The founder and CEO of on-chain analytics agency CryptoQuant has revealed how Bitcoin on-chain capital inflows have stalled during the last couple of months.

Bitcoin Realized Cap Has Witnessed A Slowdown Not too long ago

In a brand new put up on X, CryptoQuant founder and CEO Ki Younger Ju has talked about how on-chain capital inflows have been weakening for Bitcoin lately. “After about 2.5 years of progress, realized cap has stalled over the previous month,” famous Younger Ju. The “Realized Cap” right here refers to an on-chain capitalization mannequin for Bitcoin that calculates its complete worth by assuming the worth of every coin in circulation is the same as the value at which it was final transacted on the blockchain.

For the reason that final transaction of any coin is prone to signify the final occasion of it altering arms, the value at the moment will be thought-about as its present value foundation. Due to this fact, the Realized Cap is only a sum of the fee foundation of your complete BTC provide. In different phrases, it tracks the capital that the buyers used to buy their tokens.

Realized Cap had been having fun with progress for the final couple of years, however because the CryptoQuant founder has revealed, capital inflows have dropped off. This implies a decline in sentiment round Bitcoin.

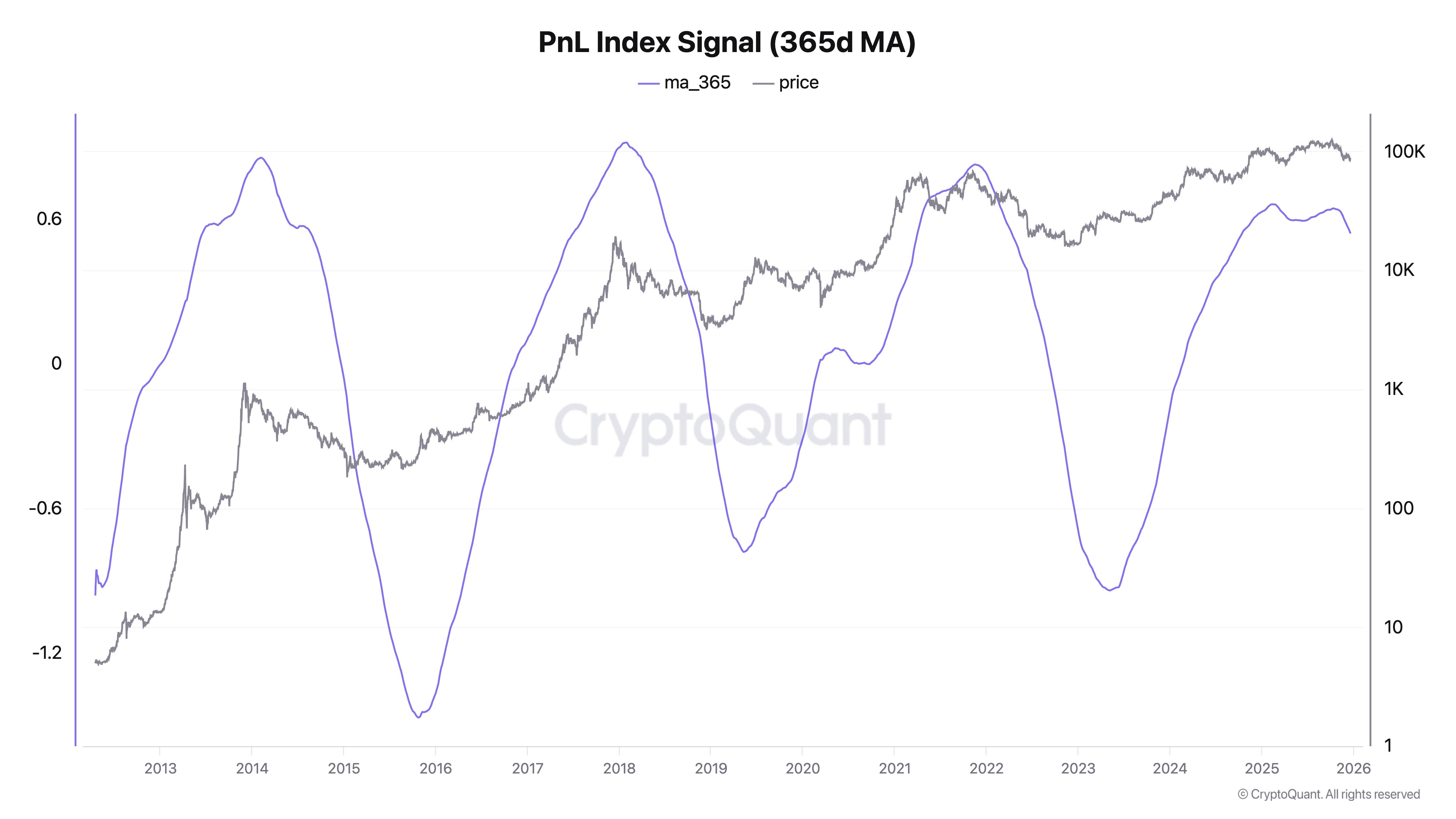

The turnaround in sentiment can be seen by the analytics agency’s PnL Index, which contains key on-chain indicators to construct a single valuation metric for BTC.

The indications in query are the MVRV Ratio, NUPL, and STH/LTH SOPR. The primary two each cope with the quantity of unrealized revenue or loss held by the buyers as a complete, whereas the latter supplies a glance into investor profit-taking.

Beneath is the chart shared by Younger Ju that exhibits the pattern within the 365-day shifting common (MA) of the Bitcoin PnL Index over the historical past of the asset.

From the graph, it’s seen that the Bitcoin PnL Index noticed its 365-day MA attain a excessive earlier within the 12 months, implying that the coin had doubtlessly change into overvalued.

Since then, the metric has seen a reversal to the draw back. At the moment, its worth remains to be notably constructive, so the cryptocurrency could also be thought-about to be in a bullish section, however traditionally, drawdowns have tended to guide into bear markets.

Although there have been a few cases the place this sample didn’t maintain. One being the aftermath of the COVID crash and the opposite the decline that occurred within the early months of 2025.

Up to now, the indicator hasn’t proven indicators of any turnaround again to the upside, though it must be famous that it’s a mean over the previous 12 months, so there’s some delay connected.

Primarily based on the on-chain pattern, Younger Ju has stated, “Sentiment restoration may take just a few months.”

BTC Value

Bitcoin has made restoration from final week’s plunge as its worth is now again at $89,800.