- Bitcoin continues to face sturdy resistance close to the $90,000 stage.

- BTC is consolidating round $87,000–$88,000 amid macro uncertainty.

- A possible rebound towards $90,000 might emerge in early 2026.

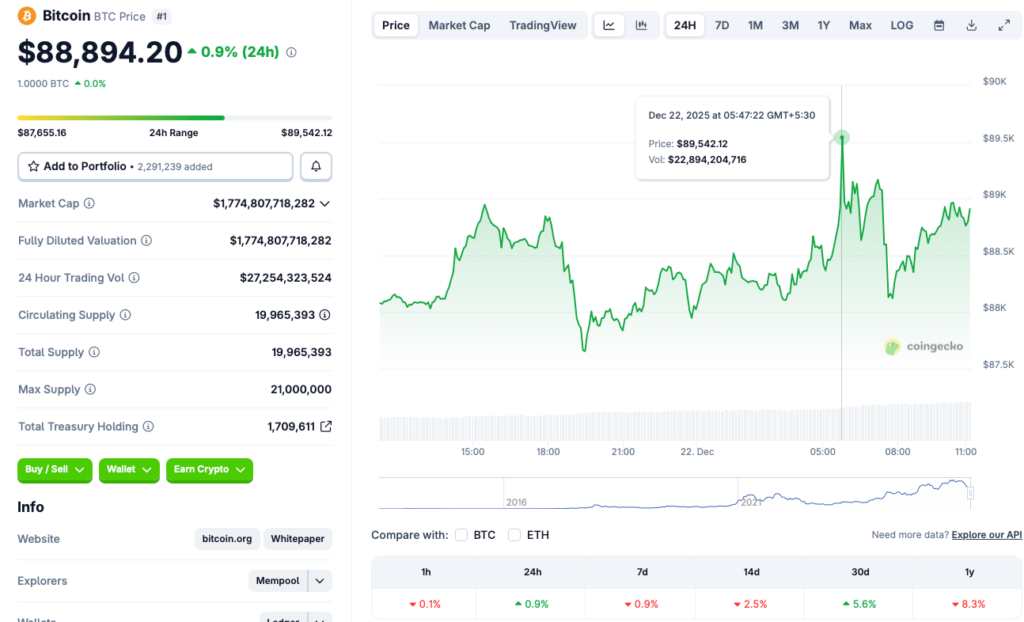

Bitcoin is as soon as once more working into stiff resistance close to the $90,000 stage, a zone that has repeatedly capped upside makes an attempt in latest weeks. Earlier right now, Dec. 22, 2025, BTC climbed to round $89,542 earlier than slipping again towards the $88,000 vary. Based on CoinGecko knowledge, Bitcoin is up 0.9% over the past 24 hours and 5.6% over the previous month, however it stays down 0.9% on the week, 2.5% over 14 days, and greater than 8% since December 2024.

Consolidation Indicators Warning, Not Capitulation

Regardless of the pullback, Bitcoin seems to be stabilizing between $87,000 and $88,000, suggesting consolidation reasonably than panic promoting. This sideways motion comes after months of strain following BTC’s all-time excessive of $126,000 in October. Traditionally bullish, October delivered the other lead to 2025, with Bitcoin getting into a sustained downtrend that has but to totally reverse.

Fee Cuts Did not Spark Momentum

The bearish shift started shortly after the Federal Reserve delivered an rate of interest reduce in October, usually a supportive sign for danger belongings. Markets, nevertheless, reacted negatively as traders questioned whether or not additional easing would observe. Even December’s extra charge reduce didn’t revive momentum throughout crypto, highlighting how macro uncertainty continues to outweigh financial tailwinds.

Capital Rotates Into Secure Havens

Investor habits suggests a defensive stance. Capital has been flowing into conventional secure havens equivalent to gold and silver, each of which lately reached new all-time highs. That rotation alerts diminished urge for food for risky belongings like cryptocurrencies, serving to clarify Bitcoin’s muted response to in any other case bullish coverage developments.

A Window for a 2026 Breakout

Whereas near-term momentum stays weak, the outlook shouldn’t be solely bleak. If macro circumstances stabilize and danger urge for food returns, Bitcoin might see renewed inflows in early 2026. A decisive push above $90,000 would seemingly require a broader shift in sentiment, however consolidation at present ranges could also be laying the groundwork for that subsequent transfer.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.