could be a distinction of about $1.35 billion, sufficiently small to fade on a traditional day. A 1% transfer on BNB’s cap is round $1.18 billion, so one strong session can swap the order and immediately rewrite the story round “who’s profitable” this cycle.

What makes it messy is the break up between worth and exercise. XRP is buying and selling close to $1.92 with about $2.41 billion in 24-hour quantity, whereas BNB sits close to $854.59 with about $1.4 billion in 24-hour quantity, which means merchants are pushing XRP tougher whilst BNB holds the upper valuation.

On the week, they’re taking related hits (BNB -4.08%, XRP -4.04%), which says this isn’t a weekly pattern name; it’s a positioning tug-of-war.

Who’s profitable?

In the event you have a look at the large image, BNB is profitable. The 2025 Binance comparability reveals BNB up +31.55%, whereas XRP is down -12.81%. That unfold explains why BNB retains getting bids on pullbacks and why XRP’s bounces maintain fading.

The following catalyst will determine the headline. BNB’s bid is all in regards to the ecosystem. It has trade stream, BNB Chain utilization and the fixed burn narrative.

As for XRP, it’s all in regards to the headlines: funds adoption, regulation wins and any strong information about institutional merchandise. With the cap hole this small, the primary plausible story wins the rating, at the very least for some time.