With the top of the yr in sight, Asia Specific seems to be again at a few of the most vital developments for Bitcoin and cryptocurrency within the area in 2025.

Bitcoin treasuries face pushback in Asia

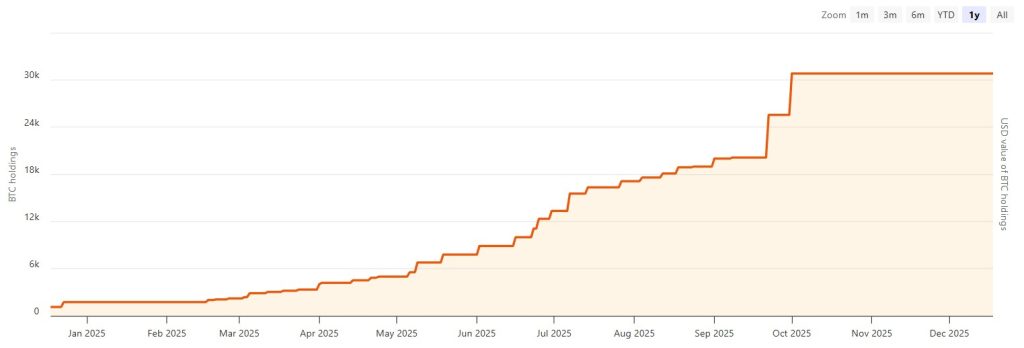

The rise of Bitcoin treasury companies was a serious growth in Asia in 2024, after Japan-based Metaplanet adopted the blueprint popularized by Michael Saylor’s Technique.

In 2025, the mannequin gained a proper label with the companies now often known as digital asset treasury corporations, or DATs. However for a lot of DATs, the embrace of Bitcoin was actually only a last-ditch try and revive moribund share costs. A number of had little to do with crypto previous to their pivots, and DAT bulletins usually triggered short-lived inventory rallies earlier than costs normalized.

Japan was the new spot in Asia, with not less than 13 publicly listed DATs holding Bitcoin on their stability sheets. The fast development caught the eye of Japan Trade Group, which is reportedly inspecting tighter oversight of Bitcoin treasury methods, together with considerations round backdoor listings.

Hong Kong-based DATs have additionally begun to emerge. Meme tradition pioneer 9GAG snapped up a stake in Hong Kong-listed Howkingtech Worldwide Holdings, with plans to rebrand the corporate as “MemeStrategy” and add Bitcoin and different crypto belongings to its stability sheet.

Hong Kong’s inventory change has taken discover as nicely. Native media reported that regulators have begun weighing the dangers related to DAT buildings, reflecting rising warning round listed corporations utilizing crypto holdings as a market narrative.

Stablecoins have became a geopolitical battlefield

Stablecoins grew to become the blockchain use case grabbing regulatory consideration throughout Asia after US President Donald Trump signed the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act into regulation in July.

The strain was seen in China, the place core crypto actions equivalent to mining and buying and selling stay banned. Whereas stablecoins are more and more seen as a key element of the longer term funds panorama, Beijing has been pushing its personal central financial institution digital forex.

For a lot of the yr, business gamers speculated that the rise of stablecoins may show too massive for even China to disregard. The considering was that rising international adoption may power Beijing to melt its long-running hostility towards cryptocurrencies.

That hypothesis intensified as main media shops reported that China was contemplating a yuan-backed stablecoin of its personal, whereas native e-commerce giants have been mentioned to be lobbying the Individuals’s Financial institution of China (PBOC) to greenlight yuan-pegged tokens in Hong Kong. Lecturers additionally warned that stablecoins reinforce US greenback dominance and pose a menace to China’s financial sovereignty.

In late October, the PBOC laid the stablecoin rumors to relaxation. Governor Pan Gongsheng mentioned that no coverage shift was underway, slamming stablecoins as devices that fail to fulfill primary Anti-Cash Laundering necessities.

Hong Kong is usually described as a monetary gateway to the mainland. Its business-friendly tax regime and bespoke monetary entry schemes have lengthy allowed international capital to have interaction with Chinese language markets in managed methods. By way of crypto, the town has positioned itself as a regulated hub for digital asset companies, rolling out its Stablecoin Ordinance, which got here into impact in August. A number of corporations utilized to acquire a license, however Hong Kong regulators mentioned that solely a handful of candidates will obtain approvals.

Regardless of Hong Kong stealing headlines with its stablecoin framework, Japan grew to become the primary main economic system within the area to really launch a regulated stablecoin. Amendments to Japan’s Fee Providers Act that took impact in 2023 laid the groundwork for a yen-pegged stablecoin to enter the market in October, with the primary financial institution backed stablecoin anticipated to be accessible by mid-2026.

Learn additionally

Options

Earlier than NFTs: Surging curiosity in pre-CryptoPunk collectibles

Options

Bitcoin: A Peer To Peer On-line Poker Fee System by Satoshi Nakamoto

Governments hit the reset button on crypto coverage

Authorities attitudes towards crypto throughout Asia shifted in 2025, formed partly by political and regulatory developments in the US.

In South Korea, former president Yoon Suk Yeol had been anticipated to stay in workplace till Might 2027 however his tenure ended early after a failed martial regulation try in late 2024 triggered impeachment proceedings, culminating in his elimination in April 2025. A snap election adopted, bringing crypto-friendly president Lee Jae Myung into workplace.

Whereas a extra supportive stance towards digital belongings had been broadly anticipated whatever the election consequence, Lee’s victory helped reset the political tone round crypto. His administration signaled renewed momentum on long-delayed regulatory discussions, together with proposals associated to stablecoins.

South Korea’s monetary regulator was purported to submit draft laws on Dec. 10, however missed the deadline. Lawmakers have since pressed the Monetary Providers Fee to ship a proposal by the top of the yr, warning that parliament will introduce its personal framework in January if regulators fail to behave.

Elsewhere in Asia, governments pursued blockchain adoption extra selectively. The Philippines superior laws selling using blockchain know-how as an anti-corruption instrument, framing it as public-sector infrastructure slightly than a car for monetary hypothesis.

Not each jurisdiction moved in a permissive route. Singapore, lengthy seen by crypto companies as a secure and predictable base of operations, moved to shut regulatory loopholes. Many companies had operated from Singapore with out a license by excluding native customers, assuming this construction would protect them from regulatory oversight. In 2025, authorities made clear that such preparations would not be tolerated, warning corporations to get licensed or get out.

Learn additionally

Artwork Week

Coldie And Citadel 6.15: The Creator, The Collector, The Curator

Options

Tim Draper’s ‘odd’ guidelines for investing in success

Memecoins frenzy recycles movie star and popular culture nostalgia

The memecoin frenzy on Solana prolonged into the primary half of 2025 and spilled over to different networks, together with BNB Chain. The pattern additionally revived acquainted playbooks. Throughout Asia, legacy popular culture figures and international celebrities resurfaced via token launches, usually marketed towards offshore buyers.

One of the crucial distinguished examples concerned Japanese grownup video star and pop singer Yua Mikami, who launched a Solana-based memecoin that raised hundreds of thousands of {dollars} in presale funding regardless of questions round its construction and administration. The challenge’s disclaimer prohibited Japanese residents however no technical restrictions have been made. Blockchain analysts flagged promotional exercise aimed toward Chinese language-language communities and claims that the challenge’s rights had been acquired by entities linked to China.

In March, Chinese language social media circulated rumors of a Shenzhen-based “movie star memecoin manufacturing unit” after a token related to Brazilian soccer legend Ronaldinho briefly surged earlier than collapsing. Unconfirmed rumors alleged that organized groups have been systematically launching and selling celebrity-linked tokens, elevating considerations about industrialized pump-and-dump operations working at scale.

Nostalgia-driven hypothesis additionally resurfaced in a special type. Tokenized representations of Pokémon buying and selling playing cards gained traction throughout blockchains, reflecting the enduring attraction of the Japanese gaming and anime franchise. In 2025, randomized digital merchandising machine-style merchandise grew to become a recurring pattern, permitting customers to attract digital variations of uncommon Pokémon playing cards and increasing collectibles hypothesis into onchain markets.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.