- Bitget now holds 34,055 BTC value about $3 billion.

- Bitcoin reserves grew 114% year-over-year via regular accumulation.

- The change experiences surplus protection throughout BTC, ETH, USDC, and USDT.

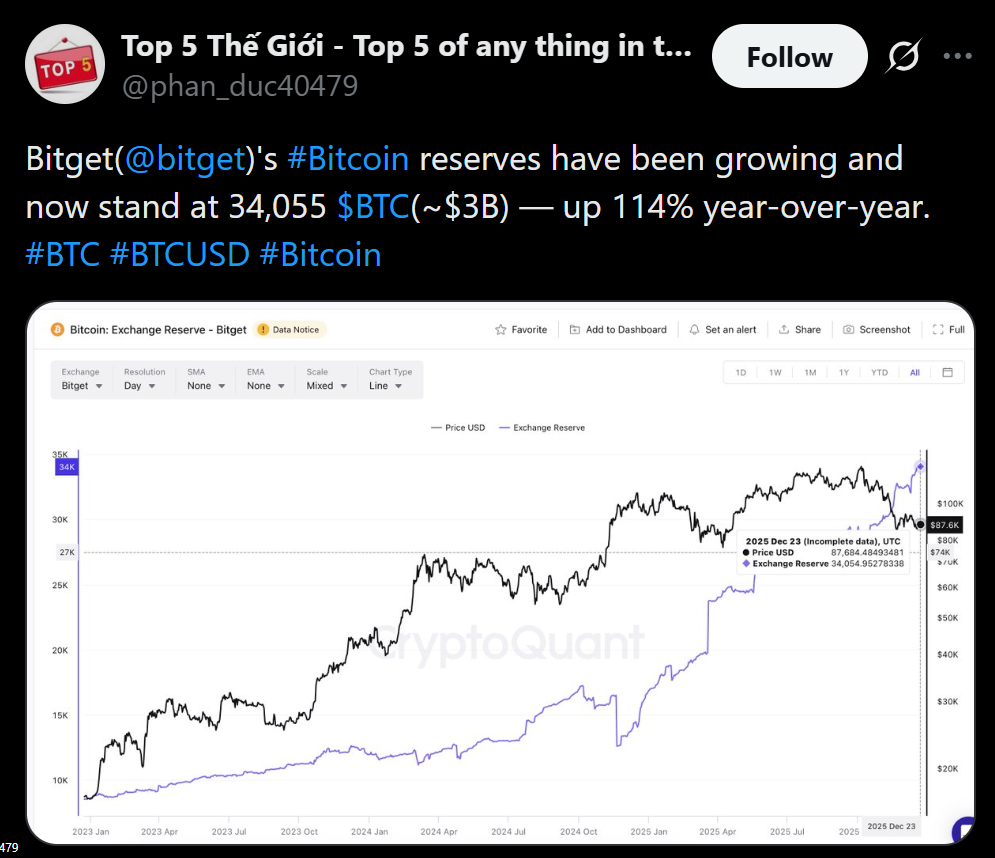

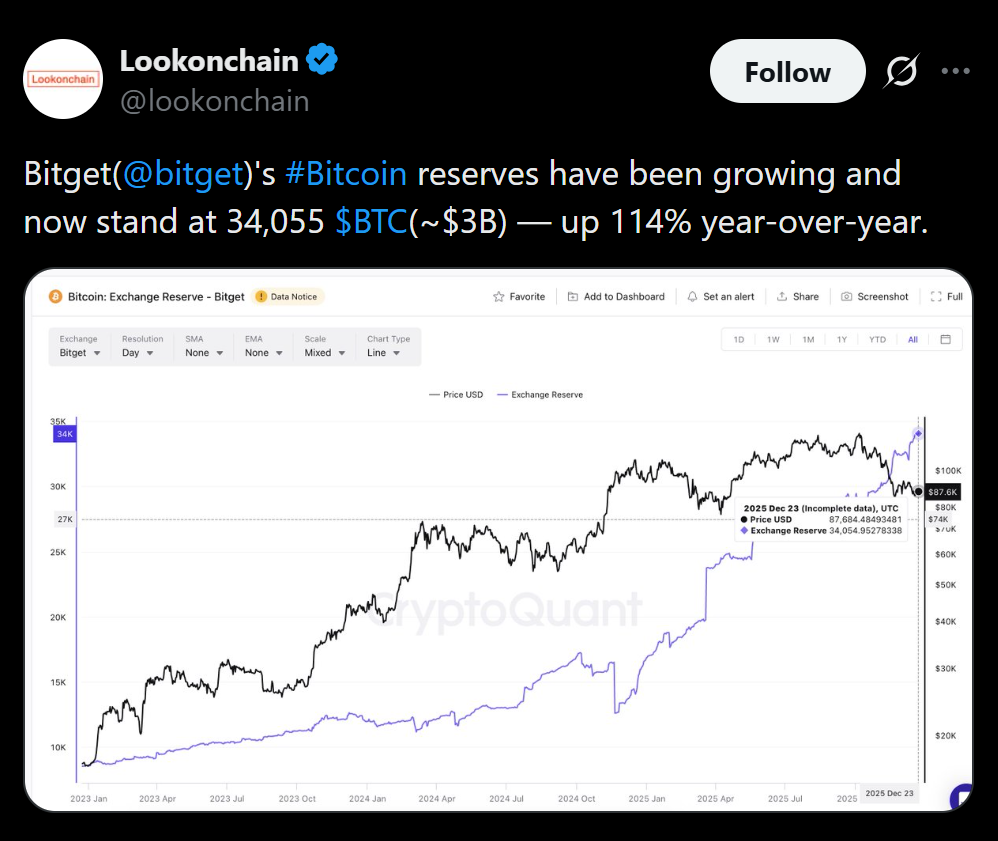

Bitget has quietly however aggressively expanded its Bitcoin holdings over the previous yr, greater than doubling its reserves as institutional curiosity in crypto continues to rise. As of December 2025, the change holds 34,055 BTC value roughly $3 billion, representing a 114% year-over-year enhance. The buildup alerts a transparent deal with stability sheet resilience at a time when transparency and solvency matter greater than ever.

Bitcoin Accumulation Picked Up Pace in 2025

Bitget’s reserve development accelerated steadily all year long somewhat than arriving in a single burst. The change held 28,022 BTC in August, elevated that determine to 30,300 BTC by October, and added roughly one other 4,000 BTC by December. The tempo of accumulation suggests rising confidence and a deliberate technique somewhat than reactive positioning.

A Broader Push for Over-Collateralization

Bitcoin isn’t the one asset the place Bitget is working with a surplus. In response to the change’s December reserves report, Bitget maintains full backing throughout all main belongings. Protection at present stands at 300% for Bitcoin, 183% for Ethereum, 129% for USDC, and 100% for USDT. That degree of over-collateralization is designed to reassure customers amid heightened scrutiny of centralized exchanges.

Why This Issues for the Market

As institutional participation will increase, exchanges are underneath strain to display monetary energy and danger self-discipline. Bitget’s increasing reserves level to a technique centered on credibility and long-term positioning somewhat than short-term optics. In an setting the place proof-of-reserves has turn into desk stakes, extra protection could more and more separate trusted platforms from the remainder.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.