- BNB is hovering close to $850 after a 1.5% day by day decline.

- Quantity suggests defensive buying and selling slightly than aggressive shopping for.

- Merchants are centered on a $850–$870 consolidation vary.

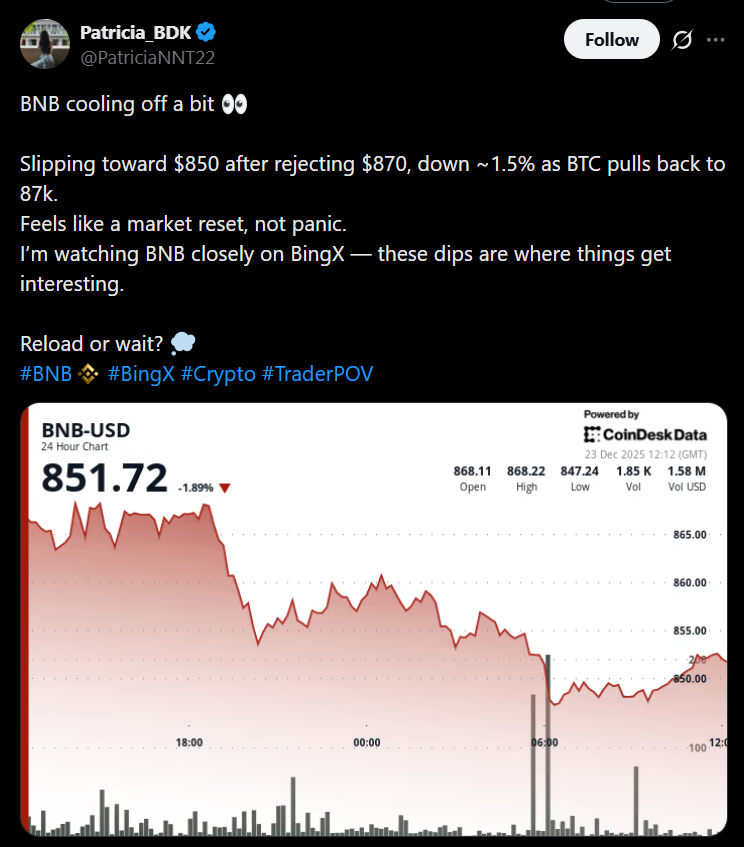

BNB is buying and selling across the $850 stage after slipping greater than 1.5% over the previous 24 hours, reflecting a broader pullback throughout the crypto market. The token has eased from a latest excessive close to $870, shifting consistent with bitcoin’s drop from above $90,000 again towards the $87,000 vary earlier Tuesday. The tone throughout markets feels cautious once more, with merchants opting to guard capital slightly than chase upside.

Promoting Strain Caps the Newest Bounce

Value motion confirmed early indicators of energy when BNB briefly pushed above $860 on elevated quantity. That transfer, nonetheless, failed to carry. Sellers stepped in shortly and capped positive aspects, reinforcing resistance in that zone. The broader CoinDesk 20 index additionally weakened, falling about 2.5% over the identical interval, underscoring that the transfer decrease wasn’t remoted to BNB alone.

Quantity Alerts Defensive Positioning

Based on CoinDesk Analysis’s technical evaluation mannequin, latest quantity spikes seem tied extra to defensive repositioning than recent risk-on exercise. Merchants appear to be reacting to volatility slightly than expressing sturdy directional conviction. That habits usually accompanies consolidation phases, the place markets anticipate clearer macro or technical alerts earlier than committing.

Adoption Continues within the Background

Not every part has turned bearish. On the adoption entrance, prediction market Kalshi introduced assist for deposits and withdrawals in BNB and stablecoins on BNB Chain. Whereas the information didn’t spark a direct worth response, it provides to the longer-term narrative of regular community utilization progress even in periods of market stress.

Key Ranges Outline the Close to-Time period Outlook

For now, merchants are watching a good vary between $850 and $870. A sustained break above that zone may revive speak of a transfer towards $900 later within the yr. On the draw back, a drop under $820 would doubtless sign deeper losses and a shift towards a extra defensive market posture.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.