- The Ghost of Bitcoinâs previous

- What now?

As we shut out one other risky, history-making 12 months in 2025, it’s simple to get misplaced within the minute-by-minute value motion. However tonight, on Christmas Eve, we’re zooming out. U.Right this moment is taking a retrospective journey via 16 years of vacation buying and selling.

The Ghost of Bitcoin’s previous

In 2009, Bitcoin was lower than a 12 months outdated. It had no market value, no exchanges, and will solely be mined on a house pc. It was purely an concept shared amongst cypherpunks on mailing lists. The next 12 months, Bitcoin was nonetheless cheaper than a gumball.

By 2011, Bitcoin had skilled its first main bubble earlier than crashing by a staggering 90%. By Christmas, it had stabilized round $4.

Contemporary off the very first “halving” occasion in November, provide shock mechanics have been kicking in in 2012. The value had tripled from the earlier 12 months to a whopping $13. The WordPress Basis additionally started accepting Bitcoin.

2013 was the 12 months Bitcoin broke the sound barrier, hovering from $13 to over $1,100. Later, it crashed again all the way down to the $600s after China banned monetary establishments from dealing with it. It was the primary time the “normies” began discussing Bitcoin at Christmas dinner.

Following the catastrophic collapse of Mt. Gox (which dealt with 70% of trades), 2014 was a painful 12 months of decline. Bitcoin spent Christmas bleeding out.

Ten years in the past, Bitcoin was buying and selling for lower than the worth of a brand new gaming console. The market was recovering from the Mt. Gox period, and whereas the worth was low, the conviction was constructing

In 2016, Bitcoin had almost doubled from the earlier Christmas, knocking on the door of $1,000. The vitality was palpable; merchants knew one thing huge was coming in 2017.

Simply days after almost touching $20,000, Bitcoin corrected sharply to $14,000 on Christmas Day in 2017. It was a hectic vacation for many who purchased the highest, however a miraculous one for long-term holders.

After a brutal year-long decline, Bitcoin limped into Christmas at roughly $3,800. The mainstream media declared crypto “lifeless” (once more).

The value had almost doubled from the 2018 lows. It wasn’t a moon mission but, however stability had returned to the market.

In 2020, Bitcoin smashed its earlier all-time highs simply in time for the vacations, breaking $24,000. Institutional traders had lastly arrived.

Following the FTX collapse, costs plummeted again to 2020 ranges. It was a somber Christmas for portfolios.

The winter ended, and Bitcoin surged again over $40,000, pushed by spot ETF hype. The temper modified from worry to greed as soon as once more.

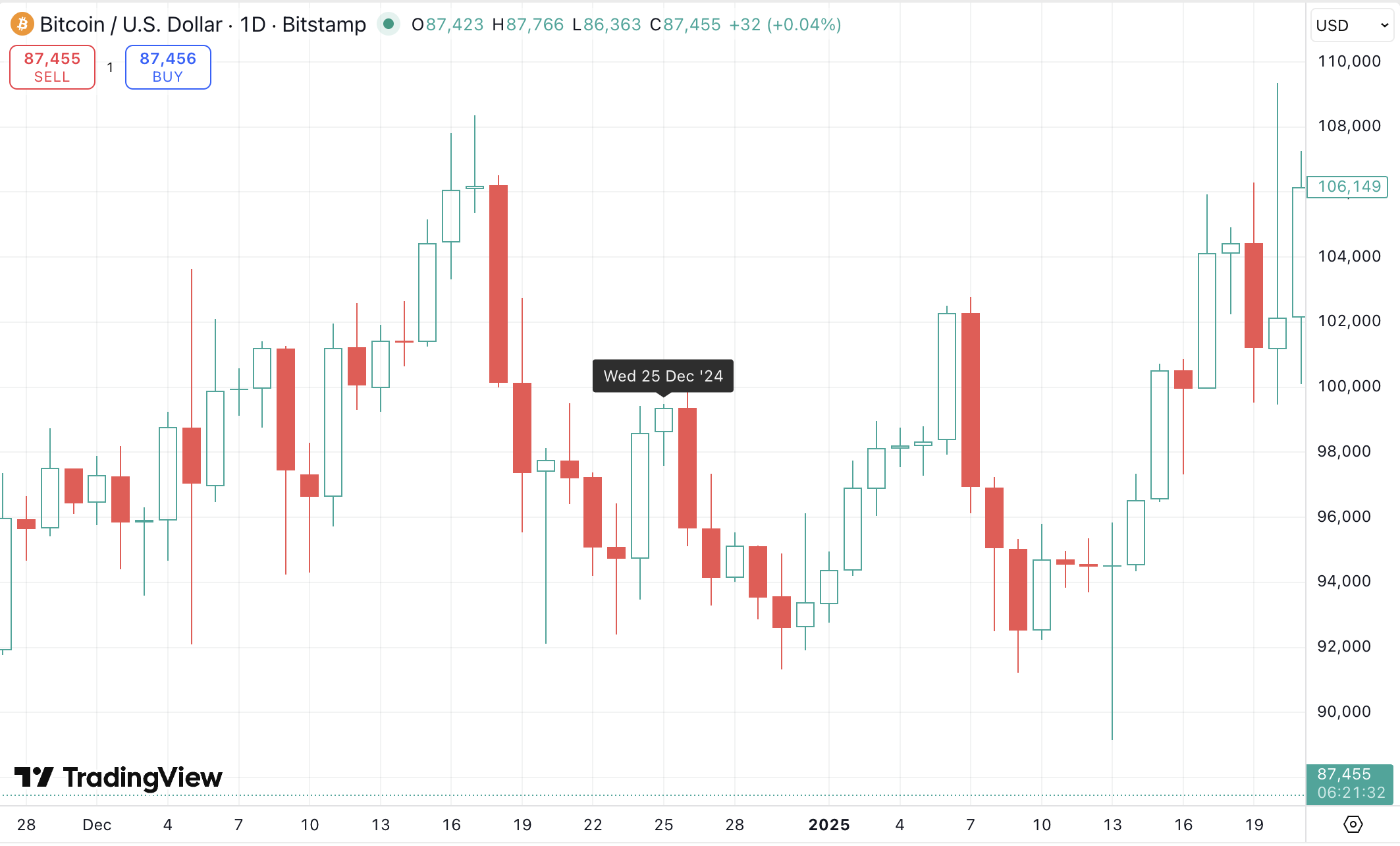

Final 12 months, we witnessed historical past as Bitcoin surpassed the psychological six-figure barrier. It was the fruits of a decade of onerous work, growth, and neighborhood constructing.

What now?

After a roaring begin to the 12 months and an all-time excessive of $126,000 in October, gravity has taken over. We’re closing out 2025 with Bitcoin buying and selling sideways round $86,800. The market feels “caught” between the euphoria of autumn and the uncertainty of 2026.

As reported by U.Right this moment, Galaxy CEO Mike Novogratz just lately predicted that it will be difficult for the Bitcoin value to reclaim the $100,000 degree.

But, congratulations are so as: you will have efficiently survived a landmark 12 months the place Bitcoin lastly shattered the six-figure ceiling. The street forward could also be difficult, however let’s benefit from the festivities and prepare to defy the chances once more in 2026. Merry Christmas!