Bitcoin is as soon as once more making an attempt to reclaim the $90,000 stage, however value motion stays capped under this key psychological threshold. Regardless of a number of short-lived aid rallies, momentum has didn’t comply with by means of, reinforcing rising considerations that the broader market construction is weakening.

As volatility persists and upside makes an attempt stall, an growing variety of analysts are starting to brazenly focus on the chance that Bitcoin could also be transitioning right into a bear market section. Sentiment throughout derivatives and spot markets has turned noticeably extra cautious, with danger urge for food persevering with to fade.

Associated Studying

On this context, a latest report by Darkfost attracts consideration to a well-known however controversial narrative: capital rotation from gold into Bitcoin. With gold setting a brand new all-time excessive above $4,420 per ounce, the concept traders could quickly shift capital towards Bitcoin is resurfacing throughout the market.

Traditionally, this narrative has gained traction during times when conventional safe-haven belongings outperform, fueling hypothesis that Bitcoin might comply with in its place retailer of worth.

Nevertheless, Darkfost cautions that this assumption is way from well-grounded. Whereas the rotation thesis has been extensively repeated all through this cycle, empirical proof linking gold outperformance on to sustained Bitcoin inflows stays weak.

Reasonably than signaling an imminent bullish flip, the present setup means that Bitcoin stays weak, caught between macro-driven narratives and deteriorating inner market construction.

Testing the Gold-to-Bitcoin Rotation Thesis

Darkfost emphasizes that the favored narrative of capital rotating from gold into Bitcoin lacks direct, verifiable proof. To handle this, he constructed a comparative framework to determine durations the place such rotations could have occurred. He did this with out assuming a causal relationship. The core challenge, as he notes, is that on-chain and market information can’t conclusively show that capital exiting gold is similar capital getting into Bitcoin.

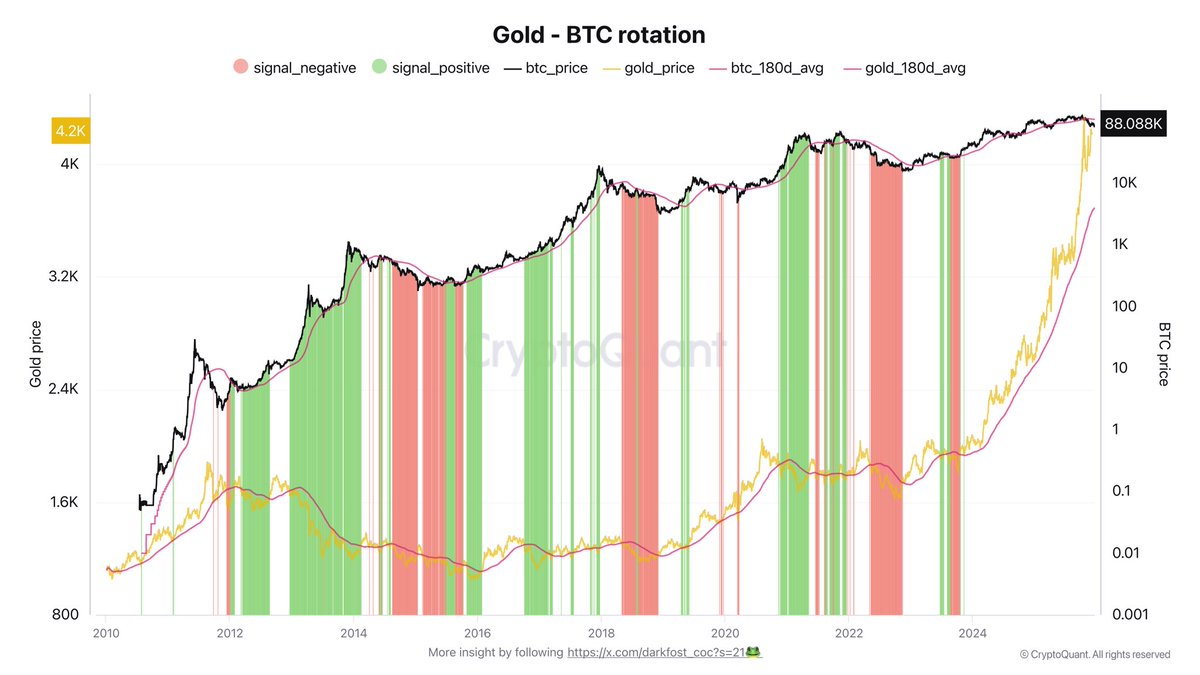

To approximate potential rotation phases, Darkfost utilized a easy however disciplined sign construction. A constructive sign seems when Bitcoin is buying and selling above its 180-day transferring common whereas gold is buying and selling under its personal 180-day transferring common. In principle, this configuration suggests relative power shifting towards Bitcoin. Conversely, a destructive sign is triggered when each Bitcoin and gold commerce under their respective 180-day transferring averages. Indicating a broad risk-off atmosphere moderately than a rotation.

This technique permits historic comparability throughout cycles, highlighting moments the place relative efficiency diverged. Nevertheless, the outcomes problem the simplicity of the narrative. As proven on the chart, these alerts don’t produce constant or dependable outcomes. In a number of situations, supposed rotation durations didn’t generate sustained upside for Bitcoin. At different occasions, Bitcoin rallied independently of gold’s pattern.

The takeaway is obvious: capital rotation between gold and Bitcoin isn’t an absolute or mechanical course of. Market conduct seems way more nuanced. Pushed by broader macro situations, liquidity dynamics, and investor positioning moderately than an easy asset-to-asset rotation.

Associated Studying

Worth Struggles Beneath Key Shifting Averages

Bitcoin is making an attempt to stabilize after a pointy corrective section, however the chart highlights that value motion stays structurally fragile. BTC is presently buying and selling just under the $90,000 stage, an space that has flipped from assist into near-term resistance following the latest breakdown. Whereas the newest bounce reveals short-term shopping for curiosity, it has not but altered the broader bearish construction that shaped after the October highs.

From a pattern perspective, Bitcoin is now buying and selling under the 50-3D transferring common (blue), which has began to slope downward, signaling weakening momentum. The failure to reclaim this stage means that latest upside strikes are corrective moderately than impulsive.

Associated Studying

Beneath the present value, the 100-3D transferring common (inexperienced) sits close to the $85,000–$86,000 zone and has acted as interim assist throughout the rebound. A sustained lack of this space would doubtless expose BTC to a deeper retracement towards the 200-3D transferring common (crimson), presently rising close to the low $80,000 area.

The sell-off was accompanied by elevated quantity. Whereas the rebound has occurred on comparatively lighter participation, pointing to a scarcity of conviction from patrons. Structurally, Bitcoin is consolidating in a decrease vary. With decrease highs and compressed volatility suggesting a pause moderately than a pattern reversal.

For bulls, reclaiming and holding above $90,000 and the declining 50-3D transferring common is vital to invalidate the bearish bias. Till then, value motion favors range-bound buying and selling with draw back danger nonetheless current.

Featured picture from ChatGPT, chart from TradingView.com